Markets witnessed a bounce back from the bottom over-optimism on relief measures introduced by government but continuous rise in COVID-19 cases and bad earning season weighed on the sentiments.

A volatile week for Indian markets which started off on a weak note, but witnessed mild recovery towards the close of the week. Benchmark indices closed below their crucial support levels while small and mid-caps outperformed on a relative basis.

The Nifty50 plunged 6.17 percent while the S&P BSE Sensex was down 6.15 percent for the week ended May 8 compared to 4.9 percent fall seen in the S&P BSE Mid-cap index, and 4.17 percent drop in the S&P BSE Small-cap index in the same period.

Small and Mid-caps outperform on a relative basis, but profit-taking was seen across the board as market participants preferred to book profits at higher levels after a sharp rally seen in the previous week.

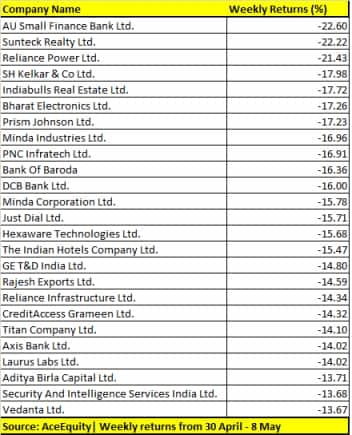

There are as many as 87 stocks in the S&P BSE 500 index which fell 10-30 percent for the week ended May 8 that include names like Power Finance Corp., Motherson Sumi, Quess Corp, Tata Motors, ITC, Maruti Suzuki, Havells India, Titan, SIS, Reliance Power, and AU Small Finance Bank.

The Nifty50 rose over 14 percent in April, and more than 7 percent in the last week of April; hence, some profit-taking was on cards.

“Broader markets have substantially recovered but not all stocks would prove to be outstanding wealth creators in the long run. A crack in the larger weights will eventually trickle down to the small and mid-caps taking them lower in times to come,” Umesh Mehta, Head of Research, Samco Securities told Moneycontrol.

Weak global cues, muted economic activity, rise in COVID-19 related cases, weak numbers from India Inc. for March quarter, and fears of extension in lockdown weighed on sentiment.

“Markets witnessed a bounce back from the bottom over-optimism on relief measures introduced by government but continuous rise in COVID-19 cases and bad earning season weighed on the sentiments which lead to a sharp selloff,” Ritesh Asher - Chief Strategic Officer(CSO) told Moneycontrol.

“But, speculations over various stimulus packages for stressed industries from the government has contributed to this end of the week recovery,” he said.

The Nifty settled the week at 9252. Broader markets behaved in tandem with the benchmark as Nifty midcap and small-cap lost 5 percent and 4 percent, respectively. Sectorally, barring pharma, all major indices ended in the red weighed by financials, metal, and auto.

The weekly price action formed a sizable bear candle carrying lower high-low for the first time in the past six weeks, as on expected lines index took a breather after approaching in the vicinity of our target of 10,000. The index is likely to undergo consolidation in the coming week, suggest experts.

“The level of 9,500 would act as key resistance as it is 50 percent retracement of current week’s decline (9,890-9,117), at 9,506 coincided with a lower band of Monday’s negative gap placed at 9,533,” Dharmesh Shah, Head – Technical, ICICI direct told Moneycontrol.

“We expect the index to undergo healthy consolidation (9,500-8,800) that will help the index to haul the overbought condition of a weekly stochastic oscillator (placed at 83),” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365