KKR will invest Rs 11,367 crore into Jio Platforms

Global private equity firm KKR has invested Rs 11,367 core in Reliance Industries' (RIL) Jio Platforms for a 2.32 percent stake.

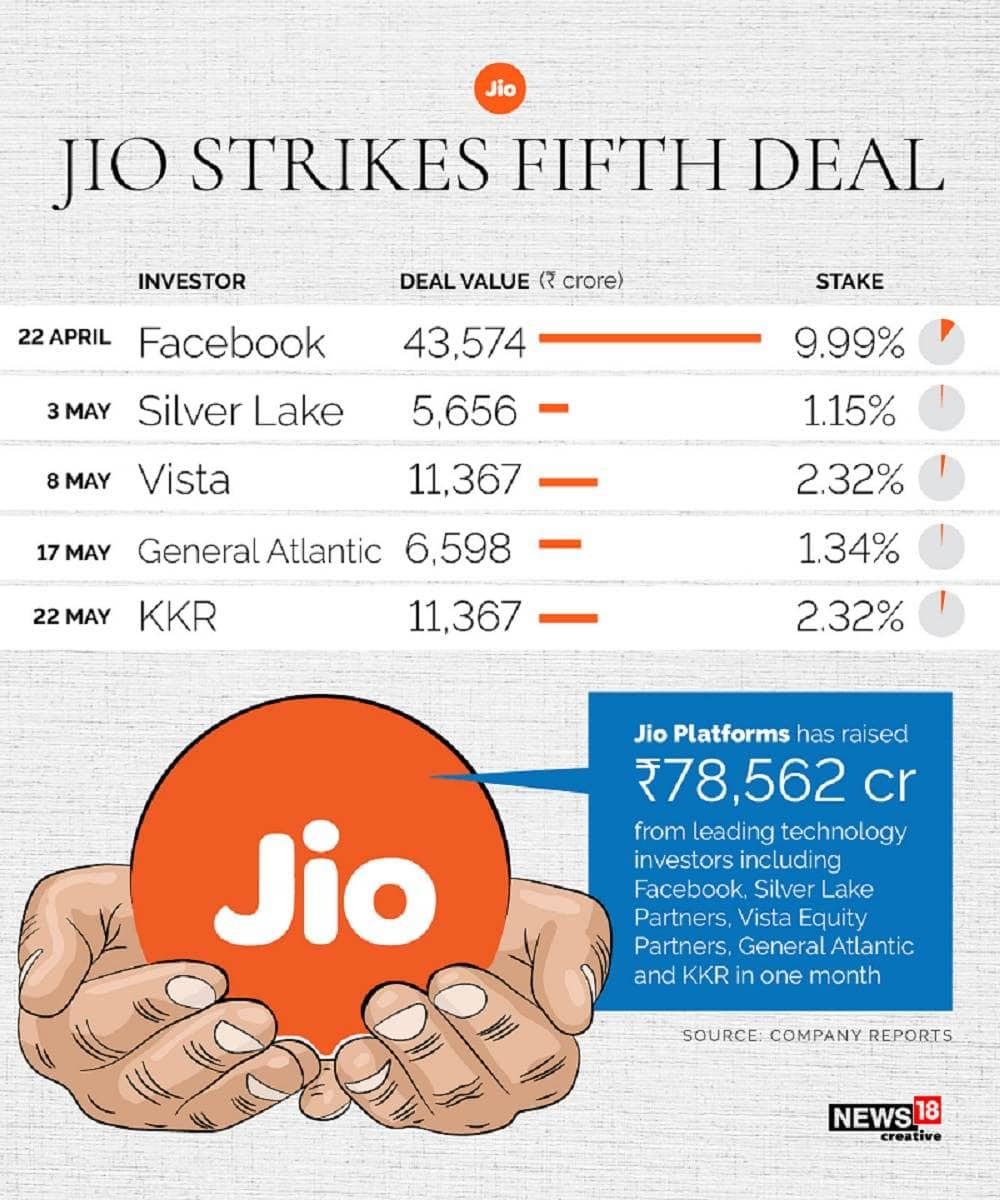

This is the fifth global company to invest in Jio in the past five weeks. So far, Jio Platforms has attracted a total investment of Rs 78,562 crore. Other investors in Jio Platforms are: Facebook, Silver Lake, Vista and General Atlantic.

Here are the 5 key things about the deal:

> KKR will invest Rs 11,367 crore into Jio Platforms, which translates into a 2.32 percent equity stake on a fully-diluted basis.

> This transaction values Jio Platforms at an equity value of Rs 4.91 lakh crore and an enterprise value of Rs 5.16 lakh crore.

> This is KKR’s largest investment in Asia. It is making the investment from its Asia private equity and growth technology funds.

> KKR's is the fifth such infusion in Jio Platforms as, over the past one month, leading technology investors such as Facebook, Silver Lake, Vista and General Atlantic have announced aggregate investments into the company. These together amount to Rs 78,562 crore of investments into Jio Platforms.

> The transaction is subject to regulatory and other customary approvals in India. KKR has a history of investing in businesses in the technology sector, including BMC Software, ByteDance and GoJek through its private equity and technology growth funds. It has invested in India since 2006.

Read all KKR Jio deal stories here

Disclaimer: Reliance Industries (RIL) is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd