Newsflow around State Bank of India (SBI) stepping in to rescue the cash-starved YES Bank has triggered a fresh sell-off in the state-owned bank's counter. While YES Bank tanked 80 per cent in intra-day deals, SBI lost over 10 per cent.

The developments have also cast a shadow on the listing of the bank's credit card arm - SBI Cards & Payment Services - which was expected to list at up to 50 per cent premium against the issue price.

While analysts continue to remain bullish on SBI Cards from a long-term perspective given its healthy business outlook and huge penetration scope, the recent developments may have an impact on SBI Cards' listing. That said, they advise using the overhang to buy the stock for the long-term.

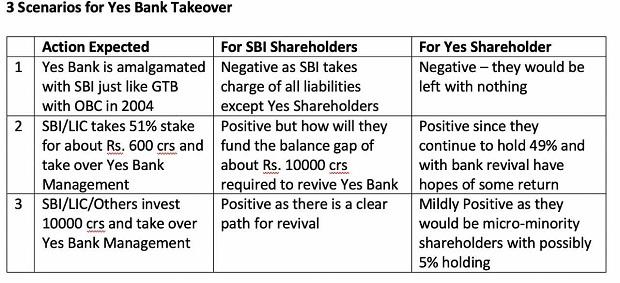

"If YES Bank gets amalagamated with SBI, just like Global Trust Bank (GTB) with Oriental Bank of Commerce (OBC) back in 2004, then it will be negative for both YES Bank shareholders as well as SBI shareholders. SBI then would have to take charge of all the liabilities of YES Bank. It will be negative for YES Bank shareholders as they would be left with nothing. However, it would be too early to jump the gun and conclude anything right now," explains Ambareesh Baliga, an independent market analyst.

On the other hand, a plan to infuse capital in YES Bank where it continues to function as a separate entity just like LIC investing in IDBI Bank, would be a big positive for all the concerned stakeholders, the analyst says.

Baliga prepares three scenarios for YES Bank takeover and their implications -

SBI Cards and Payment Services’ initial public offering (IPO) managed to attract bids worth Rs 2 trillion, in spite of challenging market conditions. The 100-million share offering generated close to 2.7 billion bids (26x). The high networth individual (HNI) portion of the IPO was subscribed 44x, with the retail portion being subscribed 2.5x. The employee segment registered 4.7x subscription, while the shareholder category was subscribed 25x — making it a rare instance in which the employee and shareholder segments garnered higher subscription than the retail segment. The institutional portion of the IPO, which closed on Wednesday, had garnered 57x subscription.