Some brokerages and market experts believe the COVID-19 will bring about a change in market leadership and pharma will emerge stronger.

At a time when COVID-19 has hit businesses hard, pharma has emerged as a bright spot.

A strong demand environment and a depreciating currency have put the pharma sector in a sweet spot.

Some brokerages and market experts believe COVID-19 will bring about a change in market leadership and pharma will emerge stronger.

"After almost 4 years of underperformance, pharma seems to have regained its lost 'mojo' in the last 2 months as focus globally turns towards this sector. We think Indian pharma stocks will be the leaders of the next bull run for the next 2/3 years as earnings, volumes & growth will see outperform. Also, the need for medicine stocking may be more psychological which could drive higher volumes both globally & locally," Sanjiv Bhasin, Director at IIFL, said in an interview with Moneycontrol.

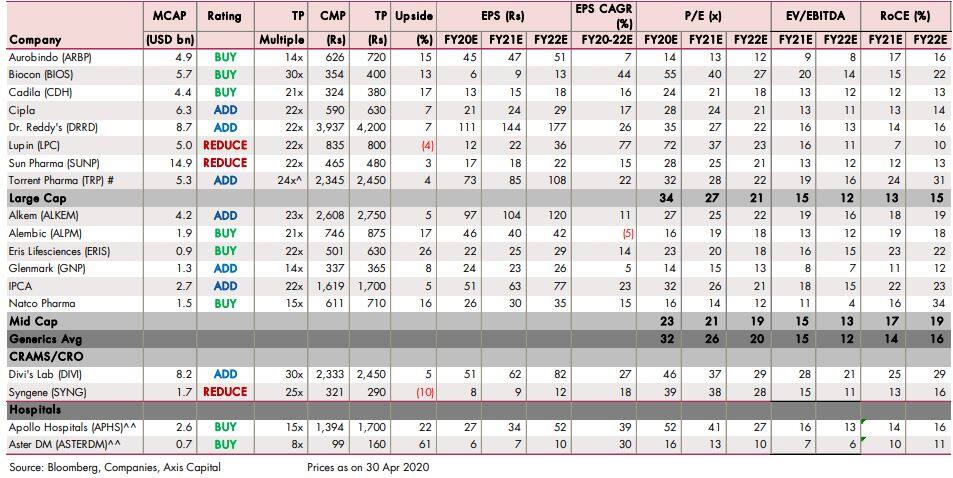

Brokerage firm Axis Capital points out tailwinds emerging in the US generic business.

"With tailwinds emerging in US generics after COVID-19, we expect negative operating leverage (high CAPEX and R&D coupled with slower approvals/ USFDA issues) which had compressed return ratios to improve over near to medium term," said Axis Capital.

The brokerage has raised EPS and PE for US-focused companies.

On the other hand, despite near-term challenges, domestic-focused companies’ growth is seen steady over the medium-term.

Axis Capital continues to like domestic-focused companies for sustainable growth and margin and the ability to generate free cash flows.

Axis has a buy recommendation on Aurobindo, Cadila, Biocon, Alembic, Eris Lifesciences and Natco Pharma.

On the earnings front, brokerages expect the domestic formulations segment to see a healthy Q4 with 9-12 percent year-on-year (YoY) organic growth for the sector, with the limited impact of COVID-19 on domestic sales for the quarter, given most companies have a cut-off date of around March 20 for book sales.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Special Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365