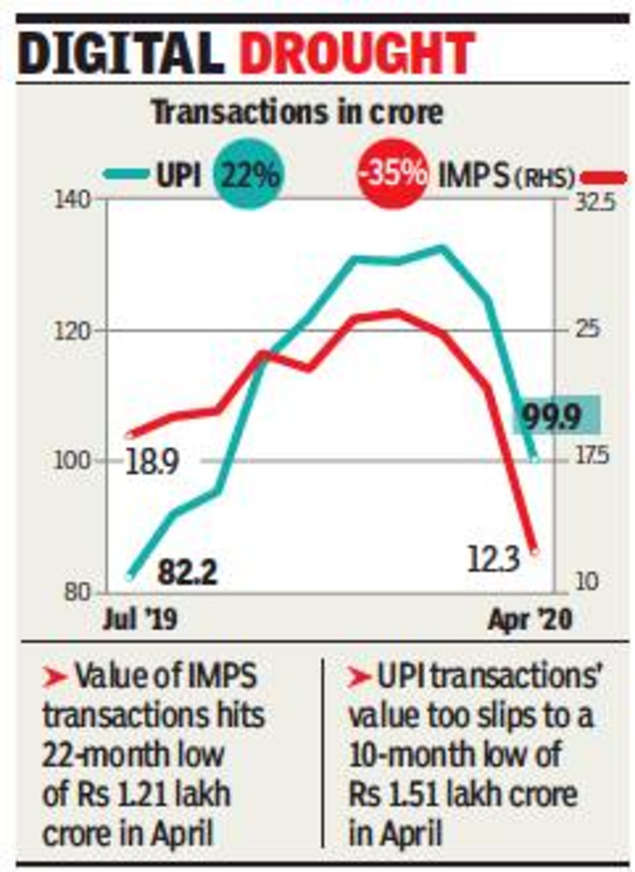

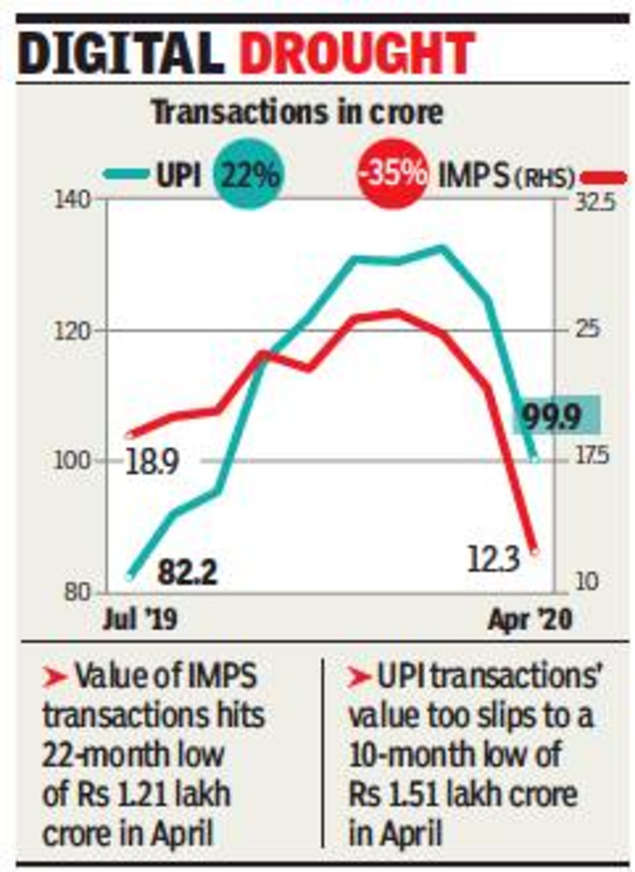

BENGALURU: The economic impact of the lockdown is reflected in the sharp drop in retail interbank transfers under the Immediate Payment System (IMPS). Transactions using this platform in April at 12.2 crore were half of the 24.7 crore transactions in February 2020. This platform is used in a big way by migrant labour and small businesses.

In the case of Unified Payment Interface(UPI) — an app-based payment platform — there has been a significant drop as well from 132 crore in February to less than 100 crore in April.

“IMPS processes the migrant workers’ remittances which is almost zero during the lockdown period,” said Dilip Abse, CEO, NPCI.

“People are aware of international remittances; NRIs in Gulf, US sending money back home. They forget that there’s a large migrant force in cities sending money back home to Bihar, Jharkhand and UP, that’s been largely hit,” said Abhijit Mazumdar, CGM, State Bank of India. April IMPS numbers are a two-year low, according to data from the National Payments Corporation of India (NPCI).

SMEs and MSMEs in garments, textiles, chemicals and contractors for construction companies, city corporations largely use IMPS for vendor payments, say banks. With most Indians now having a bank account, IMPS transactions are replacing money order as a prime mode of transfer for the domestic remittance market.

Bankers say that given the Rs 2 lakh limit under IMPS, it is largely small businesses that use the IMPS platform.

“For anything above that, you’d need to use RTGS. So, larger corporates and mid-cap companies prefer RTGS for bulk payments such as salary credits to employees and vendor payments,” said Deepak Sharma, chief digital officer, Kotak Mahindra Bank.

For April, UPI transactions have hit a 10-month low of Rs 1.51 lakh crore, which is an indication oflow retail consumption, said banks. Consumption like ecommerce purchases, movie tickets, dining out, flight tickets — are paid using debit cards, netbanking or UPI.

In the case of Unified Payment Interface(UPI) — an app-based payment platform — there has been a significant drop as well from 132 crore in February to less than 100 crore in April.

“IMPS processes the migrant workers’ remittances which is almost zero during the lockdown period,” said Dilip Abse, CEO, NPCI.

“People are aware of international remittances; NRIs in Gulf, US sending money back home. They forget that there’s a large migrant force in cities sending money back home to Bihar, Jharkhand and UP, that’s been largely hit,” said Abhijit Mazumdar, CGM, State Bank of India. April IMPS numbers are a two-year low, according to data from the National Payments Corporation of India (NPCI).

SMEs and MSMEs in garments, textiles, chemicals and contractors for construction companies, city corporations largely use IMPS for vendor payments, say banks. With most Indians now having a bank account, IMPS transactions are replacing money order as a prime mode of transfer for the domestic remittance market.

Bankers say that given the Rs 2 lakh limit under IMPS, it is largely small businesses that use the IMPS platform.

“For anything above that, you’d need to use RTGS. So, larger corporates and mid-cap companies prefer RTGS for bulk payments such as salary credits to employees and vendor payments,” said Deepak Sharma, chief digital officer, Kotak Mahindra Bank.

For April, UPI transactions have hit a 10-month low of Rs 1.51 lakh crore, which is an indication oflow retail consumption, said banks. Consumption like ecommerce purchases, movie tickets, dining out, flight tickets — are paid using debit cards, netbanking or UPI.

Download

The Times of India News App for Latest Business News

more from times of india business

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app