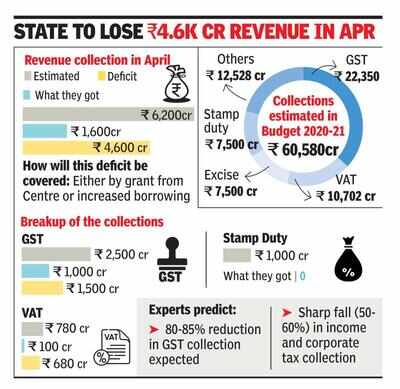

Gurgaon: The Covid-19 outbreak could have a deep impact on Haryana’s already feeble financial health. Due to the lockdown, the state lost Rs 3,000 crore in revenue collection last month and is set to lose another Rs 4,600 crore in April.

In a recent televised address, chief minister Manohar Lal Khattar noted that the overall expenditure to be incurred this month to mitigate the pandemic stands at Rs 6,200 crore. But from GST to VAT and direct tax to excise duty, he said all levies have taken a major hit and the recovery is likely to be staggered. The state government will be able to realise only Rs 1,600 crore against the expenditure requirement in April.

“Our revenue collection has dropped down due to the lockdown and limited economic activity. We expected around Rs 2,500 crore from GST this month, but we’ll be getting only Rs 1,000 crore. Similarly, over Rs 1,000 crore to be realised from stamp duty has been lost entirely. In all, we’ll collect just Rs 1,600 crore against the expenditure requirement of over Rs 6,000 crore in April. The deficit amount can be covered only by grant from the Centre or else we’ll have to borrow to fill the gaps,” the CM pointed out.

This borrowing is in addition to this year’s budget estimates that have already pegged the state’s debt liability at Rs 1.98 lakh crore at the end of 2020-21 fiscal as compared to Rs 1.76 lakh crore, as per the revised estimates for 2019-20 fiscal. In simple terms, during the tabling of the budget, the government had estimated that it would need to borrow additional Rs 21,868 crore in this financial year.

To put things in perspective, in 2014 when the BJP came to power, the outstanding debt for 2014-15 fiscal was pegged at Rs 70,931 crore. In September last year, TOI had reported that the total debt has risen 115% — from Rs 76,263 crore in 2013-14 to Rs 1.64 lakh crore in 2017-18. The per capita liability, which stood at around Rs 27,700 per person in 2013, has gone up to Rs 63,000 per person. During the period, the state’s internal debt increased by 183%, from Rs 48,681 crore to Rs 1.37 lakh crore. This was despite the increased expenditure on paying off debts.

Economists and political scientists say that the state’s economy, which is already in choppy waters, will make the navigation difficult.

“The situation in Haryana, like other states, is dire at the moment. Only 25% of production is happening, and in sectors where tax collection is low. Overall, 80-85% reduction in GST collection is expected. This is in addition to the sharp fall (50-60%) in income and corporate tax collection. This could result in many businesses being pushed to the brink, NPAs surging further and fiscal deficit shooting up,” said senior economist Arun Kumar.

Economists have suggested a staggered lifting of the lockdown and a survival package for SMEs and MSMEs.

“Neither concessions nor increased taxation would help. The trick is to keep things moving by providing survival package to stabilise farmers’ income by better procurement and wider public distribution to avoid possibility of food riots. And, when the Covid-19 curve flattens, SMEs and MSMEs should be given a push through Jan Dhan,” Kumar said.

The state government, on its part, is banking on its good record of adhering to the Fiscal Responsibility and Budget Management (FRBM) norms and GDP to debt liabilities ratio. This, it claims, provides it a cushion to absorb the current shock that mandates increased borrowing.

"We have been recording less than 3% fiscal deficit as directed under FRBM norms. Moreover, the overall debt, in terms of percentage of GDP, is at 22% against the limit of 25%. So, we have cushion to borrow. Also, in March we were allowed to avail the liberty of more borrowings for our year-on-year on commitment to FRBM norms. But we didn’t avail it then,” said TVSN Prasad, additional chief secretary of finance and planning.

In a recent televised address, chief minister Manohar Lal Khattar noted that the overall expenditure to be incurred this month to mitigate the pandemic stands at Rs 6,200 crore. But from GST to VAT and direct tax to excise duty, he said all levies have taken a major hit and the recovery is likely to be staggered. The state government will be able to realise only Rs 1,600 crore against the expenditure requirement in April.

“Our revenue collection has dropped down due to the lockdown and limited economic activity. We expected around Rs 2,500 crore from GST this month, but we’ll be getting only Rs 1,000 crore. Similarly, over Rs 1,000 crore to be realised from stamp duty has been lost entirely. In all, we’ll collect just Rs 1,600 crore against the expenditure requirement of over Rs 6,000 crore in April. The deficit amount can be covered only by grant from the Centre or else we’ll have to borrow to fill the gaps,” the CM pointed out.

This borrowing is in addition to this year’s budget estimates that have already pegged the state’s debt liability at Rs 1.98 lakh crore at the end of 2020-21 fiscal as compared to Rs 1.76 lakh crore, as per the revised estimates for 2019-20 fiscal. In simple terms, during the tabling of the budget, the government had estimated that it would need to borrow additional Rs 21,868 crore in this financial year.

To put things in perspective, in 2014 when the BJP came to power, the outstanding debt for 2014-15 fiscal was pegged at Rs 70,931 crore. In September last year, TOI had reported that the total debt has risen 115% — from Rs 76,263 crore in 2013-14 to Rs 1.64 lakh crore in 2017-18. The per capita liability, which stood at around Rs 27,700 per person in 2013, has gone up to Rs 63,000 per person. During the period, the state’s internal debt increased by 183%, from Rs 48,681 crore to Rs 1.37 lakh crore. This was despite the increased expenditure on paying off debts.

Economists and political scientists say that the state’s economy, which is already in choppy waters, will make the navigation difficult.

“The situation in Haryana, like other states, is dire at the moment. Only 25% of production is happening, and in sectors where tax collection is low. Overall, 80-85% reduction in GST collection is expected. This is in addition to the sharp fall (50-60%) in income and corporate tax collection. This could result in many businesses being pushed to the brink, NPAs surging further and fiscal deficit shooting up,” said senior economist Arun Kumar.

Economists have suggested a staggered lifting of the lockdown and a survival package for SMEs and MSMEs.

“Neither concessions nor increased taxation would help. The trick is to keep things moving by providing survival package to stabilise farmers’ income by better procurement and wider public distribution to avoid possibility of food riots. And, when the Covid-19 curve flattens, SMEs and MSMEs should be given a push through Jan Dhan,” Kumar said.

The state government, on its part, is banking on its good record of adhering to the Fiscal Responsibility and Budget Management (FRBM) norms and GDP to debt liabilities ratio. This, it claims, provides it a cushion to absorb the current shock that mandates increased borrowing.

"We have been recording less than 3% fiscal deficit as directed under FRBM norms. Moreover, the overall debt, in terms of percentage of GDP, is at 22% against the limit of 25%. So, we have cushion to borrow. Also, in March we were allowed to avail the liberty of more borrowings for our year-on-year on commitment to FRBM norms. But we didn’t avail it then,” said TVSN Prasad, additional chief secretary of finance and planning.

Quick Links

Kerala Coronavirus Helpline NumberHaryana Coronavirus Helpline NumberUP Coronavirus Helpline NumberBareilly NewsBhopal NewsCoronavirus in DelhiCoronavirus in HyderabadCoronavirus in IndiaCoronavirus symptomsCoronavirusRajasthan Coronavirus Helpline NumberAditya ThackerayShiv SenaFire in MumbaiAP Coronavirus Helpline NumberArvind KejriwalJammu Kashmir Coronavirus Helpline NumberSrinagar encounter

Get the app