The company announced its quarterly and annual results today

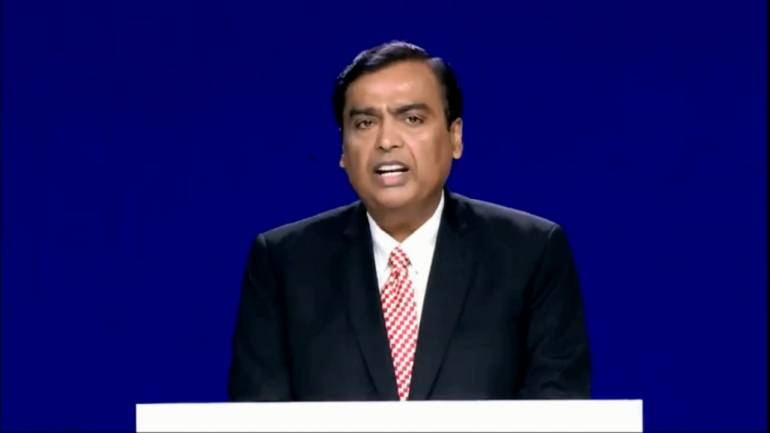

Reliance Industries Thursday said it will achieve zero net debt status ahead of schedule, as it announced its quarterly and annual results.

RIL said it expected to complete the capital raising programme totalling over Rs 1.04 lakh crore by Q1 of the current financial year. This includes the investment by Facebook in Jio Platforms, the upcoming rights issue and the previous investment by British Petroleum in FY2019-20.

In addition to the investment by Facebook, the company said, it has received strong interest from other strategic and financial investors and is in good shape to announce a similar-sized investment in the coming months.

"This establishes the attractiveness of Jio Platforms to the world and is a strong validation of RIL’s capability to conceive large-scale disruptive greenfield businesses. With strong visibility to these equity infusions, the Board was informed that RIL is set to achieve net-zero debt status ahead of its own aggressive timeline," the company said in its quarterly result release.

The company had targeted to be zero net-debt by early 2021.

The company also announced a 1:15 rights issue at Rs 1,257 per share to raise Rs 53,125 crore.

The country's largest listed company by market capitalisation posted a consolidated profit of Rs 6,348 crore during January-March quarter 2020, registering a decline of 45.5 percent QoQ and 38.7 percent YoY.

The consolidated profit in the previous quarter was Rs 11,640 crore and in the corresponding quarter last year, it was Rs 10,362 crore.

The bottom line was hit by an exceptional loss of Rs 4,267 crore due to a fall in oil prices and demand destruction due to COVID-19, but healthy growth in Reliance Jio limited the profit decline.

ALSO READ: Facebook-Jio deal | Will it help RIL deleverage and re-rate?

First Anniversary Offer: Subscribe to Moneycontrol PRO’s annual plan for ₹1/- per day for the first year and claim exclusive benefits worth ₹20,000. Coupon code: PRO365