According to Glodman Sachs, the stock is pricing in 23 percent average volume growth (3.3x of real GDP) in FY22-24E, leaving limited upside from current levels.

Asian Paints share price was down almost 3 percent intraday on May 12, hitting a 7-week low. Global research firm Goldman Sachs also downgraded the stock to sell with a target at Rs 1,111 per share.

The stock has fallen over 17 percent in the last 15 days and was quoting at Rs 1,536.50, down Rs 32.75, or 2.09 percent, at 11:00 hours on May 12.

According to the research firm, there are significant risks to sales growth as it expects consumers to down trade and extend the re-painting cycle given the macroeconomic slowdown.

Goldman Sachs forecasts FY22E and FY23 volume growth to be 1.5x real GDP growth (lower than the long-term average of 1.7x). It expects volume growth to slow to an average of 6 percent over the next three years.

Asian Paints sales CAGR of 3 percent (FY19-22E) is among the lowest in its coverage, it added.

According to Glodman Sachs, the stock is pricing in 23 percent average volume growth (3.3x of real GDP) in FY22-24E, leaving limited upside from current levels.

While Asian Paints will benefit from the pullback in input costs and can re-invest the same to drive volume growth, it assumes 7 percent average higher volume growth in FY22/23E (at 2.3-2.5x real GDP growth), equates to an implied valuation suggesting 32 percent downside, the research firm said.

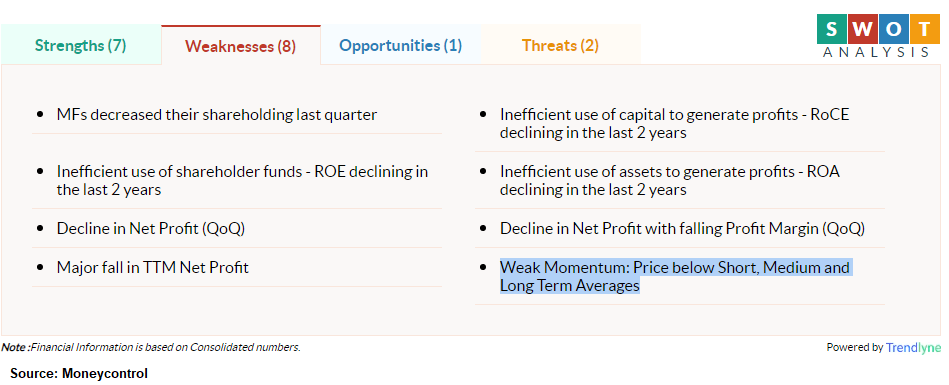

According to Moneycontrol SWOT Analysis powered by Trendlyne, MFs have decreased their shareholding last quarter. The momentum is weak with price below short, medium and long term averages.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365