MUMBAI: The Reserve Bank of India (RBI) governor Shaktikanta Das has indicated that the fiscal deficit target of 3.5% will be breached this year, but he said that no view has been formed on the central bank monetising the deficit by purchasing government bonds.

The governor added that, while there was a need for the government to support the economy through a fiscal package, it has to be balanced with a sustainable level of fiscal deficit that is consistent with macroeconomic and financial stability.

In an interview to a news agency, the first since the Covid lockdown began, Das said that the central bank was in battle-ready mode and ensuring funds flow to NBFCs and microfinance institutions was an issue that was very much “on RBI’s table”. He pointed out that the RBI had permitted banks to extend a repayment moratorium to all borrowers, including NBFCs.

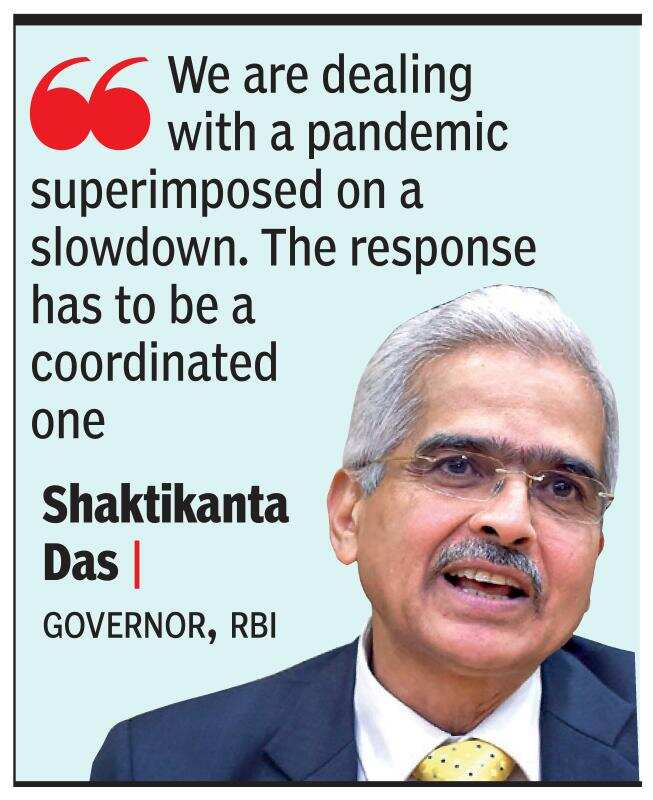

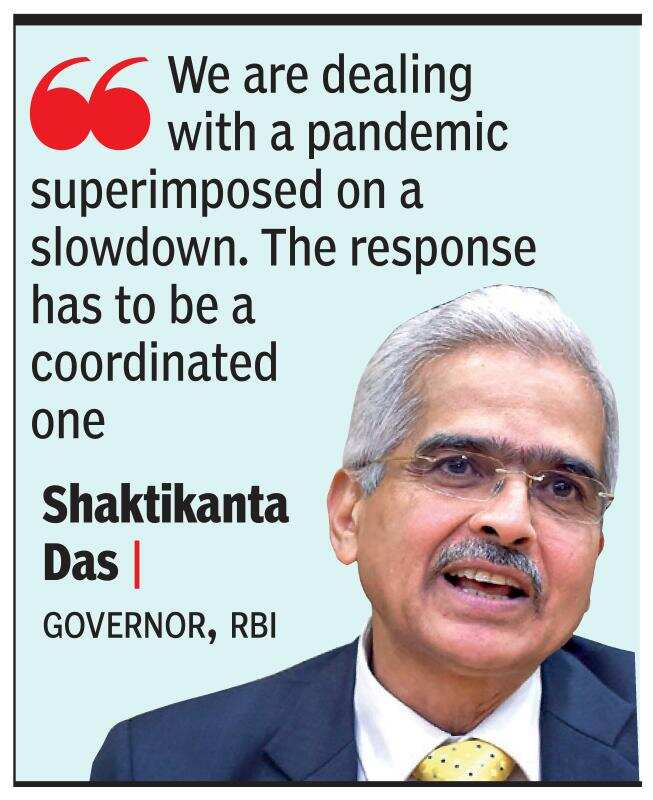

Denying that the RBI has purchased government bonds in auctions, Das said the central bank had different tools at its disposal. “We are dealing with a pandemic superimposed on a slowdown. The response has to be a coordinated one, with all arms of public policy as well as other stakeholders in the economy pulling together and working in close cooperation,” said Das.

The governor said that there should be a plan to exit the fiscal stimulus package. “The mantra of coming out of the ‘chakravyuh’ has to also be thought through very carefully and be factored in when entering the ‘chakravyuh’,” said Das. He was referencing former RBI governor D Subbarao’s quote, wherein he referred to an expansionary policy as a ‘chakravyuh’ battle formation, which was more difficult to exit than enter.

On the likelihood of the government monetising its deficit, Das said, “We will deal with it keeping in view the operational realities, the need to preserve the strength of the RBI’s balance sheet and, most importantly, the goal of macroeconomic stability, our primary mandate.”

“The 3.5% fiscal deficit target for this year will be very challenging to meet. As regards, how much it will exceed and how much the government will spend, that will depend on the view taken by the government, with regard to what kind of support measures can be taken that produce maximum impact,” said Das.

On the foreign exchange front, Das said that he did not rule out the possibility of inflows picking up. “That can also happen with so much of liquidity in the advanced economies, it will naturally spill over to economies like India, which have strong macroeconomic fundamentals,” said Das.

The governor also indicated that the dependence of foreign investors on rating agencies has diminished due to the information boom. “Rating agencies do influence some foreign investors who follow their own methods of indexation where there is application of ratings for investment. But, by and large, foreign investors in the last several years have exhibited their trust on the Indian economy irrespective of the rating upgrade or downgrade,” said Das.

The governor added that, while there was a need for the government to support the economy through a fiscal package, it has to be balanced with a sustainable level of fiscal deficit that is consistent with macroeconomic and financial stability.

In an interview to a news agency, the first since the Covid lockdown began, Das said that the central bank was in battle-ready mode and ensuring funds flow to NBFCs and microfinance institutions was an issue that was very much “on RBI’s table”. He pointed out that the RBI had permitted banks to extend a repayment moratorium to all borrowers, including NBFCs.

Denying that the RBI has purchased government bonds in auctions, Das said the central bank had different tools at its disposal. “We are dealing with a pandemic superimposed on a slowdown. The response has to be a coordinated one, with all arms of public policy as well as other stakeholders in the economy pulling together and working in close cooperation,” said Das.

The governor said that there should be a plan to exit the fiscal stimulus package. “The mantra of coming out of the ‘chakravyuh’ has to also be thought through very carefully and be factored in when entering the ‘chakravyuh’,” said Das. He was referencing former RBI governor D Subbarao’s quote, wherein he referred to an expansionary policy as a ‘chakravyuh’ battle formation, which was more difficult to exit than enter.

On the likelihood of the government monetising its deficit, Das said, “We will deal with it keeping in view the operational realities, the need to preserve the strength of the RBI’s balance sheet and, most importantly, the goal of macroeconomic stability, our primary mandate.”

“The 3.5% fiscal deficit target for this year will be very challenging to meet. As regards, how much it will exceed and how much the government will spend, that will depend on the view taken by the government, with regard to what kind of support measures can be taken that produce maximum impact,” said Das.

On the foreign exchange front, Das said that he did not rule out the possibility of inflows picking up. “That can also happen with so much of liquidity in the advanced economies, it will naturally spill over to economies like India, which have strong macroeconomic fundamentals,” said Das.

The governor also indicated that the dependence of foreign investors on rating agencies has diminished due to the information boom. “Rating agencies do influence some foreign investors who follow their own methods of indexation where there is application of ratings for investment. But, by and large, foreign investors in the last several years have exhibited their trust on the Indian economy irrespective of the rating upgrade or downgrade,” said Das.

Download

The Times of India News App for Latest Business News

Subscribe

Start Your Daily Mornings with Times of India Newspaper! Order Now

more from times of india business

Coronavirus outbreak

Business News

LATEST VIDEOS

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app