Experts feel that there are a few factors which investors should keep in mind while buying beaten-down stocks especially at a time when the COVID-19 outbreak has virtually halted the economic activity.

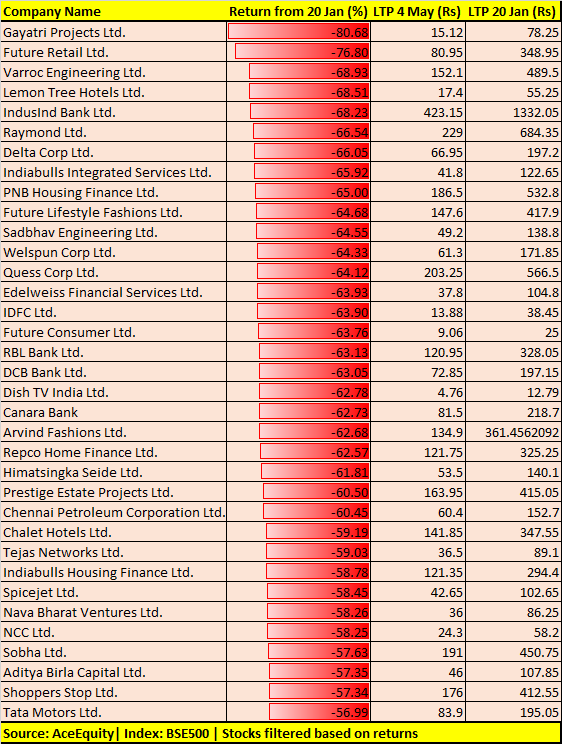

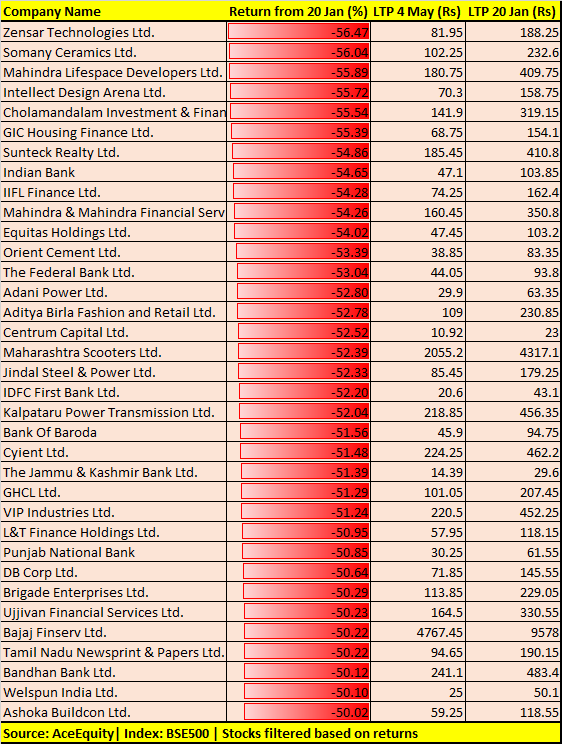

Nearly 90 percent of the top 500 companies on the BSE have given negative returns since January 20 when the S&P BSE Sensex hit a record high. 71 of those firms have fallen more than 50 percent in the same period.

One way to look at the fall is – stocks are available at a 50-80% discount from the price which they were trading at just 3 months back. The other way could be to analyse the reason behind the fall and then make an informed decision to either buy or sell.

Note: The list is for reference only and not a buy or sell recommendations

Free Cash Flow Generation:Does the company’s business generate free cash flow to sustain or survive its current obligations or will it require more capital as given that capital will be available easily in the current scenario?

Does the company produce an essential commodity:

Are the company’s products essential in nature or are they luxury or discretionary? In tough times, a lot of discretionary spending will be pushed forward or maybe down traded and thus growth may actually come down significantly.

Expert: Dinesh Rohira, Founder and CEO, 5nance.com

Growth prospects:

In the current environment, there are some businesses that will benefit. These are the companies with products that have non-discretionary demand and low elasticity to price.

Management dynamism:

Many companies that can change quickly with the times will be at an advantage. Adapting products and services to the environment is key, such that it can benefit consumers.

Valuations:

Across the board, valuations have become reasonable. Still, recent financials can have a bearing on the continuing performance. Sometimes very low valuations can also mean that poor fundamentals are expected to remain or further deteriorate.

De-leveraged companies:

Companies with lower levels of debt are always in a better position to tide through tough times. They are the ones that have more capacity to survive and change according to the requirement.

Technologically-driven businesses:

Many companies implement technology to their advantage. It is even more critical during such times as social distancing could mean more virtual dependence.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

First Anniversary Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365