Jefferies has maintained a 'hold' rating on the stock, with the target at Rs 550 per share.

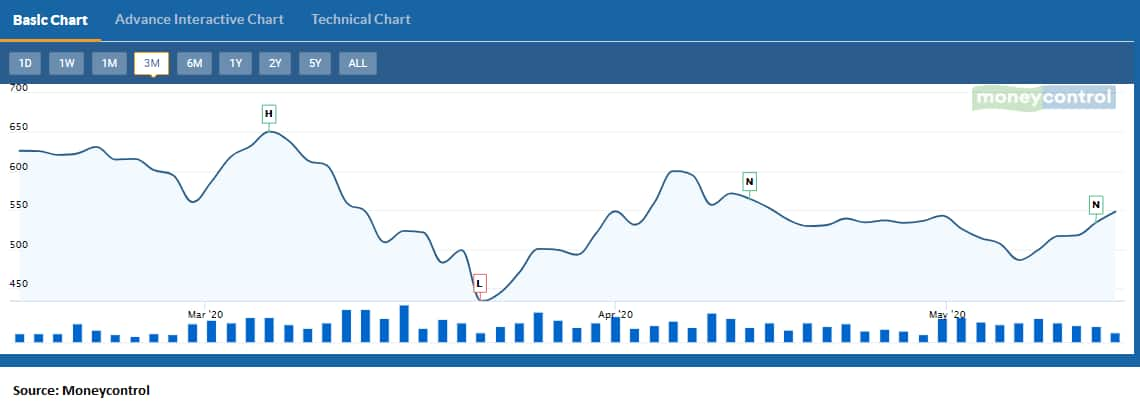

Godrej Consumer Products share price was up more than 4 percent in the morning trade on May 14.

The stock has gained over 12 percent in the last five days and was quoting at Rs 548.50, up Rs 13.95, or 2.61 percent, at 0934 hours.

The company had a day earlier reported an over 75 percent drop in consolidated net profit at Rs 229.90 crore in the fourth quarter ended March 2020, hit by disruptions in sales because of the coronavirus outbreak.

Its net sales were down 12.22 percent to Rs 2,132.69 crore during the quarter as against Rs 2,429.68 crore in the year-ago period.

GCPL's India revenue rose 17.85 percent to Rs 1,113.94 crore during the period from Rs 1,356.09 crore in the corresponding quarter a year ago.

Global research firm Jefferies has maintained a "hold" rating on the stock, with a target at Rs 550 per share.

The firm is of the view that India and Africa business were weak while Indonesia was good, CNBC-TV18 said.

The near-term outlook on Indonesia seemed positive while Africa was challenging, it said.

Commentary was cautious but focus on growth and launches will continue. The research firm expects the stock to stay range-bound.

“This quarter was an unprecedented period due to the spread of the COVID-19 pandemic across the globe, impacting all the geographies of our operations, GCPL Executive Chairperson Nisaba Godrej said.

According to the company, its India sales declined 18 percent year-on-year, led by 15 percent year-on-year decline in volume.

However, its revenue from the Indonesian market moved up 8.94 percent to Rs 449.36 crore as compared to Rs 412.47 crore in the year-ago period.

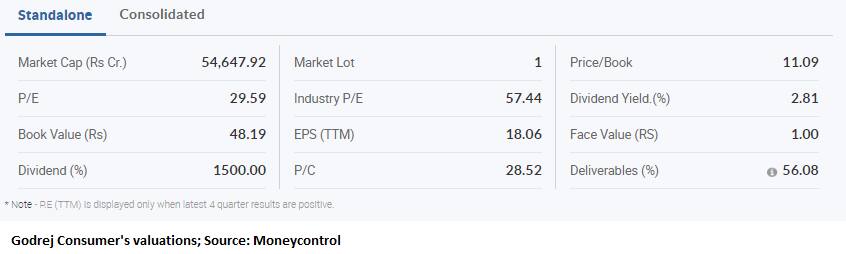

According to Moneycontrol SWOT Analysis powered by Trendlyne, Godrej Consumer has low debt while it is efficient in managing assets to generate profits, with return on assets (RoA) improving in the last two years.

Technical rating is neutral, with moving averages bullish while technical indicators are neutral.

Disclaimer: The views and investment tips expressed by experts on moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365