The equity market sell-off has taken a heavy toll on the performance of portfolio management services (PMS strategies) — which cater to high net-worth individuals (HNIs) — with 147 such offerings showing 3-41 per cent drawdown in returns in March.

“Equity as an asset class has been battered in March. Strategies, where returns have dipped 35-40 per cent, can be attributed to concentrated bets on portfolios and exposure to lower-quality companies,” said Kamal Manocha, chief executive officer, PMS AIF World.

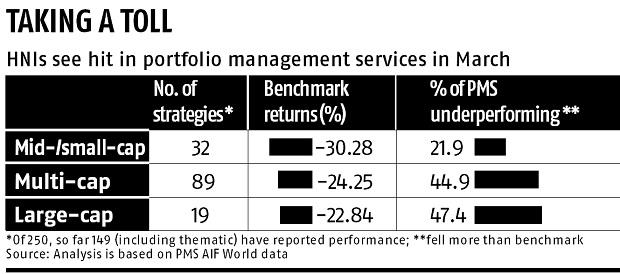

According to the data sourced from PMS AIF World, several PMS offerings in the multi-cap space have fallen more than their respective benchmarks. An analysis of 147 PMS strategies that have reported March returns so far, show that 89 multi-cap PMS portfolios have fallen more than the benchmark Nifty 500. This translates into 44.9 per cent of multi-cap investment strategies giving negative returns of more than 24.25 per cent seen by Nifty 500 in March.

“PMS generally run high-beta portfolios, which can see sharp hits when the markets are in downturn. The PMS portfolios tend to be limited to 20-22 stocks, unlike mutual funds, where portfolios have a larger diversification,” said Jay Shah, co-founder, PMSKart.

“While there is concentration risk in the portfolios, the PMS strategies also tend to outperform when markets turn due to a more focused portfolio construction,” added Shah.

Interestingly, few of the PMS strategies that have managed to mitigate the impact of March sell-off also belong to the multi-cap space. First Global India Super 50 has fallen 7.59 per cent. Among other strategies, Ambit Coffee Can was down 13.3 per cent in March; IIFL Multicap Advantage was down 15.58 per cent.

Industry experts reckon this can be a good time for investors to rebalance their portfolios, with quality companies seeing sharp correction in valuations.

“Large-cap companies are generally cash rich, and in a better position to innovate and spend on research and development during such times. They also offer a relatively better risk reward. Investors can look for large-cap oriented portfolios,” said Manocha.

Of the 19 large-cap strategies that have disclosed their March performance so far, nine have fallen more than the Nifty 100, while 10 have fallen less than the Nifty 100, which was down 22.84 per cent in March.

“Clients should run a hygiene check on their PMS allocations in the current environment. Are they comfortable with the level of churning in the portfolio? Are there multiple portfolios that the same fund manager is overseeing? What is the pedigree of the fund management team of the PMS? This will help clients take a more informed decision on how they want take forward their allocations,” said Shah.