The market will remain closed on May 25 (Monday) for Eid-Ul-Fitr.

The market remained under pressure for the third consecutive week that ended on May 22 with the BSE Sensex and Nifty50 falling over one percent each.

Rising tensions between the United States and China, lack of demand-boosting measures from the Centre, likely NPA pressure on banking and financials after extension in the moratorium period up to August 31, consistent FII selling and rising number of COVID-19 cases in the country, hurt market sentiment.

Yet, expectations of further easing of lockdown restrictions and hopes of more fiscal measures supported the market.

Initially, the market could see some bounce this week after falling consistently in previous three weeks. But, given the reasons mentioned above and expected delay in development of a COVID-19 vaccine, it may remain a volatile week. Experts suggest that all eyes will be on the number of COVID-19 cases being reported and on the opening of the economy.

"The firm stance taken by governments across the world against China may lead to further deterioration in economic relations which would keep markets under pressure in the medium term. Non-occurrence of good news in the horizon may take markets lower with a soft landing and market is expected to reach 8,500 levels in the near term," Jimeet Modi, Founder & CEO at SAMCO Securities & StockNote told Moneycontrol.

Vinod Nair of Geojit Financial Services advised investors to tread cautiously in the coming week. "Any news regarding the slowdown in number of infections or specific sectoral news will have an impact on the markets," Nair said.

The market will remain closed on May 25 (Monday) for Eid-Ul-Fitr.

Here are 10 key factors that will keep traders busy this week:

Lockdown easing?

As we move closer to the end of fourth lockdown phase, the market will start focussing on further re-opening of the economy. So far, essential services, some industries, railways and more recently, domestic aviation was allowed to resume.

Now, all eyes will be on what are the other segments that will be able to reopen starting from June. Yet, experts suggest that companies will not be able to work in full capacity even if measures were eased significantly in June.

Many European nations and regions in the US have already reopened, albeit with social distancing norms. Globally, there have been over 53 lakh confirmed cases of COVID-19. At least 3.42 lakh people have died so far.

Click here for Moneycontrol’s full coverage of the novel coronavirus pandemic

Rising COVID-19 infections

India has completed two months of the nationwide lockdown, meant to curb the spread of the novel coronavirus pandemic. Yet, the number of confirmed COVID-19 cases have been rising.

In fact, in the week gone by, India's tally crossed the one lakh-mark (is is currently around 1.25 lakh with over 3,700 deaths).

Thus, the key factor to watch out for this week would be if we are moving closer to the peak of infections being reported.

Follow our LIVE blog for the latest updates of the novel coronavirus pandemic

US-China trade tensions

Resurgence of tensions between US and China could be real threat to global economic growth, experts suggest.

US President Donald Trump's recent comments have also raised doubts over the implementation of phase one deal between the world's two largest economies which was signed in January 2020.

Additionally, China is expected to soon impose a new national security law in Hong Kong which could irk the US and other western countries.

Earnings

Around 100 companies will report their March quarter earnings this week, including HDFC, Sun Pharma, Lupin, Dabur India, TVS Motor Company, United Spirits, Voltas, etc.

Among others, Astral Poly Technik, Bata, JSPL, Max Financial Services, Torrent Pharma, VIP Industries, KPIT Technologies, Ujjivan Financial Services, Ceat, Equitas Holdings, RCF, Amber Enterprises, Usha Martin, etc. will also release their earnings scorecard.

FII selling

FIIs' stance remained bearish on India as compared to other developed economies which attracted flow in their risky assets with large liquidity stimulus packages.

FIIs net sold Rs 6,920.28 crore worth of shares last week, in addition to Rs 5,951.15 crore of selling in the previous week — which was one of reasons for correction in equity market last week and 85 paise fall in the Indian Rupee against the US dollar in May so far.

Government's Rs 20 lakh crore financial package also seemed to have failed to lift the mood at the FII desk. So, FII flow will be closely watched in the coming days.

Crude and Rupee

The oil prices continued its run for the fourth consecutive week following easing of lockdown restriction in many parts of the world, supply cutbacks and fall in shale oil production in the US.

The international benchmark Brent crude futures climbed above $35 a barrel at the end of week gone by,which is expected to rally in coming days on further easing lockdown measures. There is hope of shale oil production back in the market, but the upside is expected to be capped as given the virus fears, the demand is unlikely to revive to pre-COVID levels soon.

The Indian rupee weakening towards April levels again, falling around 40 paise during the week to close at 75.95 against the US dollar due to consistent FII selling and lower-than-expected measures taken by the RBI to support growth. The rise in greenback amid resurgence of US-China tensions also weighed on the currency.

"Technically, 76 has been acting as a psychological resistance in USD/INR spot, a break of which can take prices towards 76.20-76.50. Otherwise, we expect the spot to trade in between 75-76 zone," Rahul Gupta, Head of Research- Currency at Emkay Global Financial Services told Moneycontrol.

Technical view

The Nifty50 fell 67 points on May 22 and formed an indecisive Doji kind of formation on daily charts, while it lost 1 percent for the week and witnessed Hammer kind of formation on the weekly scale. But the Bank Nifty lost 8 percent, which is a big concern for the Nifty50.

Hence, the overall trend could remain in favour of bears. But as it has seen a bearish candle for third consecutive week, there may be some rebound initially in the coming week, experts feel.

"Due to the recovery, Nifty index has formed a Hammer candlestick pattern with a long lower shadow which is considered as a trend reversal pattern. So, we might see some pullback towards 9,200 levels which is a major resistance level and if Nifty manages to sustain above the same, then we can expect a continuation of a current pullback towards 9,350 and then 9,500 levels. On the contrary, if Nifty breaks below 9,000, then it may retest 8,800 levels," Nilesh Ramesh Jain, Derivative and Technical Analyst - Equity Research at Anand Rathi said.

F&O expiry

This week, May series derivative contracts will expire and traders will roll over their positions to next month. The options data indicates that the maximum Put base is placed at 9,000 followed by 8,800 strikes. Fresh Put writing was also seen in 9,000 and 8,800 Put strikes, which are likely to act as a support zone.

The Call writers were active in 9,300 and 9,500 strikes, where 9,500 holds the second-highest open interest.

"So continuous Call writing at 9,500 hints that Nifty may find it difficult to surpass 9,500 in the May series. The Options data indicates a broader range of 8,800 to 9,500. Based on the data, we are expecting some broader consolidation in the coming week," Nilesh Jain said, adding with the cooling off in the volatility, he expects some stability and pullback in the coming week.

The India VIX fell 15 percent to end near 32 levels.

Corporate action and macro data

Infosys will trade ex-dividend (Rs 9.50 per share) from May 29.

On the macro front, Q1CY20 GDP data, infrastructure output & budget value for April, and foreign exchange reserves for week ended May 22 will be released on May 29.

Global cues

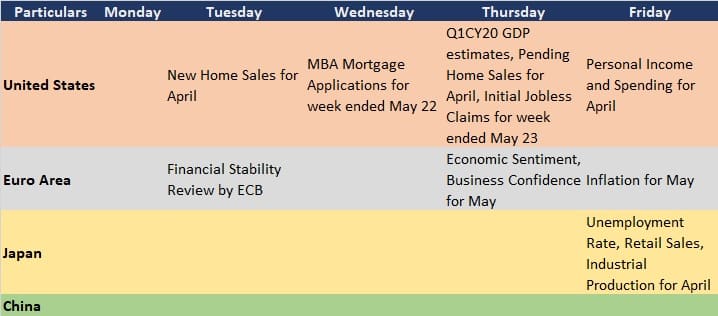

Here are key global data points to watch out for this week: