The Securities and Exchange Board of India (Sebi) has issued guidelines for benchmarking the performance of alternative investment funds (AIFs) with a view to streamlining disclosure standards and helping investors in assessing scheme performance.

The guidelines come two months after a consultation paper to this effect was floated by the regulator. “As the industry needs flexibility to showcase its performance based on different criteria, benchmarking performance will help investors in assessing the performance of the AIF industry,” the regulator said in a note put out on Thursday.

The regulator has proposed that an association of AIFs with representation from at least 51 per cent of the industry select one or more benchmarking agencies. The agreement between the benchmarking agencies and the AIFs should cover the mode and manner of data reporting, specific data that needs to be reported, and terms of confidentiality.

Benchmarking will apply to all schemes that have completed at least one year from the date of ‘First Close’. Funds incorporated overseas with India track record shall also provide the data to the agencies when they seek registration as AIFs.

Performance benchmarking shall be done on a half-yearly basis based on data as on September 30 and March 31 of each year. The performance and benchmark reports are to be made available latest by July 1, 2020 for the performance up to September 30, 2019. “The introduction of performance benchmarking will enhance transparency among AIF investors who will be able to compare performance across similar strategy schemes having the same vintage and thereby assess the relative performance of the management team while considering making investments,” said Subramaniam Krishnan, partner, EY India.

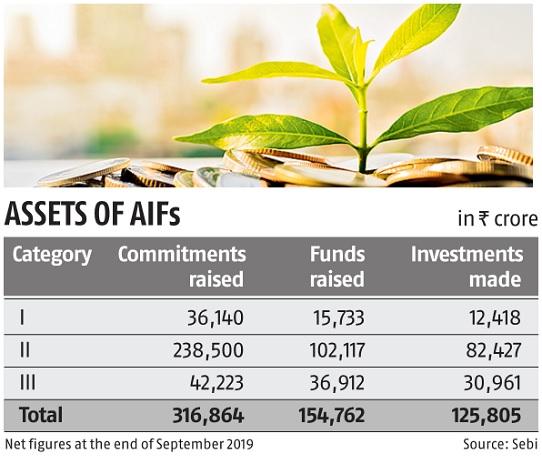

“The exclusion of angel funds from the performance benchmarking is the right approach since the decision making in an angel fund is with the investors themselves.” Investments made in AIFs have risen to Rs 1.25 trillion as of September 30, 2019, with 65 per cent of the assets coming from category II funds.