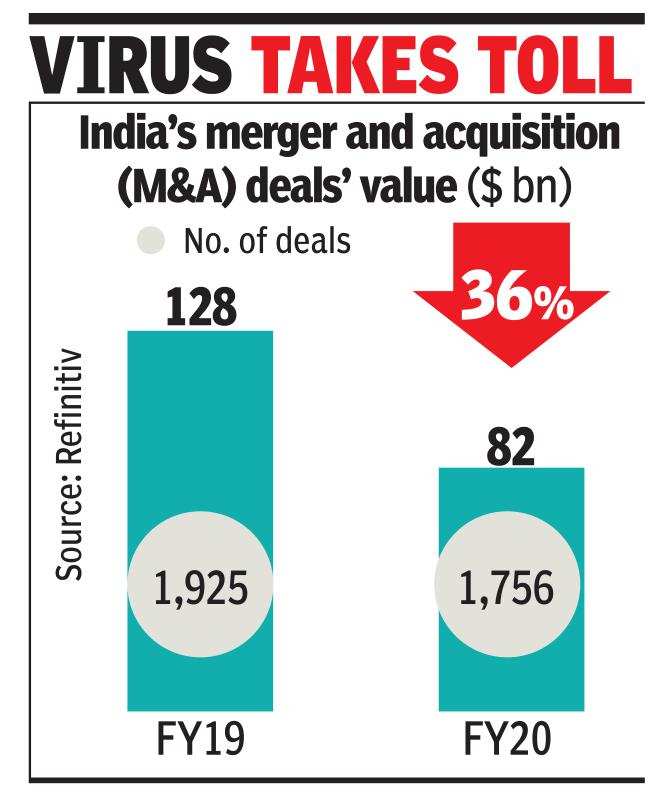

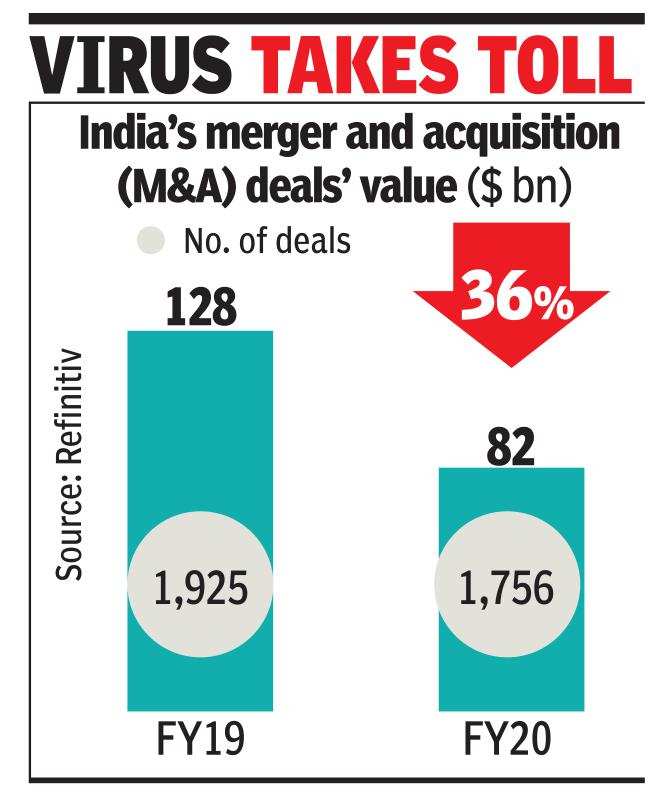

MUMBAI: India deal-making fell by more than a third in fiscal 2020 thanks to global tensions, economic slowdown, debt distress and the coronavirus outbreak. From a record high of $128 billion in fiscal 2019, merger and acquisition (M&A) value declined to $82 billion.

While several headline-making transactions were announced in fiscal 2020, a few of them like Brookfield’s purchase of Jio’s tower assets, Adani’s acquisition of Krishnapatnam Port and French company ADP’s purchase of a stake in GMR Airports are still pending closure. The number of transactions too declined from a peak of 1,925 to 1,756 in fiscal 2020, data from Refinitiv showed.

Though industry observers see continued deal activity by companies to improve market share, seek new technological capabilities and access complementary services, they predict a downward trend in overall M&A action this fiscal. Deal Street will be impacted by the deterioration of the capital market and slump in the economy as India factors in the significant fallout from Covid-19 on itself.

“Various headwinds muted India’s deal-making in fiscal 2020,” said Refinitiv senior analyst Elaine Tan. Nonetheless, the total M&A value at $82 billion remained elevated compared to historical levels, emerging as the second-best financial year in two decades, Tan added.

More than half of the M&A activity was driven by local consolidation ($43 billion), followed by deals by foreign companies ($34 billion) and cross-border transactions by Indian companies ($1.9 billion). Cross-border deals were the lowest in 14 years.

“The financial crisis, triggered by Covid-19, will increase pressure on diversified enterprises to restructure portfolios and deleverage balance sheets by selling off assets which generate returns below a certain threshold level,” said Singhi Advisors MD Mahesh Singhi. The start of the fiscal saw Reliance Industries agreeing to sell a stake in digital platforms unit to Facebook for $5.7 billion amid its debt-reduction plans.

Though US and European companies have traditionally fuelled M&A activity in India, Chinese players have been upping deal-making here. They struck 15 transactions in fiscal 2020, investing nearly $2 billion in one of Asia’s lucrative markets. In fiscal 2013, China had inked just one transaction involving an investment of $25 million. It subsequently ramped up to seven ($725 million) in fiscal 2016 and to 12 ($1.7 billion) in fiscal 2019.

However, legal experts said India’s new rules to screen foreign direct investments from China will delay deal-making. “Not only for new investments, government approval will also be required for making additional investments. It will impact all those Indian companies in which Chinese entities have made investments,” said J Sagar Associates partner Lalit Kumar. Requiring government approval (meaning Chinese companies cannot go through the automatic route) could be a “damper” on the M&A market.

While several headline-making transactions were announced in fiscal 2020, a few of them like Brookfield’s purchase of Jio’s tower assets, Adani’s acquisition of Krishnapatnam Port and French company ADP’s purchase of a stake in GMR Airports are still pending closure. The number of transactions too declined from a peak of 1,925 to 1,756 in fiscal 2020, data from Refinitiv showed.

Though industry observers see continued deal activity by companies to improve market share, seek new technological capabilities and access complementary services, they predict a downward trend in overall M&A action this fiscal. Deal Street will be impacted by the deterioration of the capital market and slump in the economy as India factors in the significant fallout from Covid-19 on itself.

“Various headwinds muted India’s deal-making in fiscal 2020,” said Refinitiv senior analyst Elaine Tan. Nonetheless, the total M&A value at $82 billion remained elevated compared to historical levels, emerging as the second-best financial year in two decades, Tan added.

More than half of the M&A activity was driven by local consolidation ($43 billion), followed by deals by foreign companies ($34 billion) and cross-border transactions by Indian companies ($1.9 billion). Cross-border deals were the lowest in 14 years.

“The financial crisis, triggered by Covid-19, will increase pressure on diversified enterprises to restructure portfolios and deleverage balance sheets by selling off assets which generate returns below a certain threshold level,” said Singhi Advisors MD Mahesh Singhi. The start of the fiscal saw Reliance Industries agreeing to sell a stake in digital platforms unit to Facebook for $5.7 billion amid its debt-reduction plans.

Though US and European companies have traditionally fuelled M&A activity in India, Chinese players have been upping deal-making here. They struck 15 transactions in fiscal 2020, investing nearly $2 billion in one of Asia’s lucrative markets. In fiscal 2013, China had inked just one transaction involving an investment of $25 million. It subsequently ramped up to seven ($725 million) in fiscal 2016 and to 12 ($1.7 billion) in fiscal 2019.

However, legal experts said India’s new rules to screen foreign direct investments from China will delay deal-making. “Not only for new investments, government approval will also be required for making additional investments. It will impact all those Indian companies in which Chinese entities have made investments,” said J Sagar Associates partner Lalit Kumar. Requiring government approval (meaning Chinese companies cannot go through the automatic route) could be a “damper” on the M&A market.

Download

The Times of India News App for Latest Business News

Subscribe

Start Your Daily Mornings with Times of India Newspaper! Order Now

more from times of india business

Coronavirus outbreak

Business News

LATEST VIDEOS

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app