The local bourse extended its gains on Tuesday in line with global stocks which advanced amid improved sentiment on the coronavirus.

Global markets seemed to rally on the back of similar sentiment from the prior session in which a lower number of coronavirus related deaths were reported from Italy, Spain and China. This gives hope that the spread of the virus is being contained and this could potentially lead to reduced economic downtime due to quarantining and self-isolation. With no economic data being released locally, the all-share index took direction from the trend from other major global indices.

The rally in stocks has seen a slight outflow from the greenback, which has benefited emerging market currencies such as the rand. The rand extended its gains against the US dollar as it peaked at a session high of R18.08/$. At 17:00, the rand was trading 2.03% firmer at R18.29/$.

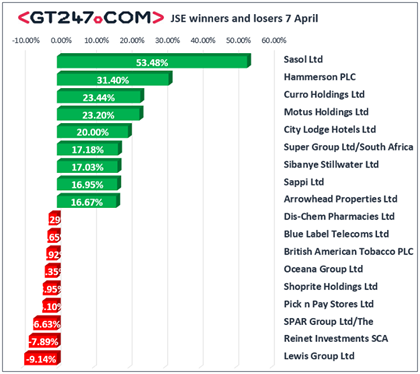

On the JSE, Sasol [JSE:SOL] had another dramatic session in which the share leaped as high as R75.96 before it settled 53.48% higher at R71.60. Hammerson [JSE:HMN] surged 31.4% to close at R16.95, while Resilient REIT [JSE:RES] rallied 11.72% to close at R34.99. Motus Holdings [JSE:MTH] extended its gains as it added 23.2% to end the day at R36.00, while City Lodge Hotels [JSE:CLH] rocketed 20% to close at R24.00.

Sibanye Stillwater [JSE:SSW] gained 17.03% as it closed at R29.76, while platinum miner Impala Platinum [JSE:IMP] added 14.92% to close at R99.98. Significant gains were also recorded for The Foschini Group [JSE:TFG] which rallied 11.22% to close at R77.50, Anglo American [JSE:AGL] which climbed 6.36% to close at R318.01, and Capitec Bank Holdings [JSE:CPI] which closed at R1085.00 after adding 6.06%.

Significant declines were recorded for a handful of retailers in today's session. Lewis Group [JSE:LEW] fell 9.14% to close at R15.81, Pick n Pay [JSE:PIK] lost 4.1% to close at R56.43, while Shoprite [JSE:SHP] dropped 3.95% to close at R122.63.

Tobacco producer British American Tobacco [JSE:BTI] retreated 2.92% to close at R659.00, while television content provider Multichoice Group [JSE:MCG] weakened by 2.12% to close at R88.14. Losses were also recorded for Dis-Chem Pharmacies [JSE:DCP] which closed at R23.01 after losing 2.29%, as well as MTN Group [JSE:MTN] which shed a modest 0.95% to close at R51.21.

The JSE All-Share index closed 2.72% firmer while the JSE Top-40 index gained 2.48%. The financials index topped gains amongst the major indices as it surged 5.02%, while the resources and industrials indices gained 4.11% and 0.97% respectively.

Brent crude was trading flat just after the JSE close at it was recorded at $33.04/barrel.

At 17:00, gold was 0.7% softer at $1651.36/Oz, platinum had shed 0.17% to trade at $739.76/Oz, and palladium was 3.37% higher at $2235.29/Oz.

*Musa Makoni is a trading specialist at Purple Group