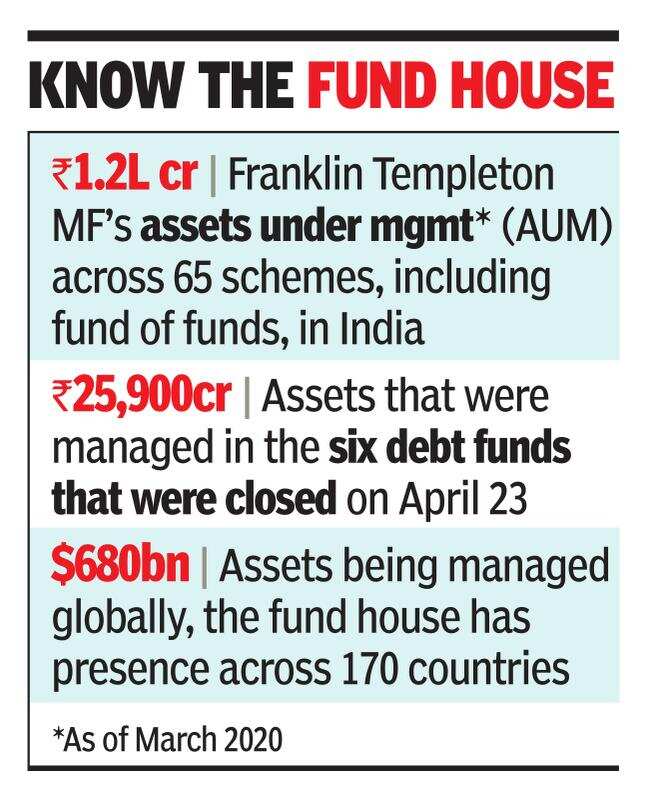

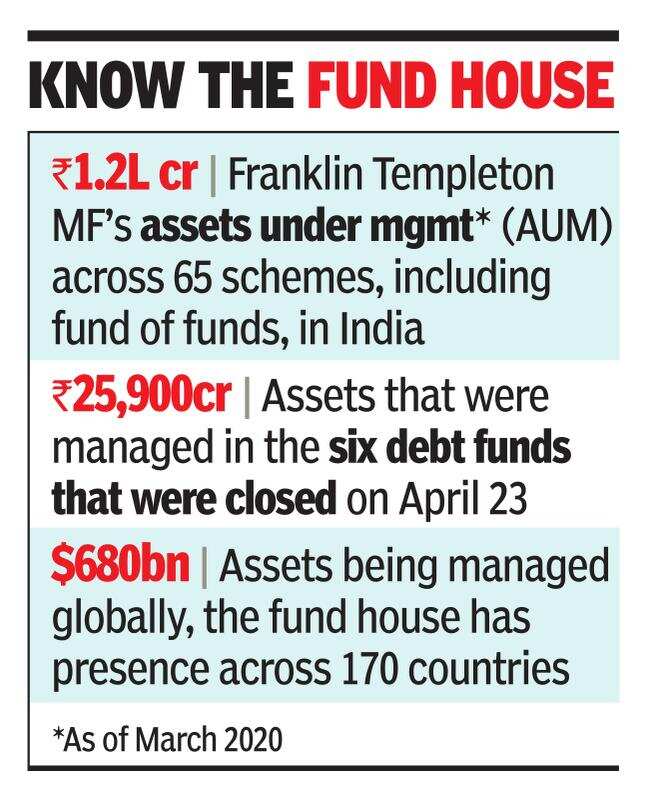

MUMBAI: A day after Franklin Templeton Mutual Fund said it was winding down six of its debt funds with nearly Rs 25,900 crore in total assets under management, fund industry leaders found themselves busy assuaging frayed nerves of investors, distributors and other stakeholders.

In a hurriedly called conference call, top officials of industry body Association of Mutual Funds in India (AMFI) said that the Franklin Templeton incident was an isolated one and there was ample liquidity in the system, which will prevent any repetition of it.

Pointing out that the assets of these six schemes constitute less than 1.4% of the total funds managed by Indian fund houses, an AMFI release said “income-oriented debt schemes of most mutual funds have superior credit quality and continue to remain fairly liquid even in these challenging times”.

It also pointed out that fund houses were not borrowing large amounts from banks to meet their redemption needs. Although Sebi regulations allowed funds to borrow up to 20% of their assets to meet redemptions and dividend payouts, only four of the 42 fund houses had borrowings aggregating Rs 4,428 crore.

According to AMFI chairman Nilesh Shah, there is nearly Rs 7 lakh crore worth of liquidity in the banking system. The central bank is conducting its targeted long-term repo operations (TLTROs) to provide funds to entities in need and the central bank is likely to keep the bond market liquid in the current challenging times. “The fund industry continues to remain robust, like in 2008 sub-prime crisis or 2013 taper tantrum crisis,” Shah said.

During the day, brokers’ body Association of National Exchanges of Members of India (ANMI) approached the finance ministry and markets regulator Sebi to step in to restore confidence of fund investors. It also requested the government to start an investigation by an expert committee to look into the circumstances that led the fund house to take this drastic step.

“ANMI believes that this is of paramount importance as the confidence of investors in debt mutual funds is at risk,” a letter from ANMI said and added that an isolated event should not dent the confidence in a Rs 24-lakh-crore industry.

The overnight developments in the fund industry also impacted confidence of investors on Dalal Street on Friday with the sensex, after volatile trades, closing 536 points lower at 31,327 as banking & financial and IT stocks led the laggards.

In a hurriedly called conference call, top officials of industry body Association of Mutual Funds in India (AMFI) said that the Franklin Templeton incident was an isolated one and there was ample liquidity in the system, which will prevent any repetition of it.

Pointing out that the assets of these six schemes constitute less than 1.4% of the total funds managed by Indian fund houses, an AMFI release said “income-oriented debt schemes of most mutual funds have superior credit quality and continue to remain fairly liquid even in these challenging times”.

It also pointed out that fund houses were not borrowing large amounts from banks to meet their redemption needs. Although Sebi regulations allowed funds to borrow up to 20% of their assets to meet redemptions and dividend payouts, only four of the 42 fund houses had borrowings aggregating Rs 4,428 crore.

According to AMFI chairman Nilesh Shah, there is nearly Rs 7 lakh crore worth of liquidity in the banking system. The central bank is conducting its targeted long-term repo operations (TLTROs) to provide funds to entities in need and the central bank is likely to keep the bond market liquid in the current challenging times. “The fund industry continues to remain robust, like in 2008 sub-prime crisis or 2013 taper tantrum crisis,” Shah said.

During the day, brokers’ body Association of National Exchanges of Members of India (ANMI) approached the finance ministry and markets regulator Sebi to step in to restore confidence of fund investors. It also requested the government to start an investigation by an expert committee to look into the circumstances that led the fund house to take this drastic step.

“ANMI believes that this is of paramount importance as the confidence of investors in debt mutual funds is at risk,” a letter from ANMI said and added that an isolated event should not dent the confidence in a Rs 24-lakh-crore industry.

The overnight developments in the fund industry also impacted confidence of investors on Dalal Street on Friday with the sensex, after volatile trades, closing 536 points lower at 31,327 as banking & financial and IT stocks led the laggards.

Download

The Times of India News App for Latest Business News

Subscribe

Start Your Daily Mornings with Times of India Newspaper! Order Now

more from times of india business

Coronavirus outbreak

Business News

LATEST VIDEOS

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app