Key earnings to watch out for in this week would be Bharti Airtel, Bajaj Finance, Bajaj Auto, UPL, UltraTech Cement, Avenue Supermarts (D-Mart) and Jubilant FoodWorks.

Details of the COVID-19 economic relief package being announced by the Centre, failed to cheer markets as benchmark indices fell for the second consecutive week that ended on May 15.

The fear of indebtedness, even after the package's announcement, no quick fix for the economy seen in measures, rising number of COVID-19 cases in the country which has delayed full reopening of the economy and concerns over United States-China relations, pulled the BSE Sensex lower by 1.7 percent and Nifty50 1.2 percent during the week.

Hence, the volatility in the market is likely to continue and the mood could largely be in favour of the bears due to the continued rise in new confirmed cases of COVID-19, uncertainty around the economy's reopening and the US-China trade tensions, experts feel.

"Government has made it clear that it will introduce the measures in tranches, but execution is key and that will be followed by the markets. Markets will also be driven by the rate of infections, lockdown 4.0 norms and any stock specific earnings commentary in the ongoing results season," Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

"Additionally, emerging US-Sino relationship along with other global responses will be key clues for markets going ahead," said Jimeet Modi, Founder & CEO at SAMCO Securities & StockNote who advised investors to remain on cash and selectively book profits which would aid to boost liquidity.

Here are 10 key factors that will keep traders busy this week:

Rising COVID-19 cases

We are in the third month of the fight against the novel coronavirus and the number for infections have been rising. However, the recovery rate is now around 35 percent against what was below 30 percent a week ago. Additionally, some areas in the country have not registered new cases for a while.

Follow our LIVE blog for the latest updates of the novel coronavirus pandemic

India's COVID-19 tally has crossed that of China's. India has so far reported almost 86,000 cases and around 2,750 deaths. Globally, there have been over 46.3 lakh confirmed cases of COVID-19. At least 3.11 lakh people have died so far.

Hence, the coronavirus will remain the key talking point globally unless and until a vaccine reaches at final stage.

Click here for Moneycontrol’s full coverage of the novel coronavirus pandemic

Lockdown 4.0

India is set to enter the fourth phase of the nationwide lockdown from May 18. Prime Minister Narendra Modi , during his address to the nation on May 12, had said that 'lockdown 4.0' will have different set of rules and guidelines.

The Centre had also sought suggestions from state governments. Reports suggest that there could be further easing of rules for reopening industries and shops in green and orange zone areas. However, these activities will be allowed only under strict social distancing norms.

Hence, the new guidelines will be the key thing to watch out for.

Reliance Industries' rights issue

Apart from the novel coronavirus pandemic, RIL's rights issue will be keenly watched by the street this week.

Reliance Industries will open its rights issue of Rs 53,125 crore on May 20 — the biggest ever by an Indian entity and the first by RIL in nearly three decades. The closing date for issue will be June 3.

The company has fixed rights issue price at Rs 1,257 per share and the rights entitlement ratio is one equity share for every 15 equity shares held by eligible shareholders as on the record date which was May 14.

"Given the pessimism on the street, it would be worthwhile to catch sight of how Reliance's rights offer sails through, measuring the retail investors response would also send a signal of strength or weakness in the market. It could be an apt yardstick to see how investors at the grassroot level are perceiving current state of the markets," Jimeet Modi said.

Vedanta Delising Proposal

Vedanta is an another stock to watch out for next week as billionaire Anil Agarwal has planned to make Vedanta private by buying shares from the public.

The meeting of the board of directors will take place on May 18 to consider the proposal for voluntary delisting of the company's equity shares, while SBI Capital Markets is appointed as a merchant banker to carry out due diligence.

Promoter Vedanta Resources made an offer to buy out the 48.94 percent non-promoter stake at Rs 87.5 per share, which was 9.9 percent higher over May 11 price. But currently, the stock is trading 6.2 percent higher than the offer price. Hence, another key thing to watch out for would be whether shareholders agree to the pricing.

Earnings

March quarter earnings season will continue to be longer than usual due to the coronavirus lockdown. Hence, the number of companies to announce results every week will remain less than usual.

Around 80 companies will declare their earnings this week. The key earnings to watch out for next would be Bharti Airtel, Bajaj Finance, Bajaj Auto, UPL, UltraTech Cement, Avenue Supermarts (D-Mart), Jubilant FoodWorks, Tata Power, JSW Energy, Colgate Palmolive, Bajaj Finserv and Alembic Pharma.

Among others, Torrent Power, Dr Lal Path Labs, GlaxoSmithKline Pharma, Delta Corp, AstraZeneca Pharma, Apollo Tyres, Ujjivan Small Finance Bank, L&T Infotech, Strides Pharma, Kalpataru Power Transmission, JK Lakshmi Cement, Tata Metaliks, Hindustan Zinc, BSE, IDFC First Bank, Bosch, Chambal Fertilizers, DCB Bank will also announce quarterly earnings.

US-China trade tensions

Last week, tensions between US and China seemed to be easing as officials of both sides had indicated of positive meetings. However, reports now suggest that the possibility of US President Donald Trump cutting relations with world's second largest economy may have increased a bit.

Reuters said the Trump administration on May 15 moved to block global chip supplies to blacklisted telecoms equipment giant Huawei Technologies, spurring fears of Chinese retaliation.

"The United States needed to stop the "unreasonable suppression" of Chinese companies like Huawei," the report said quoting China's foreign ministry.

Oil prices

Oil prices managed to hold $30 mark in the passing week also with Brent crude futures rising 5 percent to $32.50 a barrel amid gradual opening of economies, lower inventories and reduced production capacities in the US, and ahead of further capacity cut from Saudi Arabia.

But experts feel that the prices may not see big rise as the demand is yet to be picked up and economies will have to be at normal levels. Hence, there could be further consolidation in the prices.

Technical view and F&O cues

The Nifty50 fell 1.24 percent for the week and formed bearish candle on the weekly scale again, indicating bears still have upper hand at Dalal Street trade.

Experts feel the 9,050, the low point of trade on May 15, is expected to act as a support level, hence breaking of the same could take the index down to 8,900-8,500 levels while on the upside, 9,300 could be near term resistance.

"If Nifty breaks below 9,050 levels decisively, then we can expect further downside towards 8,500. MACD oscillator has provided fresh sell crossover on the daily chart. The momentum indicator RSI has also slipped below 50 levels and shows that Nifty is losing its strength and we may see further selling pressure going forward," Nilesh Ramesh Jain, Technical and Derivative Analyst at Anand Rathi told Moneycontrol.

The Options data indicates that the 9,000 strike which have the maximum open interest are providing support. The Call writers were active in the majority of the out-of-the-money strikes where the maximum open interest is placed at 9,500 strike, which could be resistance point.

"For the coming week, Call options have seen more writing, which means the index may remain subdued for a while declines may be seen towards 8,900," Amit Gupta of ICICI Securities said.

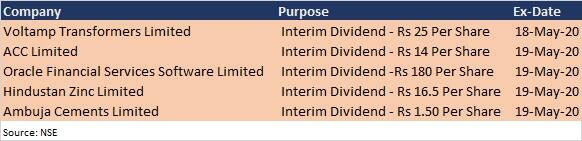

Corporate action and macro data

Here are key corporate actions taking place this week:

On the macro front, deposit and bank loan growth for the fortnight ended May 8, and foreign exchange reserves for week ended May 15 will be released on coming May 22.

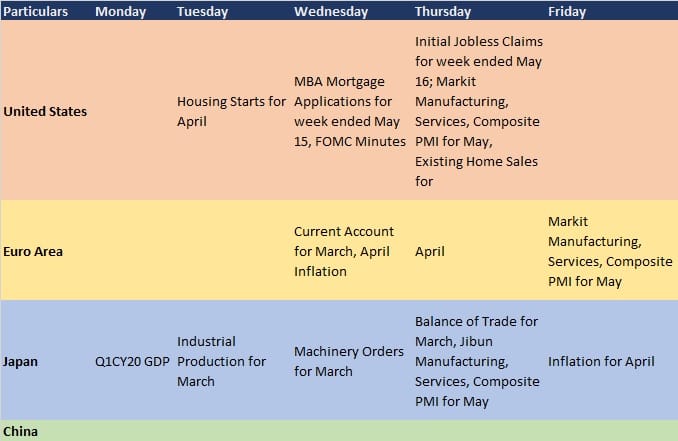

Global cues

The trend in coronavirus cases, especially in the United States and European nations, and update on gradual opening of some less affected areas (due to virus) will be closely watched and could drive the sentiment.

Here are key global data points to watch out for this week:

Moneycontrol Virtual Summit presents 'The Future of Indian Industry', powered by Salesforce

Register Now! and watch industry stalwarts forecast how India Inc will shape up in post COVID-19 world

Date: May 19