Maruti restarted its manufacturing operations at its Manesar plant with one shift and manpower permission of up to 75 percent. It is one of the most active stocks on NSE in terms of value with 6,31,989 shares being traded.

Maruti Suzuki share price fell over 4 percent in the morning trade on May 12 as the auto major restarted its manufacturing operations at its Manesar plant. The company after almost 2 months of lockdown has been allowed to start with one shift and manpower permission of up to 75 percent.

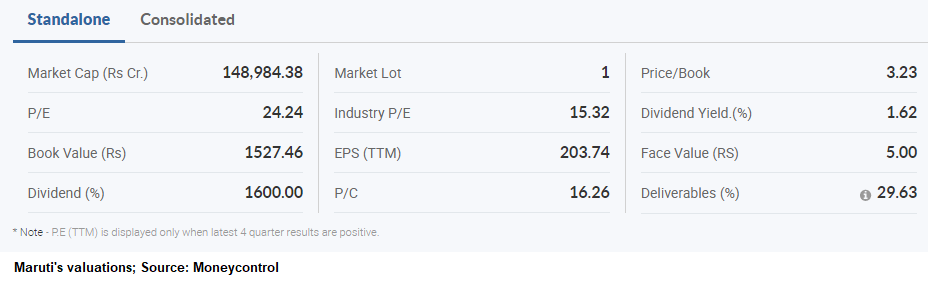

The stock price has been under pressure and has fallen over 32 percent in the last 3 months. It was quoting at Rs 4,715.50, down Rs 216.45, or 4.39 percent at 09:48 hours and is the top index loser. It is also one of the most active stocks on NSE in terms of value with 6,31,989 shares being traded at 09:59 hours.

Maruti Suzuki is scheduled to come out with its March quarter earnings numbers on May 13 and to recommend dividend, if any, on equity shares of the company for the financial year 2019-20, the company said in a filing to the exchanges.

According to Kotak Institutional Equities, revenues are likely to decline by 12 percent YoY to Rs 18,846.7 crore in Q4 FY20, led by 16 percent YoY decline in volumes and 1 percent YoY increase in ASPs.

Profit may also dip 28 percent YoY to Rs 1,293.5 crore. The brokerage firm expects EBITDA to decline by 20 percent in the quarter under study led by 12 percent YoY decline in revenues and 80 bps decline in EBITDA margin driven by negative operating leverage.

Japanese research firm Nomura is of the view that Maruti's revenues may decline around 13 percent YoY on the back of volume drop while EBITDA margins is expected to remain flat sequentially. Revenue may fall 13 percent YoY to Rs 18,596.5 crore. Net profit of Maruti is expected to decline 17 percent YoY to Rs 1,496 crore.

In an interview to CNBC-TV18, RC Bhargava, Chairman at Maruti Suzuki said that the company is starting in a small way with limited number of models with only one shift allowed now and manpower permission up to 75 percent. Working hours have come down to 6.5 from 8 hours/shift due to safety measures adding that dealerships have recently started opening up.

Maruti Suzuki is seeing a supply side constraint currently, he said. There could be labour related issues once production picks up adding that the company has given cash advance against supplies to many of its vendors. The auto industry could end up with 20-25 percent less sales compared to last year.

According to According to Moneycontrol SWOT Analysis powered by Trendlyne, Maruti Suzuki's RoCE has been declining in the last two years while the momentum is weak with price trading below the short, medium and long term averages. The technical rating is also very bearish.

Disclaimer: The above report is compiled from information available on public platforms. Moneycontrol advises users to check with certified experts before taking any investment decisions.Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365