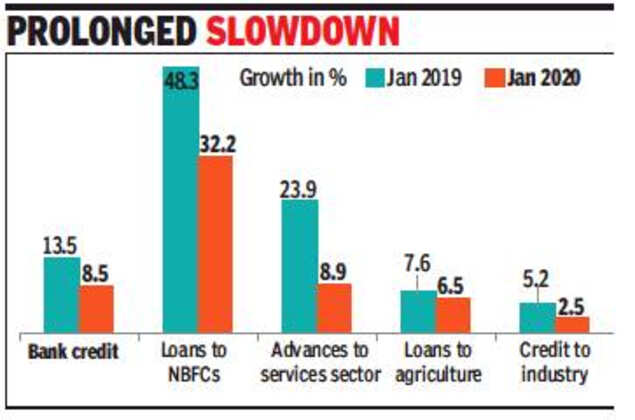

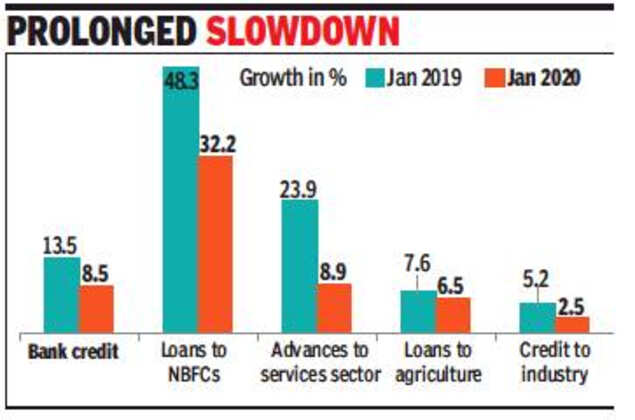

MUMBAI: Bank credit growth declined to 8.5% in January from 13.5% in the year-ago period led by a sharp slowdown in loans to the services sector, according to RBI data. Growth in advances to the services sector decelerated to 8.9% from 23.9% in January 2019. (see graphic) During the month, personal loans segment grew by 16.9%. Within personal loans, credit to housing segment grew by 17.5% from 18.4%, while education loan showed a negative growth of 3.1% as against a negative growth of 2.3% in January 2019, RBI data showed.

Credit growth to industry decelerated to 2.5% from 5.2%. Within industry, loan growth to paper and paper products, rubber plastic and their products and construction accelerated. “However, credit growth to textile, food processing, chemical products, basic metal & metal products, all engineering and infrastructure decelerated,” the RBI said.

According to the latest quarterly statistics on deposits and credit of banks, bank loan growth decelerated to 7.4% in October-December 2019 from 12.9% in the year-ago period. During the quarter, loans by public sector banks grew by 3.7% while credit from private sector banks saw a growth of 13.1%.

In February, RBI governor Shaktikanta Das had said slowing credit growth is the biggest challenge the banking industry was facing. “The most critical challenge today for banks, not just in India but also elsewhere, is slowing credit offtake. It affects the banks’ profitability,” Das had said.

Rating agency Crisil, in a recent note, said credit growth is likely to be around 6% in this fiscal but is expected to accelerate to 8-9% in FY21.“ The country’s GDP grew at 4.7% in the December quarter, its slowest rate in more than six years.

Credit growth to industry decelerated to 2.5% from 5.2%. Within industry, loan growth to paper and paper products, rubber plastic and their products and construction accelerated. “However, credit growth to textile, food processing, chemical products, basic metal & metal products, all engineering and infrastructure decelerated,” the RBI said.

According to the latest quarterly statistics on deposits and credit of banks, bank loan growth decelerated to 7.4% in October-December 2019 from 12.9% in the year-ago period. During the quarter, loans by public sector banks grew by 3.7% while credit from private sector banks saw a growth of 13.1%.

In February, RBI governor Shaktikanta Das had said slowing credit growth is the biggest challenge the banking industry was facing. “The most critical challenge today for banks, not just in India but also elsewhere, is slowing credit offtake. It affects the banks’ profitability,” Das had said.

Rating agency Crisil, in a recent note, said credit growth is likely to be around 6% in this fiscal but is expected to accelerate to 8-9% in FY21.“ The country’s GDP grew at 4.7% in the December quarter, its slowest rate in more than six years.

Download The Times of India News App for Latest Business News.

more from times of india business

Business News

LATEST VIDEOS

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app