Nagpur: Apart from paying up banks against defaulting loan accounts of farmers, state’s waiver scheme also reimburses farmers who cleared their dues after the cut off date. In such cases, amount to be paid to the bank will be paid into farmers’ account.

Fineprint of the scheme reads that if a farmer has cleared the dues after cut-off date of September 30, 2019, the amount would be reimbursed to the borrower by the state government.

MVA waiver scheme covers loans granted between April 2015 and March 31, 2019, and are unpaid as on September 30, 2019. The notification for the scheme was issued on December 29, 2019. If a farmer cleared the dues after September 30, the person would still be treated as eligible for waiver. The unpaid loan amount will be given to the banks so they could write off the loan. The amount paid will go to farmer’s savings account.

As banks have been asked to submit details of loans that have not been cleared till September 30, 2019, a list of loans loans repaid after the date is also to be provided to the government. “This is because the scheme says the loans due as on September 30, 2019 are covered. Even if the amount has been paid after the date it would be treated as pending due technically,” said a banker.

Some loans would definitely have been repaid after the cut off date as the scheme was declared in December 2019. There are cases when the banks adjusted the insurance compensation or other government aid received by the farmer against the loan account. In all such cases, the amounts will be given to the farmer.

A banker said there are cases where the farmers made partial payments after the cut-off date. Some banks are declaring such accounts as unpaid so the pending amount comes back to them. This is because there are apprehensions that if the amount is credited directly into farmers’ account they may end up using it themselves, a source said.

(please take as inset)

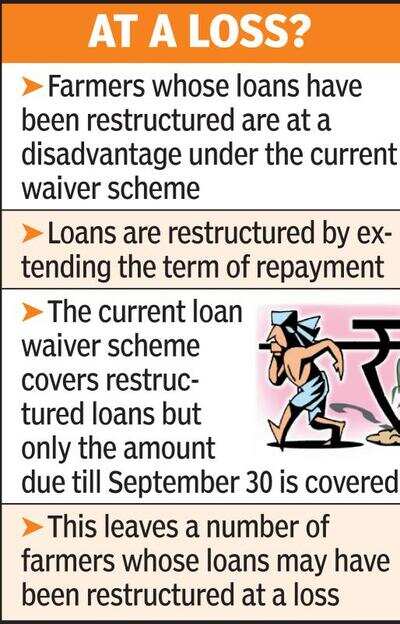

* Farmers whose loans have been restructured are at a disadvantage under the current waiver scheme. Loans are restructured by extending the term of repayment. This is done in lines with standing orders of the government after an area is declared affected by a natural calamity.

* The current loan waiver scheme covers restructured loans but only the amount due till September 30 is covered. This leaves a number of farmers whose loans may have been restructured at a loss, said a farmer.

Fineprint of the scheme reads that if a farmer has cleared the dues after cut-off date of September 30, 2019, the amount would be reimbursed to the borrower by the state government.

MVA waiver scheme covers loans granted between April 2015 and March 31, 2019, and are unpaid as on September 30, 2019. The notification for the scheme was issued on December 29, 2019. If a farmer cleared the dues after September 30, the person would still be treated as eligible for waiver. The unpaid loan amount will be given to the banks so they could write off the loan. The amount paid will go to farmer’s savings account.

As banks have been asked to submit details of loans that have not been cleared till September 30, 2019, a list of loans loans repaid after the date is also to be provided to the government. “This is because the scheme says the loans due as on September 30, 2019 are covered. Even if the amount has been paid after the date it would be treated as pending due technically,” said a banker.

Some loans would definitely have been repaid after the cut off date as the scheme was declared in December 2019. There are cases when the banks adjusted the insurance compensation or other government aid received by the farmer against the loan account. In all such cases, the amounts will be given to the farmer.

A banker said there are cases where the farmers made partial payments after the cut-off date. Some banks are declaring such accounts as unpaid so the pending amount comes back to them. This is because there are apprehensions that if the amount is credited directly into farmers’ account they may end up using it themselves, a source said.

(please take as inset)

* Farmers whose loans have been restructured are at a disadvantage under the current waiver scheme. Loans are restructured by extending the term of repayment. This is done in lines with standing orders of the government after an area is declared affected by a natural calamity.

* The current loan waiver scheme covers restructured loans but only the amount due till September 30 is covered. This leaves a number of farmers whose loans may have been restructured at a loss, said a farmer.

Trending Topics

LATEST VIDEOS

City

Delhi riots: Video of day 2 violence shows mob attacking cops with sticks, stones

Delhi riots: Video of day 2 violence shows mob attacking cops with sticks, stones  Bharuch: Man caught smuggling liquor in scooter’s footboard, video goes viral

Bharuch: Man caught smuggling liquor in scooter’s footboard, video goes viral  International Women's Day: 14-year-old girl becomes DSP 'for a day' in Maharashtra's Buldhana district

International Women's Day: 14-year-old girl becomes DSP 'for a day' in Maharashtra's Buldhana district  Nirbhaya case: 4 convicts to hang on March 20, says Delhi court

Nirbhaya case: 4 convicts to hang on March 20, says Delhi court

More from TOI

Navbharat Times

Featured Today in Travel

Get the app