Real estate has been a buyer’s market for a few years now. COVID has only added to the panic of sellers

Raj Khosla

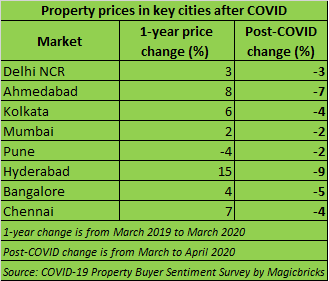

The impact of the COVID-19 crisis on the capital markets is very visible in the stock market tickers on TV screens. Many sectors have been adversely affected by the pandemic. According to a survey by Magicbricks.com, property prices in large metros have fallen 2-9 per cent after the lockdown announced in March.

On the face of it, this appears to be a good opportunity for home buyers, especially those planning to buy for self-use. But it looks like the good prices could become even better in the coming months. Deepak Parekh, the grand old man of housing finance in India, says that property prices could correct by up to 20 per cent due to the demand drought caused by the COVID-19 pandemic.

His pessimism stems from the headwinds that the economy is facing. Moody’s has projected a 0 per cent GDP growth for India for this financial year. The fiscal deficit has touched 4.4 per cent and top agencies have cautioned that the shock from the coronavirus pandemic will only worsen the fiscal situation. Apart from these macroeconomic metrics, the personal finance of individuals has also got mauled. Salary cuts are widespread, many companies are downsizing staff and some have even shut shop.

related news

What does this mean for the property market? The MagicBricks survey shows that 67 per cent of potential buyers will still go ahead with their plans to purchase property, but 73 per cent of these buyers have reduced their budgets. What is worth noting is that one out of every three buyers has either dropped the plans (9 per cent) or kept them on hold (24 per cent). That this is happening in a sluggish market shows that demand has really dried up.

Is this the time to buy?

A clear distinction between self-use and investment is necessary. For those looking to buy a house for self-use, the opportunity could show up in the next few months. If you are planning to take a loan for purchasing the property, get an in-principle home loan approval from the lender. Banks give such loan approvals solely on the basis of the credit history and repayment capacity of the bidder. The lockdown has slowed down the process, so you may need to act immediately.

There is also a possibility that a lot of repossessed properties may enter the market over the next few months. As mentioned earlier, a lot of people have suffered salary cuts and job losses. Those with hefty loan commitments may not be in a position to service their EMIs. Although the RBI has asked banks to offer a three-month payment moratorium to all borrowers, there is little hope of things returning to normal after June and there are likely to be a large number of defaults.

When a borrower defaults on loan repayments, the lender seizes (or repossesses) the property. These properties are then auctioned off to recover the outstanding loan amount. Typically, the prices in auction are 20-30 per cent lower than the prevailing market rates. But this is a tricky terrain. Auctioned properties are usually embroiled in legal disputes or have unpaid bills and loans against them. After it is bought in auction, the buyer has to bear these expenses and settle the outstanding dues. Therefore, the real cost of the property could be significantly higher than anticipated.

The normal due diligence undertaken while buying a property will be hampered due to the lockdown across the country. Even so, a site visit is necessary before you sign the deal. A good property consultant will be able to assess the structural quality of the building and point out other issues. It is also recommended to take the help of a property lawyer to study the ownership papers and other documents. A professional will be able to spot if there is something amiss.

Property as investment

A lot of people may also be looking to invest in property now. After the stock market crash, they don’t want to risk their money in volatile instruments. But fixed income options are not looking very attractive after a flurry of rate cuts. On top of that, the recent Franklin Templeton debacle has taken the sheen off debt funds. Property is seen as a safer bet that will continue to hold value even in a downturn.

Even so, invest in property only if your time horizon is at least 8-10 years. That is the minimum time that an investment will take to earn good returns. It might also be a better idea to invest in commercial property where the rental yield is higher than that of a residential property.

(The writer is Managing Director, MyMoneyMantra.com)Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365