Value Research Stock Advisor has just released a new stock recommendation. You can click here to learn more about this premium service, and get immediate access to the live recommendations, plus new ones as soon as they are issued.

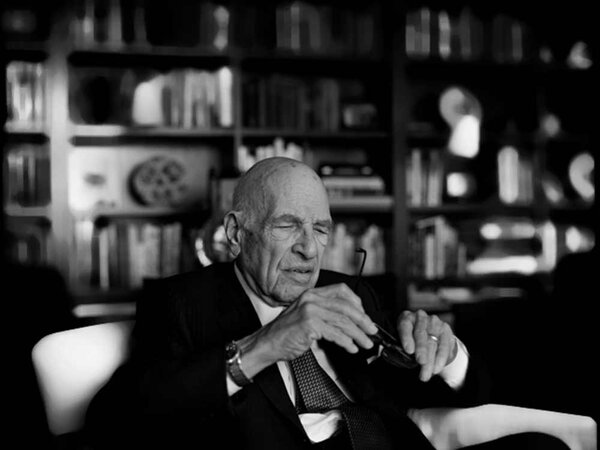

There is a lot one can learn from the legends of investing. One such legend was Walter Schloss. Warren Buffett called him a 'superinvestor'. In this issue of Value Guru, we analyse the investing style of Walter Schloss and discuss why it's important to learn how he picked stocks.

Walter started his career as a runner, delivering stock certificates by hand. He studied under Graham and went on to work for him at Graham-Newman. After Graham wound up his firm, Walter opened his own shop. Working alone, without any staff, Walter was joined by his son Edwin. Walter compounded his returns by 20 per cent over 47 years - twice of what the S&P 500 gave during this period.

Why did Walter invest the way he did?

Walter lived through the Great Depression of 1929. Many fortunes and empires crumbled during this period. As such, he was unwilling to pay a very high premium for stocks. Protecting the downside became a hallmark of Walter's style. That protection often came in staying close to the book or asset value by not overpaying for a stock. He looked for stocks that had a depressed price and a history that went back 20 years. And he didn't like debt. He believed buying depressed stocks reduced the risks in his favour.

Bargain hunter

The most remarkable aspect of Walter's investing style was that he beat the market not by chasing hot stocks, multibaggers or even those that were great companies. Walter was a bargain hunter. He looked for depressed stocks, stocks that were down in the dumps and were hitting their lows. This is an investing style that is alien to many Indian investors, especially newbies. How often have you heard any television market commentator saying 'this stock hit its 52-week low and is now attractive'?

What kind of stocks Walter looked at for investing

In a Columbia Business School Seminar in 1993, Walter listed out the kind of stocks he looks at (reproduced below).

We look for stocks that are depressed.

Why are they depressed?

Are they selling below book value?

Is goodwill in book value?

What has been the high low over the past 10 years?

Have they any cash flow?

Have they any net income?

How have they done over the past 10 years?

What is their debt level?

What kind of industry are they in?

What are their profit margins?

How are their competitors doing?

Is this company doing poorly compared to its competitors?

We get their annual reports, proxies and Value Line and quarterlies.

What appears to be the risk on the downside vs. the upside potential?

How much stock do the insiders own?

Walter's position in a stock would start from 5 per cent and go up to 10-12 per cent. He held a number of stocks in his portfolio, sometimes even as many as 65-70 stocks. The main reason for such a high number of stocks was to offset the risks of some stocks not performing as expected. His average holding period was four years.

Why is it important to learn how Walter Schloss invested?

Walter was one of Benjamin Graham's most illustrious students. His bargain-hunting style of investing and the success he made out of it demonstrates a very basic and sound style of investing. Plus, buying close to the value of a stock takes a lot of risk out of investing. Walter was not a proponent of the franchise system of investing - popularised by Buffett and Munger. He was not comfortable applying a future earning potential to a stock's value. Rather, he was more comfortable in what the company was earning today. If a stock fell, the price came closer to its value. A number of older Indian investors used this system of investing - buying stocks in comparison to their book or asset value. Today, as Indian markets zoom to record highs, this style of investing is becoming extinct. Yet, it's wise to learn how to invest using asset values. You never know when you could get an opportunity to pick stocks close to or below their asset values. When that time comes, such stocks would be low-hanging fruits ready to be plucked.

It's simplistic, yet difficult

Make no mistake; Walter's investing style is simplistic, not easy. It's not just about stocks trading below book. Take a relook at the criteria for stocks mentioned above. You will need to dig into cash flows, incomes, historical performance and valuations. The number of factors Walter would look out for would match those that any modern stock analyst would look into - minus discounting future income.

__w1000__h564__.jpg)