We feel with the current situation Gold price is in a holding pattern. It remains to be seen as to what will be economy's direction hereafter.

Gaurav Garg

Gold touched 7-year high in April 2020. However, we have not seen much uptrend since then.

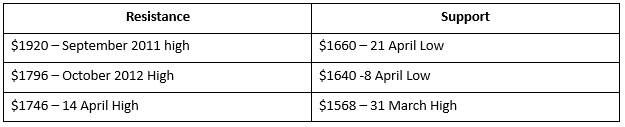

The yellow metal has been trading in quite a tight range recently, with resistance at $1,746 per troy ounce and support at the level of $1660, i.e. $80 range or about 5 percent swing which is a reasonable swing. Gold future made a high of $1,747 on April 14, which was its best level since November 2012.

Having seen this seven-year high in April, it indicated a classic breakout for the precious metal. But, there hasn't been much progress since then. Arguably, one of the things that might be holding it back is the strong performance of other assets including the stock markets which recovered considerably in April.

Traditionally, Gold is seen as a safe-haven. But the stock markets have rallied more than 30 percent in April from their March lows. So, investors have definitely turned their attention back to the riskier waters of the equity segment. That has led Gold to lose some of its lustre, as compared to the metal's bright shining prospects earlier when the whole pandemic situation had erupted.

Stock markets are up by 30 percent and Gold has also rallied around 15 percent from March lows. So it is clear that investors still have some doubts about equities and are not ready to give up on Gold completely.

Apart from that, volatility in the US dollar clearly has had its share of impact on the prices of Gold. The future price movement of Gold now completely depends on the state of the economy and any relief packages to meet investors' expectations. A lot of traders find the bounce back in the stock market to be a little too quick and very remarkable.

This is the classic situation where the prices of gold and equities are inversely proportional. And this will be reinforced further if the economy fails to stand up on its feet again.

A US Consumer Confidence data released last week states that consumer confidence is at its worst level since 1973. In our view, the fortunes of Gold will shine, if the stock markets start to weaken or there is an overdue pullback.

Whereas on the global front, investors are looking at the guidelines which may be issued by the US Federal Reserve regarding interest rates in the future. There are expectations that the US Federal Reserve will cut the interest rates and this will lead to the weakening of the dollar and hence can trigger a bullish trend in Gold and Silver prices.

The US Federal Reserve said that the US economy could possibly start its recovery from the economic impact of the virus in the second half of 2020. But it warned that growth is likely to be slow and uneven as the US economy grapples with its worst depression in decades.

So we feel with the current situation Gold price is in a holding pattern. It remains to be seen as to what will be the economy's direction hereafter.

On the technical side, the immediate resistance for the Gold price is at $1,746, a level that was tested in April 2020. Post that, the next hurdle can be at $1,800. On the downside as well, the support is placed at $1,660-1,640- both of these levels having been touched in April.

As the volatility has been quite low, these two levels can help short to medium term traders pick up trades. If we look at the Gold futures charts, currently everything is indicating a weakness in the short term. RSI indicators are overbought since April 14.

Also, if we look at the signals from the MACD indicator, we had a sell signal in the last week of April. So it would not be surprising to see a little weakness in Gold.

In the upcoming week, the focus will be on the coronavirus numbers and the lifting of restrictions and lockdowns in various countries. Of course, an upsurge in COVID-19 positives numbers will lead to more lockdowns and it will create a bullish opportunity for Gold. For a long term perspective, we aren’t expecting any major change or top up on the fiscal and monetary stimulus.

The author is Head of Research at CapitalVia Global Research Limited- Investment Advisor.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365