NEW DELHI: For Facebook, Wednesday’s announcement marks its second tryst with an Ambani. It had first tied up with Anil Ambani’s now defunct RCom, which got mired in controversy over the issue of net neutrality after the American social media giant’s Free Basics platform was not allowed by the Telecom Regulatory Authority of India (Trai).

Given the size of the transaction, pegged at Rs 43,574 crore, Facebook’s deal with Mukesh Ambani’s Reliance Jio will need to be cleared by anti-trust watchdog Competition Commission of India (CCI), which will assess if the partnership will adversely impact the market — both in the telecom and retail spheres. Apart from helping Ambani deleverage, Reliance’s aggressive pitch in the retail space, through a link-up with kirana stores, is seen to be a critical element of the partnership.

Sources told TOI that papers for CCI filing are ready and may be submitted in less than a week. A section of analysts, however, said that the massive data that the two companies will jointly hold — both trade as well as consumer — could be something that regulators would want to keep an eye on. Whether CCI has the powers to look at data accumulation and aggregation is unclear, as it is a task that will be handed over to the proposed Data Protection Authority.

Experts tracking the space said that the coming together of two dominant platforms in their respective industries like RIL and Facebook could face tight regulatory scrutiny. While Reliance has been accused of predatory pricing and monopolistic tendencies by rival Bharti Airtel in the past, Facebook’s co-founder Chris Hughes has made calls to break up the platform, calling it a monopoly. Investors said that startups will now need to watch out given the distribution platform that the Facebook-Jio combine creates.

“After telecom, retail and payments will be the target. Many startups in this space need to watch out. Between the popularity of WhatsApp and Reliance Jio’s subscriber base, they can leverage the existing infrastructure and get into any business that they want,” said Mohan Kumar, managing partner at venture firm Avataar, which has a $300-million fund backing software startups.

As part of an anti-trust probe, Facebook’s acquisitions (eg, WhatApp) have been the subject of an investigation by the US Federal Trade Commission seeking to determine if the acquisition of potential rivals was aimed at heading off competitive threats.

With the mega financial deal in Jio Platforms and the massive FDI that it brings in, Facebook will look to ward off negative sentiments around its brand that stemmed from a CBI probe into the Cambridge Analytica data-violation episode and criticism over profusion of fake news on its platforms. The company has also been lobbying hard on issues related to the data protection bill and encryption.

In the Cambridge Analytica episode, Facebook’s former vendor was accused of illegally harvesting data of millions of Indians (and also people around the world) to manipulate and subvert the election processes. This had created a massive outrage against Facebook, which finally culminated in the CBI probe. Investigations are still on.

WhatsApp has also been accused of being a platform that has increasingly been used to spread hate messaging and fake news in India, leading to a series of lynching episodes across the country. The messaging platform has been prodded time and again by the government to provide the identities of those spreading such messages.

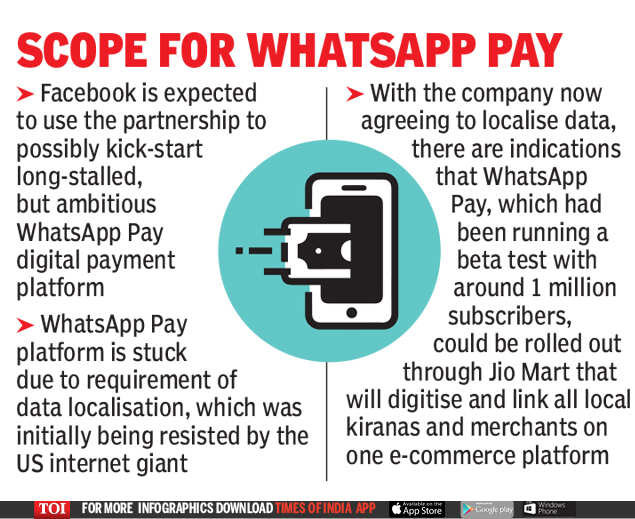

Facebook is expected to use this partnership to possibly kick-start its long-stalled, ambitious WhatsApp Pay digital payment platform, which has been stuck due to the requirement of data localisation, which was initially being resisted by the US internet giant.

However, with the company now coming around on the matter and agreeing to localise data, there are indications that WhatsApp Pay — which has been running a beta test with around 1 million subscribers — could be rolled out aggressively, especially through the Jio Mart, which will digitise and link local kiranas and merchants on one e-commerce platform. However, it is not yet clear what will be Reliance’s stance on the mass rollout of WhatsApp Pay in this venture even though it appears to be a natural progression considering WhatsApp’s strong hold in messaging with over 400 million users.

Given the size of the transaction, pegged at Rs 43,574 crore, Facebook’s deal with Mukesh Ambani’s Reliance Jio will need to be cleared by anti-trust watchdog Competition Commission of India (CCI), which will assess if the partnership will adversely impact the market — both in the telecom and retail spheres. Apart from helping Ambani deleverage, Reliance’s aggressive pitch in the retail space, through a link-up with kirana stores, is seen to be a critical element of the partnership.

Sources told TOI that papers for CCI filing are ready and may be submitted in less than a week. A section of analysts, however, said that the massive data that the two companies will jointly hold — both trade as well as consumer — could be something that regulators would want to keep an eye on. Whether CCI has the powers to look at data accumulation and aggregation is unclear, as it is a task that will be handed over to the proposed Data Protection Authority.

Experts tracking the space said that the coming together of two dominant platforms in their respective industries like RIL and Facebook could face tight regulatory scrutiny. While Reliance has been accused of predatory pricing and monopolistic tendencies by rival Bharti Airtel in the past, Facebook’s co-founder Chris Hughes has made calls to break up the platform, calling it a monopoly. Investors said that startups will now need to watch out given the distribution platform that the Facebook-Jio combine creates.

“After telecom, retail and payments will be the target. Many startups in this space need to watch out. Between the popularity of WhatsApp and Reliance Jio’s subscriber base, they can leverage the existing infrastructure and get into any business that they want,” said Mohan Kumar, managing partner at venture firm Avataar, which has a $300-million fund backing software startups.

As part of an anti-trust probe, Facebook’s acquisitions (eg, WhatApp) have been the subject of an investigation by the US Federal Trade Commission seeking to determine if the acquisition of potential rivals was aimed at heading off competitive threats.

With the mega financial deal in Jio Platforms and the massive FDI that it brings in, Facebook will look to ward off negative sentiments around its brand that stemmed from a CBI probe into the Cambridge Analytica data-violation episode and criticism over profusion of fake news on its platforms. The company has also been lobbying hard on issues related to the data protection bill and encryption.

In the Cambridge Analytica episode, Facebook’s former vendor was accused of illegally harvesting data of millions of Indians (and also people around the world) to manipulate and subvert the election processes. This had created a massive outrage against Facebook, which finally culminated in the CBI probe. Investigations are still on.

WhatsApp has also been accused of being a platform that has increasingly been used to spread hate messaging and fake news in India, leading to a series of lynching episodes across the country. The messaging platform has been prodded time and again by the government to provide the identities of those spreading such messages.

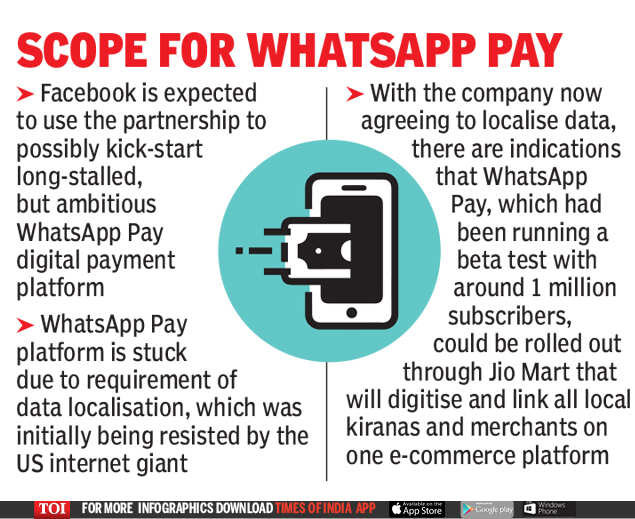

Facebook is expected to use this partnership to possibly kick-start its long-stalled, ambitious WhatsApp Pay digital payment platform, which has been stuck due to the requirement of data localisation, which was initially being resisted by the US internet giant.

However, with the company now coming around on the matter and agreeing to localise data, there are indications that WhatsApp Pay — which has been running a beta test with around 1 million subscribers — could be rolled out aggressively, especially through the Jio Mart, which will digitise and link local kiranas and merchants on one e-commerce platform. However, it is not yet clear what will be Reliance’s stance on the mass rollout of WhatsApp Pay in this venture even though it appears to be a natural progression considering WhatsApp’s strong hold in messaging with over 400 million users.

Download

The Times of India News App for Latest Business News

Subscribe

Start Your Daily Mornings with Times of India Newspaper! Order Now

more from times of india business

Coronavirus outbreak

Business News

LATEST VIDEOS

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

Coronavirus in MumbaiCoronavirus in KolkataCoronavirus in HyderabadCoronavirus in DelhiCoronavirus in BangaloreCoronavirus symptomsCoronavirus in IndiaWhat is CoronavirusCoronavirus NewsSolar EclipseNPRWhat is NRCCAB BillCAB and NRCRTI BillPodcast newsLok SabhaShiv SenaYSRCPCongressBJP newsUIDAIIndian ArmyISRO newsSupreme Court

Get the app