Saurabh Mukherjea and his team give tips on investing during tough times.

Saurabh Mukherjea, Rakshit Ranjan & Salil Desai

The year 2019 ended on a pretty strong wicket for equity markets around the world. Most major indices were up 10-25 percent during the year. The Dow Jones increased investors’ wealth by ~22 percent, the FTSE, Hang Seng, and India’s Nifty by ~12 percent and the Nikkei by 18 percent.

However, 2020 brought with it the rumblings of what eventually became a global pandemic, bringing some of the largest economies of the world to a standstill. As COVID-19 spread worldwide, stock markets crashed globally, with many indices recording their worst-ever quarter performance and many others seeing the fastest-ever correction in recent history.

In India, the broader markets were anyway appearing shaky due to the weak growth in corporate profits for the past 6-7 years. Then came COVID-19 to add to investors’ troubles. And in the middle of all this came the collapse of Yes Bank. In a matter of weeks, the stock markets and the larger economy were dealing with a full-fledged crisis.

In five parts, Saurabh Mukherjea, founder of Marcellus Investment Managers, and his team elaborate on their investment process and emphasise on the techniques that have helped their fund navigate through tough markets and a crisis.

Part 4

Why Consistent Compounders are the best bet in a crisis?

Summary: A portfolio of Consistent Compounders offers the most optimised risk-reward for an investor in the Indian markets – healthy returns with the volatility close to that of a government bond. This makes them an investment for all seasons, and more so in times of market stress and crisis where investors are especially worried about large drawdowns in their portfolios. Consistent Compounders not only fall less in a crisis but also recover much sooner and sharper.

“Only when the tide goes out, do you discover who’s been swimming naked’. This insight from Warren Buffett has repeatedly proven to be correct when it comes to investing in stocks. When the broader market is undergoing a euphoric or bullish phase, most stocks do well regardless of the quality of their underlying fundamentals. However, when the euphoria ends, stocks with poor underlying fundamentals are decimated, leading to significant capital erosion for investors who did not adequately understand the weak fundamentals of their portfolio companies.” – from ‘Coffee Can Investing: The low-risk route to stupendous wealth’ (2018) by Rakshit Ranjan, Saurabh Mukherjea & Pranab Uniyal.

Investors desire not just healthy returns on their portfolio, but also for the returns to be steady or consistent. Most of all, no one likes large drawdowns (declines) in their portfolios. However, when the broad markets decline during a crisis, it is rare for a portfolio of stocks not to do so. A sharp fall in stock prices often leads to panic among investors and they end up selling their holdings at or near market bottoms. Unless an investor is extremely lucky, it is nearly impossible to exactly time the market and exit at a pre-crisis peak to avoid the heartburn of large drawdowns and then enter at a post-crisis bottom to maximise returns from the rally that follows.

It is here that Consistent Compounders emerge as the best allies of an investor. Not only does a portfolio of Consistent Compounders fall less during a crisis it also recovers sooner and sharper on the other side of the crisis.

Why Consistent Compounders are the best bet in a crisis?

In simple terms, the share price of a firm can be expressed as a function of two variables –the P/E valuation multiple and ‘Earnings’.The P/E multiple is a function of many factors external to the company (macroeconomic variables, political uncertainty, global commodity market tends, geopolitical dynamics, etc.) as well as factors internal to a company (expectations of future earnings growth sustainability). The external factors are nearly impossible to predict and by extension, so is their impact on the earnings multiple of a stock. Therefore, at a time when market P/E multiples compress due to external factors, individual stock prices take a hit too. But for a company with strong fundamentals, the impact is limited due to its strong annualised earnings growth (which offsets the P/E compression) as well as the longevity of these earnings (which restricts the P/E compression). As we have seen earlier, such strong fundamentals are the essence of consistent compounders.

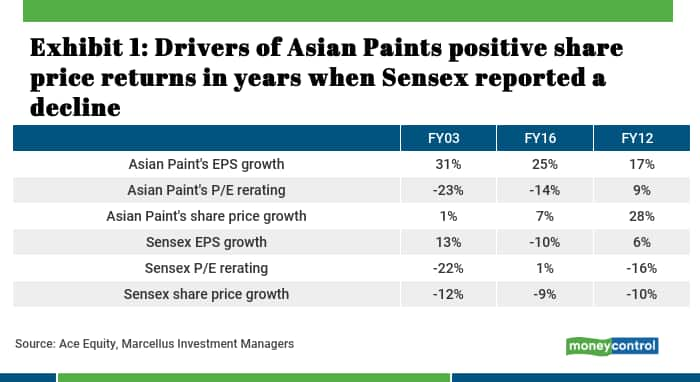

Taking the case of Asian Paints as an example. In FY03 and FY16 (see Exhibit 1 below), Asian Paints managed to maintain healthy earnings growth even in a disruptive external environment<what was this environment>. Hence, the ripple effect of a stressed stock market’s P/E multiple de-rating was more than offset by Asian Paints’ earnings growth during the same period. In FY12, Asian Paints’ P/E multiple expanded by 9 percent with an EPS growth of 17 percent, in a year when the Sensex’s P/E multiple deflated by 16 percent and Sensex’s earnings grew by 6%.

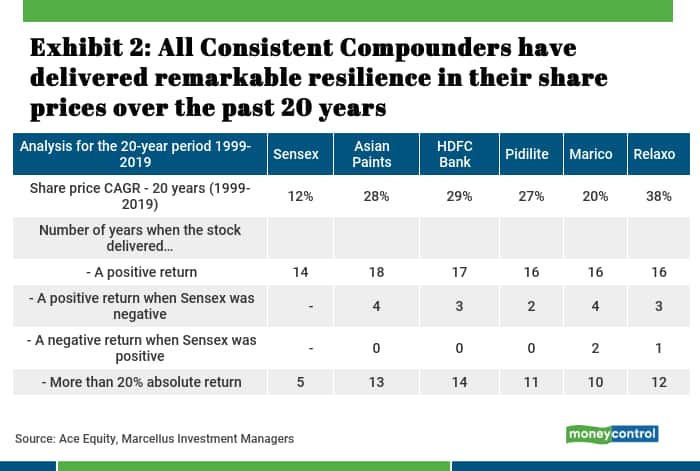

The observations for Asian Paints hold true for all Consistent Compounders. As seen in Exhibit 2, Consistent Compounders not only give returns in absolute terms as well as relative to the broader market, they do so on a steady basis over long periods of time.

Even during periods of a wider economic or financial system crisis, Consistent Compounders tend to sustain their fundamental strengths and their stocks fall less, and recover sooner and sharper after the stock market crisis. In most cases, these companies emerge stronger from a crisis. A portfolio of Consistent Compoundersthus addresses the investor’s worry of large drawdowns in her portfolio in times of a crisis.

During the global financial crisis of 2008-09, the BSE Sensex declined by 61 percent over the period January 2008 to March 2009. As against this, the average drawdown of all Large-cap CCP portfolios constructed based on principles laid out in Coffee Can Investing: The low-risk route to stupendous wealth’ (2018) by Rakshit Ranjan, Saurabh Mukherjea & Pranab Uniyal (refer to ‘Maximum drawdown’ of ‘Large-cap CCP’ portfolios which were active during the 2008 crash i.e. portfolios shown from Exhibit 90 and Exhibit 111 of the book) was only 35 percent.

Some of the most common stocks amongst these active Large-cap CCP portfolios from the book ‘Coffee Can Investing’ included HDFC Bank, Asian Paints, Cipla, HDFC Ltd, Hero Motocop and Infosys. An equal-weighted portfolio (let’s call it the Consistent Compounders portfolio) of these six stocks, for instance, fell by only 25 percent between January 2008 and March 2009.

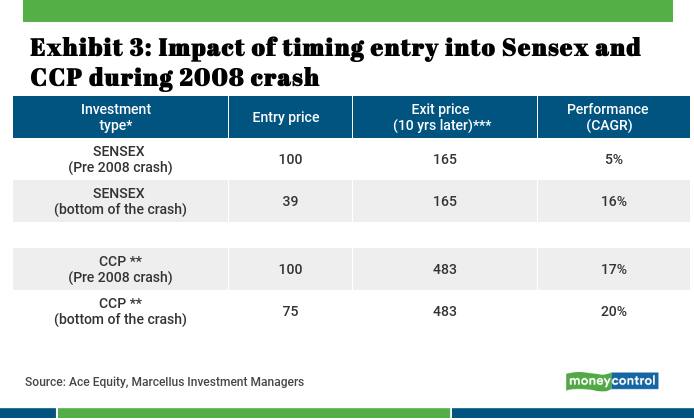

Now let’s analyse the data shown in Exhibit 3 above, to quantify the benefit/futility of timing entry at the bottom of the stock market crash of 2008, for investment in Sensex vs the Consistent Compounders portfolio.

Entry into a mediocre quality stock/portfolio just before the 2008 crash delivered a mere 5 percent CAGR over the next decade, in-line with the weak earnings growth potential of the underlying asset as well as compression in the valuation multiples for the stocks as a reflection of deteriorating fundamentals due to the crisis. However, if an entry in the mediocre portfolio was timed exactly at the bottom of the crash, the 10-year CAGR achieved would have increased to 16%! The difference between 5 percent (without timing) and 16 percent (with perfect timing) is not only large, it also changes the relevance of compounding for such a portfolio consisting of mediocre stocks. At a 5 percent CAGR, an investor is perhaps not even beating inflation in his cost of living. However, at 16 percent CAGR, the investor would have created substantial wealth over a ten-year period.

On the other hand, timing entry/exit from the Consistent Compounders portfolio (as shown in Exhibit 7 above) during the global financial crisis does not materially change the decadal returns. The returns for the Consistent Compounders portfolio increase from an already healthy 17 percent to 20 percent if entry into such a portfolio is perfectly timed at the bottom of the stock market crash.

Hence, the conclusion that emerges from Exhibit 3 is that Resilience of the Consistent Compounders portfolio makes the timing of entry and exit redundant. Meaning that staying invested in a portfolio of Consistent Compounder stocks eliminates the need to time the buying or selling of stocks to avoid large drawdowns in a portfolio.

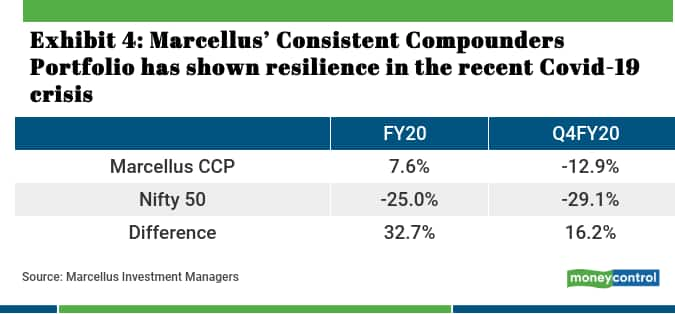

The resilience of companies with strong fundamentals through a crisis is evident from the performance of Marcellus’ Consistent Compounders Portfolio through the recent market meltdown led by the Covid-19 pandemic. As seen in Exhibit 4, the portfolio has delivered a positive absolute return of 7.6 percent over the past 12 months, unlike the -25.0 percent return of Nifty50 over the same period. And this holds true when we back-test returns for a portfolio of CCP companies.

Even on the way up, CCP portfolios recover much sooner and sharper compared to the broader stock market. After a 14-month long fall in the stock market during the 2008 global financial crisis, the market bottomed out on March 9, 2009. As shown in Exhibit 4, CCP stocks recovered back to their pre-crash levels much sooner compared to a long drawn 20-months recovery period for the Nifty50.

As explained earlier, this rapid recovery in share prices of CCP portfolios after the market has bottomed out is because of a combination of the following factors:

• CCP companies might strengthen their fundamentals during such crisis and come out stronger on the other side of the crisis• Before the stock market crash, share price performance of CCP companies is fully supported by their earnings and fundamentals.

In addition to the challenges highlighted in Exhibit 7 and Exhibit 9 above, an investor trying to time entry/exit during a stock market crash will also incur costs involved around a) risk of getting the timing wrong; b) transaction costs; and c) the intense focus on share prices rather than on fundamental research (or your day job) during such times of stock market crash.

What do Consistent Compounders do differently during a crisis? A look at non-financial companies in the ongoing COVID-19 crisis

The Consistent Compounder companies sell products and services which are the small ticket, day-to-day essentials consumed by Indian middle-class households. Unlike spends on tourism/entertainment/leisure/luxury categories, demand for products and services of our portfolio companies is highly utility-oriented and hence cannot be cancelled easily. For instance: a) you cannot defer the purchase of packaged foods like baby milk, COVID tests, essential medicines etc; b) you can delay by few weeks, the purchase of innerwear, footwear, diagnostic tests, etc; and c) you can delay by few months, the repainting or furniture repair in your home. Moreover, no matter how our lifestyle changes after such a crisis, habits and consumption patterns of these products are not likely to change or get substituted in the foreseeable future.

So, what do Consistent Compounders do differently?

• Support offered to channel partners: Addressing the concerns of and managing the interests of the network of distributors and other partners in the supply chain in mind is a common trait among Consistent Compounders. For example, during a crisis like demonetization or the ongoing COVID crisis, Page extends an extra 60 days of credit to distributors. Such support from Page helps strengthen the firm’s relationship with their channel over the longer term”. What is so unique about this? Page’s competitive advantages have allowed it to build a strong balance sheet, which can support a short-to-medium term pressure on working capital due to an extended credit period. Most of its competitors cannot as their RoCEs remain close to their CoC and hence restrict the business’ ability to generate sufficient free cash to build a resilient balance sheet. Another such example is of Dr. Lal Pathlabs, where the firm helps their franchisees by trying to renegotiate downwards rentals for collection centers laboratories.

• Potential benefits of in-house labour force: Footwear and innerwear are the two most labor-intensive manufacturing industries. Relaxo and Page not only do their manufacturing in-house (no outsourced manufacturing), but they do so with a full-time permanent workforce (no-contract labour). On a normal day, this helps these companies maintain the quality of their products, but in crisis, it makes it easier for them to resume normalcy in their manufacturing setups much sooner than that of their competitors, who rely on contract labour and can take time in mobilizing the required workforce.

• Benefits of owning/controlling the supply chain: Once a crisis that affects operations abates, supply chains of different companies come back to normalcy at different speeds. For instance, distributor-based supply chains will come back sooner than wholesaler-based supply chains due to the unorganized/indirect nature and greater stress on the working capital of a wholesaler vs a distributor. Firms that have fewer layers in their channel compared to others will get back to normalcy quicker. Firms like Page Industries and Relaxo are unique relative to their competitors due to their reliance only on distributors rather than wholesalers. Others like Pidilite and Nestle have a greater proportion of direct distributors compared to their competitors who are more dependent on indirect distribution channels. Firms like Asian Paints and Berger do NOT have any channel partners in their supply chain barring the paint dealers on the high street. Dr. Lal Pathlabs, with its B2C business model (direct control on franchisees, lab technicians and equipment used by these lab technicians) will be better placed than competitors like Thyrocare which are more B2B in nature and do not such direct control on their supply chain infrastructure.

• Market share shift from unorganized to organized players, and from small/weak players to large/stronger players: Crises bring out the evolutionary equivalent of business, where the fittest or strongest businesses survive and the weak get weaker. Several Consistent Compounders have been massive beneficiaries of events like demonetization and GST implementation due to the shift of market share from unorganized to organized players after these events. And in all likelihood, such shifts will continue with every business disruption, be it the COVID-19 pandemic, or other domestic or global calamities that may come in the future. The opportunity to consolidate market share will be most seen in industries like footwear, paints, inner-wear, packaged foods, adhesives where the competition tail is long.

• Utilise benefits from the recent corporate tax rate cuts to suffocate competition: Consistent Compounders have been the biggest beneficiaries in their respective industries, of the corporate tax rate cuts announced in 2019. At a time when competitors struggle due to the cash flow implications of the ongoing crisis on their balance sheet, the incremental cash flow available to Consistent Compounders from tax rate cuts is likely to be used to gain market share through product price cuts, higher employee benefits, accelerated capex, support to channel partners and vendors, etc.

(This is the fourth installment of a five-part series by Saurabh Mukherjea, founder of Marcellus Investment Managers. Rakshit Ranjan is Portfolio Manager, and Salil Desai, Portfolio Counsellor at Marcellus Investment Managers.)

Read the first installment here.

Read the second installment here.

Read the third installment here.Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365