Total income of the company declined to Rs 2,919.9 crore in the March quarter from Rs 3,661.7 crore in the corresponding period of the previous fiscal.

Siemens share price was down almost 2 percent intraday on May 14 after the company declared its March quarter numbers on Wednesday.

The company reported a 38 percent drop in consolidated net profit at Rs 175.7 crore for the March quarter due to lower revenues. The company's consolidated net profit stood at Rs 284.2 crore in the quarter ended March 31, 2019, it said in a statement.

Total income of the company declined to Rs 2,919.9 crore in the March quarter from Rs 3,661.7 crore in the corresponding period of the previous fiscal. The company's order backlog stands at Rs 12,547 crore, it said.

The decline in revenues across the businesses was primarily due to deferred offtake by customers and slowdown in short-cycle business related to COVID-19 as well as continued weaker demand in large infrastructure projects, it added.

The stock price has fallen over 37 percent in the last six months and was quoting at Rs 1,026.50, down Rs 17.60, or 1.69 percent at 10:20 hours.

It was trading with volumes of 17,593 shares, compared to its five day average of 15,994 shares, an increase of 10.00 percent.

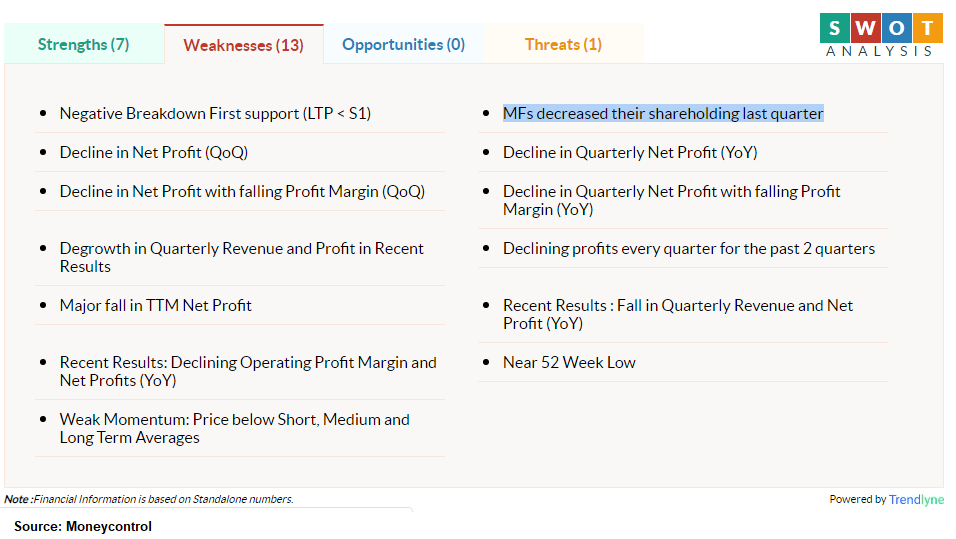

According to Moneycontrol SWOT Analysis powered by Trendlyne, Siemens stock is showing weak momentum with price below short, medium and long term averages with MFs decreasing their shareholding last quarter.

The technical rating is very bearish with moving averages and technical indicators being bearish.

Disclaimer: The views and investment tips expressed by investment experts on moneycontrol.com are their own, and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365