PUNE: A district court has upheld the Pune Cantonment Board’s (PCB) right to fix the Annual Rateable Value (ARV) of commercial properties operating from leave-and-licence rental premises, on the basis of their annual gross rent instead of the estimated cost of building and land value.

Sunita Kinkar, the PCB’s lawyer, told TOI on Thursday, “The judgment holds significance vis-à-vis issues of property tax assessment involving commercial properties operating from rented premises in the Pune cantonment area.”

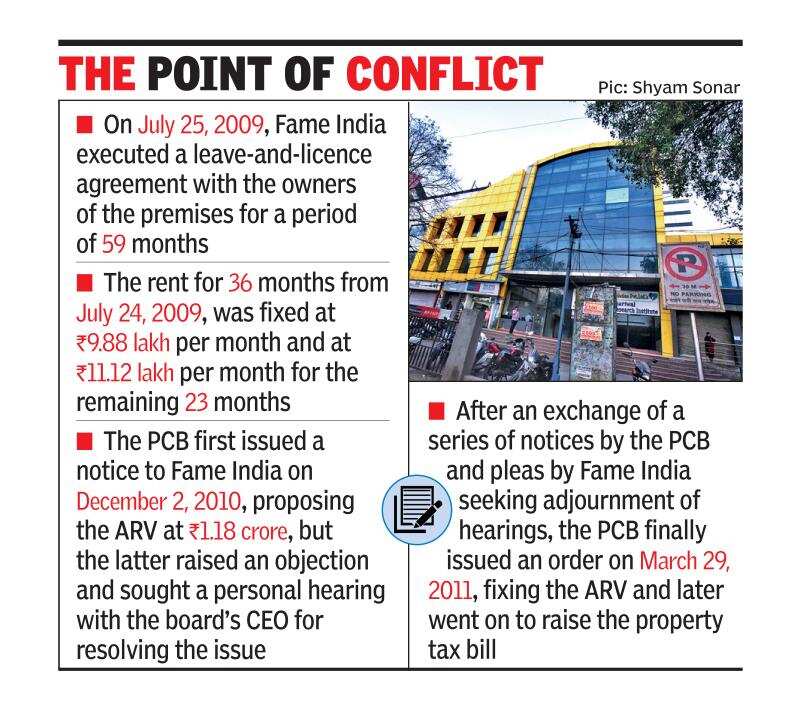

District judge Deepak D Almale on February 24 dismissed an appeal by Fame India Limited, which runs a multiplex from a 28,250sqft rented premises that is part of a commercial complex in Fatimanagar, against the PCB’s order of March 29, 2011, that fixed the ARV of this premises at Rs1.18 crore by considering annual gross rent for the period 2008-2011.

Based on it, the PCB later issued a property tax bill of over Rs32 lakh to Fame India for the period between April 1, 2010, and March 31, 2011.

The ARV forms a critical benchmark for the assessment of property tax against the rent, at which a land or building is reasonably expected to be let-out from year to year. The PCB revises the ARV after every three years. The value, so fixed, applies to each of the three years for the purpose of assessment of property tax bill.

In its appeal filed in October 2011, Fame India contended, among other things, that the PCB ought to have assessed the ARV of its premises as per the provisions under Section 73 (a) of the Cantonment Act, 2006, by taking into account the estimated cost of building. As against this, it argued that the PCB “illegally assessed” the ARV under Section 73 (b) of the Act by considering the annual gross rent and did not extend apt opportunity for hearing objections and filing of submissions.

The PCB denied all these arguments and said the leave-and-licence amount was of Rs9.88 lakh per month and by multiplying this amount with 12, it was correct in fixing the ARV at Rs1.18 crore for a year.

Judge Almale referred to the March 29, 2011, order wherein the PCB had assessed the ARV of the appeal premises under Section 73 (a) of the Act at Rs16.95 lakh, taking into account one-twentieth of estimated present cost of the building and land value appertaining thereto and further assessing the ARV under Section 73 (b), according to gross annual rent, at Rs1.18 crore. “There are recitals in the order that assessment arrived in view of Section 73 (b) is more beneficial to the interest of the board, therefore, the same is recommended,” the court observed.

The judge cited the ARV definition and observed that Section 73 (a) was applicable only to hotels, colleges, schools, hospitals, factories and any other building that the CEO decides to assess under this clause. “The appeal premises being a multiplex theatre does not come within the ambit of Section 73 (a) of the Act. The respondents (PCB) ...... have opted for Section 73 (b), to my mind, the said action is neither illegal nor contrary to the provisions of the Cantonment Act,” the judge held.

Kinkar told TOI, “We brought to the court’s notice that the legislature’s intent was quite clear from the fact that the term multiplex was not included in Section 73 (a) of the Cantonment Act, 2006 and, hence, the other option was under Section 73 (b). The court upheld our contention.”

Sunita Kinkar, the PCB’s lawyer, told TOI on Thursday, “The judgment holds significance vis-à-vis issues of property tax assessment involving commercial properties operating from rented premises in the Pune cantonment area.”

District judge Deepak D Almale on February 24 dismissed an appeal by Fame India Limited, which runs a multiplex from a 28,250sqft rented premises that is part of a commercial complex in Fatimanagar, against the PCB’s order of March 29, 2011, that fixed the ARV of this premises at Rs1.18 crore by considering annual gross rent for the period 2008-2011.

Based on it, the PCB later issued a property tax bill of over Rs32 lakh to Fame India for the period between April 1, 2010, and March 31, 2011.

The ARV forms a critical benchmark for the assessment of property tax against the rent, at which a land or building is reasonably expected to be let-out from year to year. The PCB revises the ARV after every three years. The value, so fixed, applies to each of the three years for the purpose of assessment of property tax bill.

In its appeal filed in October 2011, Fame India contended, among other things, that the PCB ought to have assessed the ARV of its premises as per the provisions under Section 73 (a) of the Cantonment Act, 2006, by taking into account the estimated cost of building. As against this, it argued that the PCB “illegally assessed” the ARV under Section 73 (b) of the Act by considering the annual gross rent and did not extend apt opportunity for hearing objections and filing of submissions.

The PCB denied all these arguments and said the leave-and-licence amount was of Rs9.88 lakh per month and by multiplying this amount with 12, it was correct in fixing the ARV at Rs1.18 crore for a year.

Judge Almale referred to the March 29, 2011, order wherein the PCB had assessed the ARV of the appeal premises under Section 73 (a) of the Act at Rs16.95 lakh, taking into account one-twentieth of estimated present cost of the building and land value appertaining thereto and further assessing the ARV under Section 73 (b), according to gross annual rent, at Rs1.18 crore. “There are recitals in the order that assessment arrived in view of Section 73 (b) is more beneficial to the interest of the board, therefore, the same is recommended,” the court observed.

The judge cited the ARV definition and observed that Section 73 (a) was applicable only to hotels, colleges, schools, hospitals, factories and any other building that the CEO decides to assess under this clause. “The appeal premises being a multiplex theatre does not come within the ambit of Section 73 (a) of the Act. The respondents (PCB) ...... have opted for Section 73 (b), to my mind, the said action is neither illegal nor contrary to the provisions of the Cantonment Act,” the judge held.

Kinkar told TOI, “We brought to the court’s notice that the legislature’s intent was quite clear from the fact that the term multiplex was not included in Section 73 (a) of the Cantonment Act, 2006 and, hence, the other option was under Section 73 (b). The court upheld our contention.”

Get the app