The share touched its 52-week high Rs 179.95 and 52-week low Rs 60.30 on 27 June, 2019 and 30 March, 2020, respectively.

Vedanta share price jumped more than 12 percent during Tuesday’s trading session. The Nifty metal index rose over 1 percent against selling seen in the overall equity market.

The company's share price has though declined 36 percent in the last 3 months.

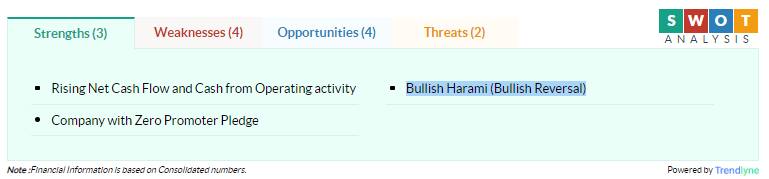

According to Moneycontrol SWOT Analysis powered by Trendlyne, Vedanta showed a decline in its quarterly net profit. Also, mutual funds decreased their shareholding in the last quarter. The company has zero promoter pledge.

The company’s PE ratio is at 8.94X higher than the industry PE of 6.66X, data showed.

The technical rating on Moneycontrol is bullish.

Vedanta share price ended at Rs 89.30, up Rs 9.70, or 12.19 percent on the BSE.

The share touched its 52-week high Rs 179.95 and 52-week low Rs 60.30 on 27 June, 2019 and 30 March, 2020, respectively.

Currently, it is trading 50.38 percent below its 52-week high and 48.09 percent above its 52-week low.

The company's trailing 12-month (TTM) EPS was at Rs 9.67 per share. (Dec, 2019).

The latest book value of the company is Rs 209.51 per share. At current value, the price-to-book value of the company was 0.43.

The dividend yield of the company was 21.11 percent.Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365