Value Research Stock Advisor has just released a new stock recommendation. You can click here to learn more about this premium service, and get immediate access to the live recommendations, plus new ones as soon as they are issued.

The National Savings Certificate (NSC) is a popular and safe small-savings instrument that combines tax savings with guaranteed returns. This scheme is backed by the government and is available at post offices. The distribution reach of India Post is responsible for the popularity of this instrument. The main objective of investing in the NSC is to avail tax deduction on deposits and guaranteed returns on investment.

Capital and Inflation Protection

When investing in the NSC, your capital is completely protected as the scheme is backed by the Government of India. The NSC is however not inflation protected. This means that whenever inflation is above the current guaranteed interest rate, the deposit earns no real returns. However, when the inflation rate is below the guaranteed interest rate, it does manage a positive real rate of return.

Guarantees

The interest rate on the NSC is guaranteed. Currently, the interest rate is 6.8 per cent on the five-year option, compounded annually. The ten-year option of the NSC has been discontinued. Ever since FY 2016-17, the interest rate on the NSC is revised every quarter as per the prevailing government bond rates. However, once you have invested in the NSC, the rate applicable at that time will be applicable throughout the tenure of your investment.

Liquidity

Liquidity in the NSC is available in the form of loans since you can borrow against your NSC savings.

Exit Option

Money in the NSC is locked in for the tenure of the investment. Premature encashment is possible in case of death of the certificate holder. The NSC is also transferable.

Tax Implications

The sum invested in the NSC is eligible for tax deduction under Section 80C up to the Rs 1.5 lakh limit stipulated in a financial year, including the accrued interest on the existing certificates. Since the interest earned on the NSC is automatically reinvested, it can be claimed as a deduction under Section 80C. But if the accrued interest is not added to the Rs 1.5 lakh deduction under Section 80C, then the entire income is taxable on maturity.

Where to Buy

The NSC can be bought from any head post office or general post office.

How to Buy

- You need to fill the NSC application form available at the post office.

- Carry original identity proof for verification at the time of buying.

- You can buy the certificate with cash, cheque or demand draft drawn in favour of the postmaster of the post office from where you are buying the NSC.

Points to Remember

- NSC certificates are en-cashable at any post office in India, provided one has obtained transfer rights.

- You can pledge NSC certificates to obtain loans.

- In case of loss or damage of NSC certificates, duplicate certificates can be obtained on furnishing an indemnity bond.

- NSC certificates are transferable across post offices.

- Interest income is taxable (if not claimed under Section 80C), but no tax is deducted at the source.

Tips and strategies

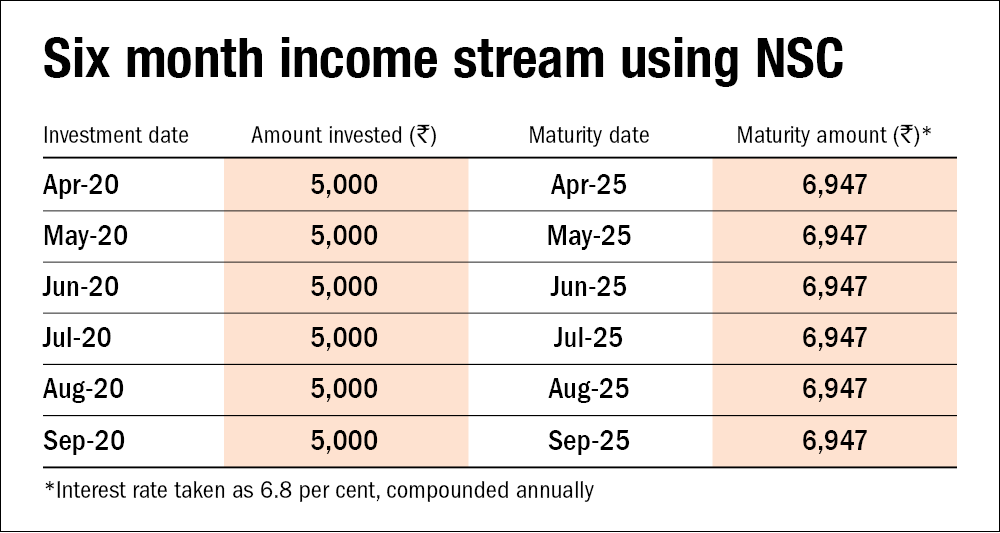

The assured return on the NSC can be used to create an income ladder. Certificates can be bought every month or quarter for appropriate denominations, which on maturity will act as a steady income stream. For instance, someone retiring in 2025 can create an income ladder by investing a fixed sum every month from April 2020. Some people use this ladder effect to create an income stream that will last 10-15 years by timing NSC maturity and re-investment to create an assured income in retirement. See the table below.

Features at a Glance

Eligibility: You need to be a resident Indian to buy the NSC

Entry age: No age is specified for account opening

Minimum Investment: Rs 1,000

Interest: 6.8 per cent compounded annually for the period April-June, 2020. Interest rates are subject to revision every quarter.

Tenure: Five years

Nomination Facility: Available

Account-holding categories

- Individual

- Joint

- Minor through the guardian