The MACD indicator is one of the most popular tools in technical analysis because it gives traders the ability to quickly and easily identify the short-term trend.

The Nifty50 recorded a bearish crossover based on the MACD indicator on the daily chart this week which suggests that the trend in the near term is likely to remain weak.

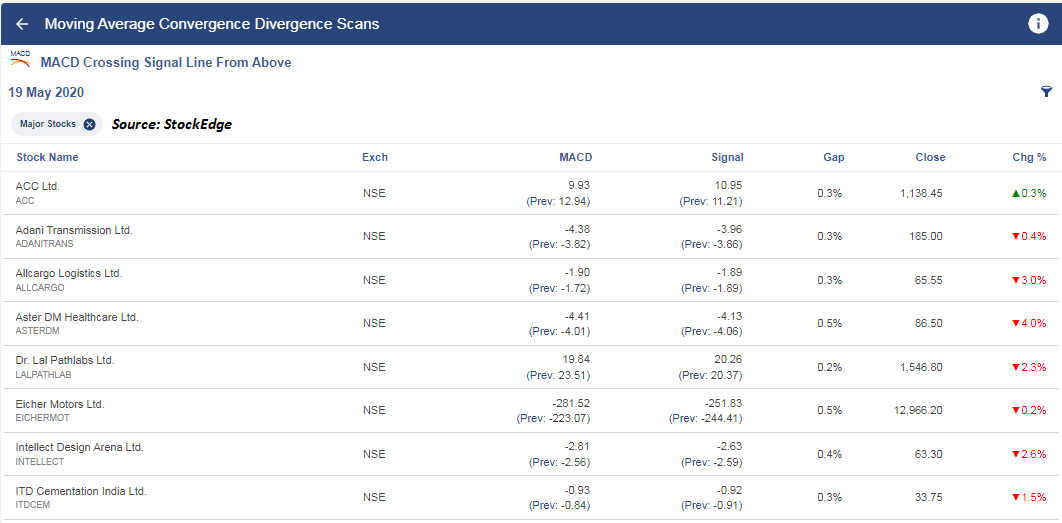

Along with Nifty, there are 32 stocks on the NSE that witnessed a similar crossover on the MACD charts that include names like ACC, SBI, Axis Bank, Ashok Leyland, Adani Transmission, Aster DM, Dr. Lal Pathlabs, and ITD Cementation, etc. among others, according to data collated by StockEdge on May 19.

MACD which stands for Moving Average Convergence Divergence is one of the simplest and most effective momentum indicators available.

The MACD indicator is one of the most popular tools in technical analysis because it gives traders the ability to quickly and easily identify the short-term trend.

The MACD indicator is calculated by taking the difference between a short-term moving average (12-day EMA) and a longer-term moving average (26-day EMA).

Also Read: Technical Classroom: MACD – simple yet versatile technical tool for every trader

A bullish crossover occurs when the MACD turns up and crosses above the signal line. A bearish crossover occurs when the MACD turns down and crosses below the signal line.

“Crossovers can last a few days or a few weeks, it all depends on the strength of the move. When the two MACD indicator lines move away from each other, it means that momentum is increasing and the trend is getting stronger,” Shabbir Kayyumi, Head - Technical & Derivative Research at Narnolia Financial Advisors told Moneycontrol.

“When the two lines are coming closer to each other, it shows that price is losing strength. Moving Average Convergence Divergence (MACD) is a lagging indicator.

The periods used to calculate the MACD can be easily customized to fit any strategy, but traders commonly rely on the default settings of 12- and 26-day periods,” he said.Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Moneycontrol Virtual Summit presents 'The Future of Indian Industry', powered by Salesforce. Watch Now!