Key risk to the thesis is the protracted income loss to household savings, ICICI Securities said.

Investment behaviour and asset allocation preferences might change in the post-COVID-19 world.

People might even prefer keeping funds in hand.

As the new infections continue to rise, there is doubt over opening of the economy fully in the immediate period, experts feel.

The economic impact of the lockdown is severe. Companies are resorting to layoffs, pay cuts, furloughs as economic activity has come to a standstill.

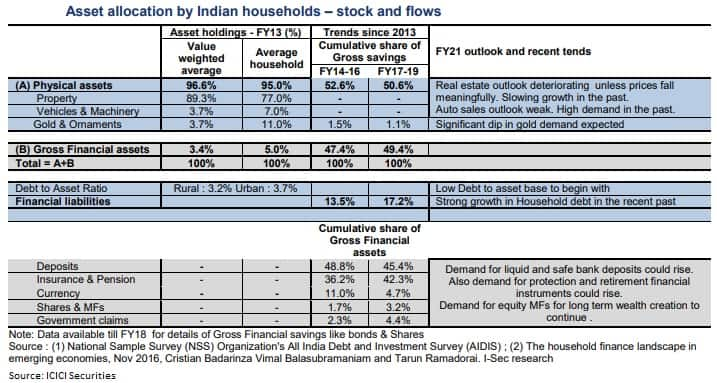

Hence, as fear of income loss rises, the skewed asset allocation of Indian households towards largely illiquid physical assets (95 percent of assets in property, vehicles, machinery, gold, etc) could incrementally shift towards relatively liquid and safe financial assets, ICICI Securities feels.

The brokerage said in FY19, Rs 22 lakh crore (11.7 percent of GDP) or 64.3 percent of net savings were invested by Indian households in physical assets and gold even as net financial assets dipped to 6.5 percent of GDP largely driven by the rise in financial liabilities.

According to the research firm, the demand for big-ticket and lumpy discretionary spends such as tourism, leisure and expensive consumer durables could dip significantly both from a supply-side issue as well as focus of households shifting towards raising liquidity (cash, bank deposits etc.) along with augmenting their life and health protection.

Given the extended lockdown and gradual opening of economy with minimum capacity with due care and safety, consensus real GDP growth expectations points towards zero or marginally negative growth for FY21 (gross national income should show similar trends), while nominal GDP and GNI might record low single-digit growth.

"Q1CY20 (January-March) GDP growth is tracking close to 2 percent YoY. The latest high-frequency data suggest GDP in Q2 is tracking towards a contraction of about 9 percent YoY," said Barclays in its report dated May 14.

The global investment firm thinks more data will bring that closer to its forecast of a 12.4 percent YoY drop. "We remain comfortable with our 0 percent CY20 GDP growth forecast," it said.

Hence, ICICI Securities feels anecdotal evidence suggests that bulk of the income loss for households is in urban unorganised sector while in 'organised sector' income loss is being largely absorbed by corporates and government in the short term although fear of income loss looms.

Therefore the brokerage believes financial intermediaries in sectors such as insurance and banks with strong brand loyalty, proven retail franchise, strong execution and clean balance sheets should benefit in the current environment.

As a result, its analysts are positive on HDFC Bank, Kotak Mahindra Bank, SBI Life Insurance and ICICI Prudential Life Insurance.

However, the key risk to the above thesis is the protracted income loss to household savings as government and corporates' ability to absorb losses and transfer income to households will be limited and a longer lockdown could hurt jobs and income prospects even in organised sector, said the brokerage.

Low-income urban workers in small scale enterprises are the worst affected but they add very little to savings although their rising indebtedness will impact net savings, it added.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Moneycontrol Virtual Summit presents 'The Future of Indian Industry', powered by Salesforce

Register Now! and watch industry stalwarts forecast how India Inc will shape up in post COVID-19 world

Date: May 19