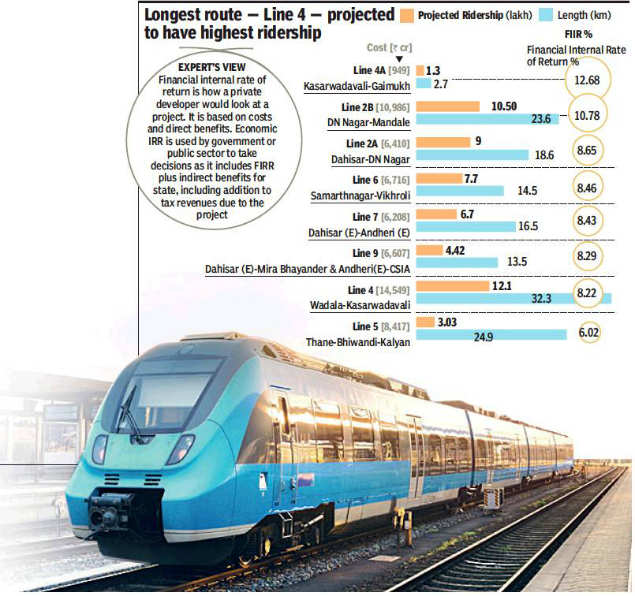

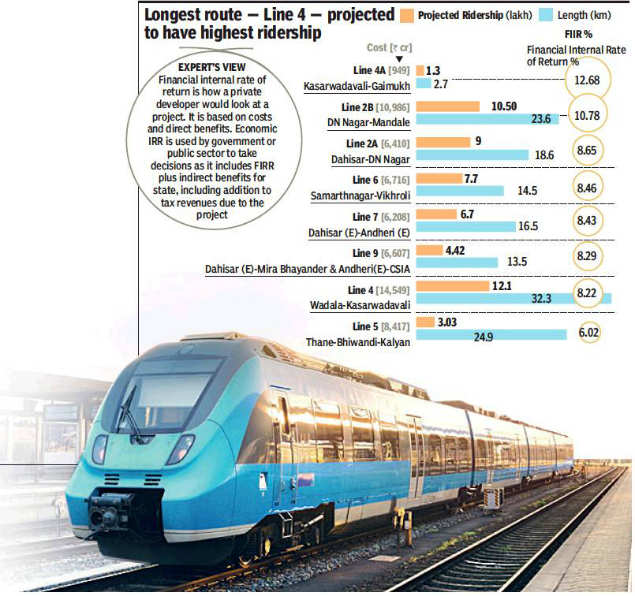

Only two of the Mumbai Metro projects, currently under execution, have a projected Financial Internal Rate of Return (FIRR) of over 10% indicating that the government expects to justify financing costs for most lines through indirect benefits from the projects. The FIRR is the return an investor can expect from a project for funds invested. If the FIRR is above the cost of funds, the project is viable.

Of the eight lines currently under execution, six have FIRR ranging between 6% to 8.65%. The Detailed Project Report of any metro project needs to give at least 8% FIRR to get a nod from the Centre and foreign agencies for loan disbursement.

“Financial internal rate of return is how a private developer would look at a project. It is based on costs and direct benefits. Economic IRR is used by the government or public sector to take decisions as it includes FIRR plus the indirect benefits for the state including the addition to tax revenues due to the project,” said Sachin Gupta, senior director, Crisil Ratings. Incidentally, all Metro projects have a high Economic IRR ranging between 15% to 25%.

“For a private developer, the FIRR is useful in deciding whether to invest in a project. For a project to be viable, FIRR would have to be above 10%, which is a ballpark figure for the cost of debt,” said Gupta.

The two lines with the highest FIRR are Metro 4A (Kasarvadavali to Gaimukh) and 2B (DN Nagar to Mandale). Metro 4A has a projected FIRR of 12.68% because of the property boom in the region. An official said, “This route lacks hi-speed public transport and roads in Thane are congested which means people will switch to Metro in large numbers.” It is estimated that the 32.5 km Wadala-Kasarwadavali route alone will carry more than 12 lakh commuters per day., which will have a cascading effect on the 4A line as well.

A proposed extension—9km from Gaimukh to Shivaji Chowk in Kashimira called Line 10—also has a FIRR of 10.91% as it is expected to carry 7.5 lakh commuters daily. This is another important east-west Metro link that will connect western suburbs to Thane and south Mumbai via eastern suburbs once it gets linked to Metro 4.

The second most profitable among the Metro lines would be the DN Nagar-Mandale 2B stretch, which is expected to carry 10.5 lakh passengers on its 23.5 km long route. It will have a FIRR of 10.78%. This means every Rs 100 invested in this line will earn Rs 110.78 before covering financing costs. “The route is an important east-west connector with links to the suburban railway at Bandra, Kurla and Mankhurd. It will also connect via Bandra-Kurla Complex which is a major hub of economic activity and employment,” said an MMRDA official.

High FIRR is also linked to the scope for non-fare revenue through advertising rights and leasing of commercial space. Interestingly, a longer route does not necessarily translate into higher ridership. Metro 5 (Thane-Bhiwandi-Kalyan) is 24 km long but will have 3.03 lakh ridership as the population is sparse compared to Thane and Mumbai and there is less scope for non-fare revenue. The FIRR from this route is estimated to be lowest at 6%.

Of the eight lines currently under execution, six have FIRR ranging between 6% to 8.65%. The Detailed Project Report of any metro project needs to give at least 8% FIRR to get a nod from the Centre and foreign agencies for loan disbursement.

“Financial internal rate of return is how a private developer would look at a project. It is based on costs and direct benefits. Economic IRR is used by the government or public sector to take decisions as it includes FIRR plus the indirect benefits for the state including the addition to tax revenues due to the project,” said Sachin Gupta, senior director, Crisil Ratings. Incidentally, all Metro projects have a high Economic IRR ranging between 15% to 25%.

“For a private developer, the FIRR is useful in deciding whether to invest in a project. For a project to be viable, FIRR would have to be above 10%, which is a ballpark figure for the cost of debt,” said Gupta.

The two lines with the highest FIRR are Metro 4A (Kasarvadavali to Gaimukh) and 2B (DN Nagar to Mandale). Metro 4A has a projected FIRR of 12.68% because of the property boom in the region. An official said, “This route lacks hi-speed public transport and roads in Thane are congested which means people will switch to Metro in large numbers.” It is estimated that the 32.5 km Wadala-Kasarwadavali route alone will carry more than 12 lakh commuters per day., which will have a cascading effect on the 4A line as well.

A proposed extension—9km from Gaimukh to Shivaji Chowk in Kashimira called Line 10—also has a FIRR of 10.91% as it is expected to carry 7.5 lakh commuters daily. This is another important east-west Metro link that will connect western suburbs to Thane and south Mumbai via eastern suburbs once it gets linked to Metro 4.

The second most profitable among the Metro lines would be the DN Nagar-Mandale 2B stretch, which is expected to carry 10.5 lakh passengers on its 23.5 km long route. It will have a FIRR of 10.78%. This means every Rs 100 invested in this line will earn Rs 110.78 before covering financing costs. “The route is an important east-west connector with links to the suburban railway at Bandra, Kurla and Mankhurd. It will also connect via Bandra-Kurla Complex which is a major hub of economic activity and employment,” said an MMRDA official.

High FIRR is also linked to the scope for non-fare revenue through advertising rights and leasing of commercial space. Interestingly, a longer route does not necessarily translate into higher ridership. Metro 5 (Thane-Bhiwandi-Kalyan) is 24 km long but will have 3.03 lakh ridership as the population is sparse compared to Thane and Mumbai and there is less scope for non-fare revenue. The FIRR from this route is estimated to be lowest at 6%.

Get the app