The gap between RoCE and CoC is the free cash flow that a firm generates for its shareholders.

Saurabh Mukherjea

Introduction to Crisis Investing

The year 2019 ended on a pretty strong wicket for equity markets around the world. Most global indices were up 10-25% during the year. The Dow Jones increased investors’ wealth by ~22%, the FTSE, Hang Seng, and India’s Nifty by ~12% and the Nikkei by 18%.

However, 2020 brought with it the rumblings of what eventually became a global pandemic, bringing some of the largest economies of the world to a standstill. As Covid19 spread worldwide, stock markets crashed globally, with many indices recording their worst-ever quarter performance and many others seeing the fastest-ever correction in recent history.

In India, the broader markets were anyway appearing shaky due to the weak growth in corporate profits for the past 6-7 years. Then came Covid-19 to add to investors’ troubles. And in the middle of all this came the collapse of Yes Bank. In a matter of weeks, the stock markets and the larger economy were dealing with a full-fledged crisis.

Despite the mayhem in the markets, in the first three months of 2020, Marcellus’s flagship Consistent Compounders portfolio fell less than half of the broader market fall. In the 12-months to March 2020, the portfolio returned 7.6%, making it the best performing PMS in India.

The market in the same period fell by 25%. Taking a longer time horizon, as per data available on SEBI’s website, Marcellus’ investment technique has beaten the Nifty Index by 19% per annum.

In the five chapters that follow we elaborate on our investment process and emphasize the techniques that have helped the portfolio navigate through tough markets and a crisis. We hope investors find value in these chapters and can take inputs to build their portfolios that survive future crises and keep compounding wealth for them through bad times as well as good.

Chapter 1

India is blessed with several companies that have the unique combination of market dominance and return ratios far in excess of the cost of capital. The resulting free cash generation enables these companies to reinvest back into their businesses to keep strengthening their dominance and return ratios. This cycle gives an opportunity to invest in these businesses and see your money compound at a steady rate over long periods of time.

Economic theory dictates that in a competitive market, no firm can consistently earn a return much higher than its cost of capital. This is because the excess returns will attract more competition, which will, in turn, reduce the profitability of all players operating in that market.

By extension, this means that in a competitive market, even a business that has a large or dominant market share in its industry will earn returns on capital employed (ROCE – earnings generated on each unit of capital employed on the balance sheet) or Returns on Equity ( RoE – returns on each unit of equity invested in the business) close to its Cost of Equity or Cost of Capital.

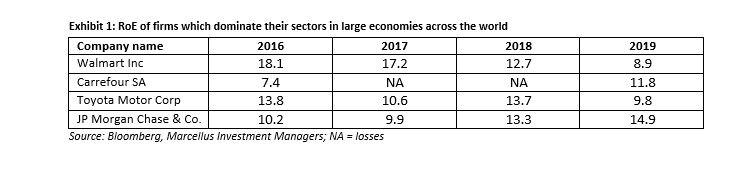

It is not hard to find global players who dominate their industries – Walmart dominates US grocery retailing, Carrefour dominates French grocery retailing, Toyota dominates the mid-segment car market in Japan, Hanes dominates Europe’s innerwear market. However, none of these companies make ROEs substantially higher than their cost of equity (see table below).

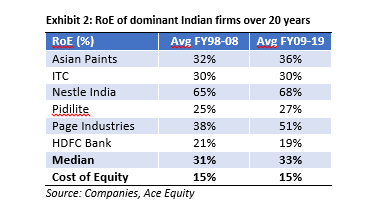

In India, on the other hand, there are several industries where one or two companies not only have a dominant market share, but their RoEs have also remained substantially above the cost of capital (CoC) for several decades in a row (see Exhibit 2).

The strong pricing power and competitive advantage of these Indian firms is what sets them apart from their global counterparts.

The gap between RoCE and CoC is the free cash flow that a firm generates for its shareholders. Provided these firms sustain this wide gap whilst also growing their capital employed, they will generate healthy earnings growth consistently over long periods of time, regardless of changes in the internal or external operating environment of these companies. We call these firms ‘Consistent Compounders’.

Once an investor builds a portfolio of such firms, all that she should do is hold them for long periods of time and benefit from the power of compounding of healthy returns, with the volatility in these returns being similar to that of a government bond!

This sounds very simple, but simple is not always easy! You need to first figure out what exactly is a company’s competitive advantage that helps it dominate its industry and generate returns much higher than its cost of capital.

Second you need to assess the sustainability of the competitive advantage, which will enable the company to maintain its dominance and free cash generation ability for long periods of time – keeping in motion a cycle of earning returns much above the cost of capital, deploying the resulting large free cash flow to grow its business, profits and market dominance, in turn further strengthening its competitive advantages leading to higher free cash flow.

For example, it is easy to find firms like Maruti Suzuki, which has maintained its industry dominance (>50% market share of cars in India), but its average 10-year ROCE is just 17% – like that of Toyota and Hanes highlighted above. Or take the example of Hindustan Unilever (HUL), which sustains a wide gap between RCE and CoC, but does not find avenues to grow its capital employed and hence, despite maintaining >80% ROCE over the past 10-15 years, has generated an annualised earnings growth of only 8% (CAGR) over this period.

Without a thorough understanding of a company’s core fundamental strengths, one may make an initial investment in a portfolio of Consistent Compounders, but may have a less than ideal percentage allocation in the portfolio and/or a shorter than ideal holding period of such stocks in the portfolio. So let’s use a case study to understand how a company builds sustainable competitive advantages and becomes a Consistent Compounder.Case Study of a Consistent Compounder: Asian Paints

One of the biggest challenges in running a decorative paints business in India is that being a chemical, paints are highly voluminous products. The average realisation of a decorative paint in India is around Rs 100 per litre – 10-times more voluminous than say FMCG where the average realisation is around Rs 1000 per litre.

This characteristic makes it challenging to store and transport 4000+ SKUs of decorative paints to 70,000+ dealers across the country. The easiest way to overcome this challenge is to appoint various layer in the distribution channel – third-party C&F Agents, stockists, wholesalers, distributors etc – and let the voluminous product be on the balance sheets of these channel partners while the supply chain through these distribution layers. This is exactly how paints used to be distributed before the 1960s.

However, as Asian Paints became the market leader, they ended up redefining the supply chain dynamics of the decorative paints industry in two ways.

Firstly, Asian Paints reached out directly to the paint dealers on the high-street, without any involvement of a distributor / wholesaler / stockist etc. This has meant that decorative paints is perhaps the only mass-market product sold in India directly to 70,000+ dealers on the high-street by the manufacturer.

Secondly, although MRP printed on a box of decorative paint gives a healthy margin to the dealer, the price at which these products get sold to customers leaves on average only ~3% margin for the dealer – one of the thinnest margins available to the last-mile distribution layer across all B2C categories.

These two changes (direct supply to paint dealers, and only about 3% average margin of the paint dealers) has totally changed the competitive advantage framework for this industry. Let’s delve into this further.

The choice of product manufacturer (and hence the driver of market shares) in a paint project is not really done by the homeowner because he chooses products of the company whose shade-card is brought to him by his trusted contractor / painter (i.e. the influencer).

The painter, in turn, chooses the shade card based on ready availability of all SKUs on the shade card at all points of time with the nearest dealer – this is because paint inventory has to be replenished few times during a paint project and the painter’s team of daily wage workers cannot afford to sit idle due to stock-outs of one of the 4000+ SKUs at the nearest dealer’s shop. Hence market shares in the industry are defined by what the paint dealer decides to stock most readily in his shop. Let us now focus on what drives decision-making of the paint dealer.

The largest element of capital employed for a paint dealer in India is real estate. On this real estate, the store economics for the ROCE of a kirana (convenience store) are totally different from that of a paint dealer.

Firstly, on the same shelf space, a kirana can stock 10x more value of FMCG products compared to the value of decorative paint products, given the voluminous nature of paints (as quantified previously). Secondly, the margin available on each Rupee of sale for a Kirana is 4x higher than that of a paint dealer (12% for a kirana store vs 3% for a paint dealer).

Hence, the only way for a paint dealer to generate ROCE similar to that of a kirana, can be by offsetting the 40x differential (10x multiplied by 4x) through inventory turns which are 40x faster for a paint dealer vs inventory turns of a kirana store.

If Britannia and Hindustan Unilever deliver once in 10 days to a kirana in a city, then the paint dealer next-door requires delivery of paint products with a frequency of 40 times in 10 days i.e. 4 times in a single day. This is exactly the solution which Asian Paints provides to paint dealers, unmatched by most other decorative paint companies in the industry. Why?

Asian Paints has perhaps been the most pro-active corporate investor in technology across the country over the past 60 years. One of the many benefits of tech investments has been the ability of Asian Paints to forecast demand with a high level of accuracy, for each SKU, each location and for every week of the year.

This ensures that without waiting for demand from a paint dealer, the firm optimises the type and quantity of raw material procurement, manufactured products and inventories for each of its depots and delivery trucks. Asian Paints’ competitors are not capable of this sort of precise demand forecasting. Furthermore, the firm continues to deepen this capability over time, since its enormous market share brings to it more data on current demand from every location, than what is received by its competitors.

The importance of supply chain efficiency in helping define winners in the decorative paints industry is so high that over the past 3 decades several competitors have failed to gain any market share by offering: a) superior quality of products (e.g. Dulux Velvet Touch); and b) greater channel margins to paint dealers (e.g. Jotun and Sherwin Williams – before the latter sold their Indian business to Berger).

Finally, Asian Paints keeps investing in ways to disrupt the industry rather than waiting for a competitor to disrupt it. For example, Asian Paints has spent more than a decade in establishing value-added labour-oriented offerings like Asian Paints Home solutions, Water Proofing solutions, Color consultancies, etc. These services benefit from a transition that the sector has undergone over the past few decades.

Asian Paints has limited product price hikes to less than 3.0% CAGR because of incremental operating efficiencies being derived by the firm consistently. This, in turn, has meant that on average, 65% of the cost of a paint project in India is labour (up from 20-30% two decades ago).

This transition calls for a possibility to drive market share in the industry by offering a value-added labour experience to a household in exchange for a labour-intensive composition of the project cost. Such initiatives increase the longevity of Asian Paints’ powerful franchise.

(The author is Founder of Marcellus Investment Managers.)

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365