‘3 in every 4 people want own vehicle post lockdown’

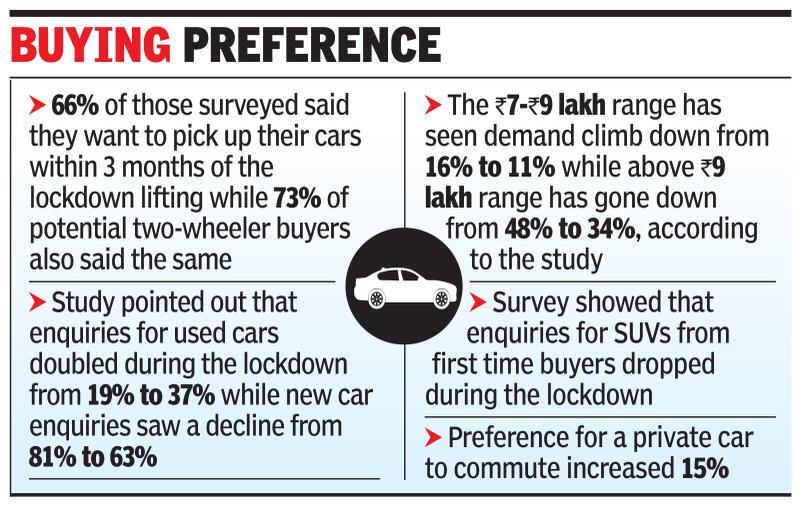

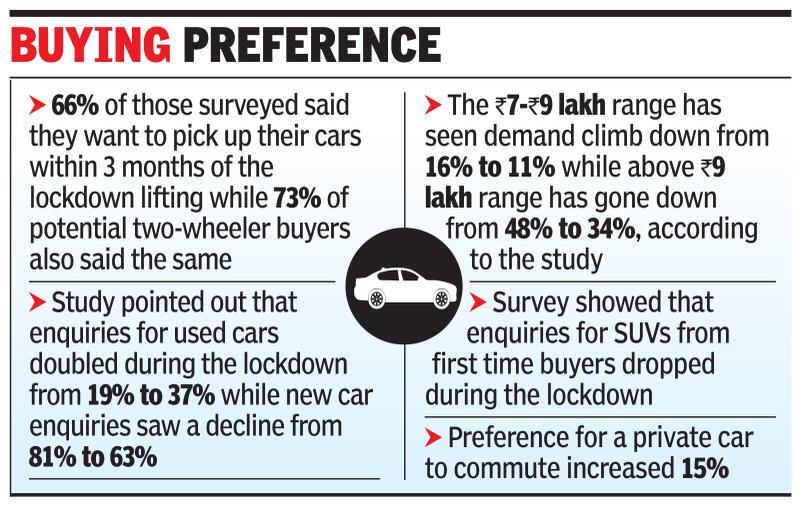

CHENNAI: Once the lockdown lifts would you invest in your own vehicle to avoid crowded public transport? And when you do, will you buy a used car or a new one, a small car or a premium SUV? According to a study of customer preferences during the lockdown by used car marketleader Mahindra First Choice Wheels, nearly 75% of the respondents said they want to buy a vehicle once the lockdown is over. Among those looking to buy a car, 66% said they want to pick up their vehicle within 3 months of the lockdown lifting while 73% of potential two wheeler buyers also said the same.

Of course with salary cuts and pink slips becoming the norm, customers are even more value conscious than before. That's why enquiries for used cars doubled during the lockdown — the study showed — from 19% to 37% while new car enquiries are down from 81% to 63%. The preference is also for smaller and more affordable vehicles. According to the survey, demand for entry level cars under Rs 2 lakh is up from 4% to 10% whereas those for cars in the Rs 2-Rs 3 lakh range is up from 6% to 12% and cars in the Rs 3-5 lakh range is up from 14% to 16%. Demand for cars in the Rs 5-Rs 7 lakh range is also up from 12% to 17%. Beyond Rs 7 lakh though there’s a sharp drop in demand as customers are looking to cut back on premium and luxury vehicle purchases to save money. The Rs 7-Rs 9 lakh range has seen demand climb down from 16% to 11% while above Rs 9 lakh range has gone down from 48% to 34%. Survey also showed that enquiries for SUVs from first time buyers dropped during the lockdown.

What the trend, shows, said Ashutosh Pandey, CEO, Mahindra First Choice Wheels, is that India’s love for small cars is back. “Customers will down-trade with budgets lower by 10%-30%,” said Pandey. “This indicates a shift in preference from bigger cars to smaller ones.”

Car buyers are also betting big on used vehicles. According to the survey, 28% of those who enquired about a new car finally ended up not buying. The percentage of no-buys is 18% for used cars. “While a section of new car owners are likely to buy used cars, potential buyers of two-wheelers are also actively considering buying a used car,” said Pandey. “This is largely on account of heightened awareness about hygiene and safety.”

Between pre and post lockdown, preference for a private car to commute increased 15% from 40% to 55%. Percentage of people planning to use a private car is highest in households with average income range of Rs 60,000-Rs 1,20,000 per month.“The impact on car and two-wheeler purchase decision is more severe in metros than in the Tier-1 and Tier-2 cities due to the widespread fear of lower discretionary income due to salary rationalization and layoffs, particularly in the larger cities,” said Pandey.

Of course with salary cuts and pink slips becoming the norm, customers are even more value conscious than before. That's why enquiries for used cars doubled during the lockdown — the study showed — from 19% to 37% while new car enquiries are down from 81% to 63%. The preference is also for smaller and more affordable vehicles. According to the survey, demand for entry level cars under Rs 2 lakh is up from 4% to 10% whereas those for cars in the Rs 2-Rs 3 lakh range is up from 6% to 12% and cars in the Rs 3-5 lakh range is up from 14% to 16%. Demand for cars in the Rs 5-Rs 7 lakh range is also up from 12% to 17%. Beyond Rs 7 lakh though there’s a sharp drop in demand as customers are looking to cut back on premium and luxury vehicle purchases to save money. The Rs 7-Rs 9 lakh range has seen demand climb down from 16% to 11% while above Rs 9 lakh range has gone down from 48% to 34%. Survey also showed that enquiries for SUVs from first time buyers dropped during the lockdown.

What the trend, shows, said Ashutosh Pandey, CEO, Mahindra First Choice Wheels, is that India’s love for small cars is back. “Customers will down-trade with budgets lower by 10%-30%,” said Pandey. “This indicates a shift in preference from bigger cars to smaller ones.”

Car buyers are also betting big on used vehicles. According to the survey, 28% of those who enquired about a new car finally ended up not buying. The percentage of no-buys is 18% for used cars. “While a section of new car owners are likely to buy used cars, potential buyers of two-wheelers are also actively considering buying a used car,” said Pandey. “This is largely on account of heightened awareness about hygiene and safety.”

Between pre and post lockdown, preference for a private car to commute increased 15% from 40% to 55%. Percentage of people planning to use a private car is highest in households with average income range of Rs 60,000-Rs 1,20,000 per month.“The impact on car and two-wheeler purchase decision is more severe in metros than in the Tier-1 and Tier-2 cities due to the widespread fear of lower discretionary income due to salary rationalization and layoffs, particularly in the larger cities,” said Pandey.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE