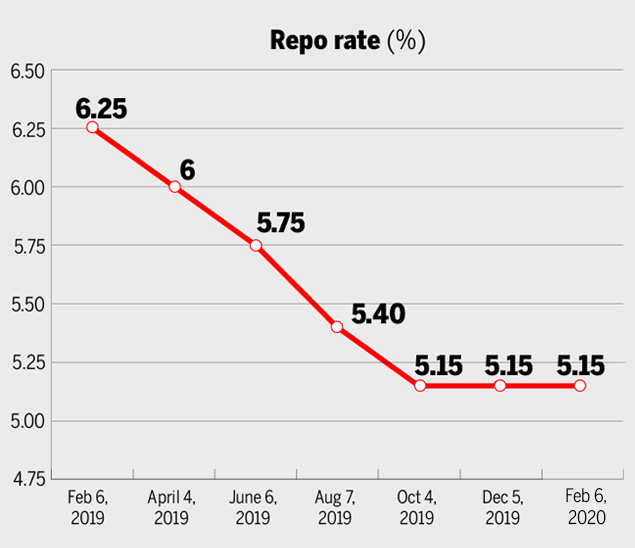

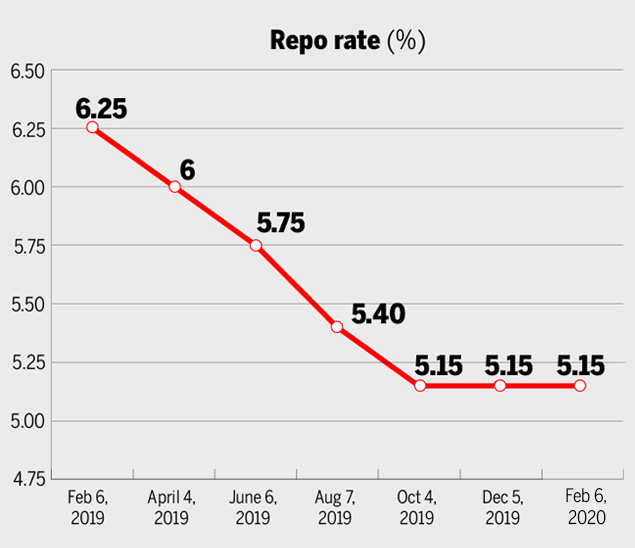

NEW DELHI: The Reserve Bank of India (RBI) on Thursday kept repo rate unchanged for the second consecutive time at 5.15 per cent and reverse repo rate at 4.90 per cent in its sixth bi-monthly monetary policy meet. It also decided to continue with its accommodative stance as long as it was necessary to revive growth.

Repo rate is the rate at which the RBI lends to banks, while reverse repo rate is at which it borrows from banks.

The central bank retained GDP (gross domestic product) growth at 5 per cent for 2019-20 and pegged GDP growth for 2020-21 at 6 per cent. It also anticipated inflation to remain elevated in short-run.

"Economic activity remains subdued and the few indicators that have moved up recently are yet to gain traction in a more broad-based manner. Given the evolving growth-inflation dynamics, the MPC felt it appropriate to maintain status quo,” the Monetary Policy Committee (MPC) said.

The RBI also revised upwards its retail inflation projection for the last quarter of the current fiscal to 6.5 per cent owing to likely increase in input costs for milk and pulses amid volatile crude oil prices and termed the overall outlook on price rise as "highly uncertain".

Going forward, the inflation outlook is likely to be influenced by several factors like food inflation, crude prices and input costs for services, RBI said.

The MPC has been tasked by the government to tame retail inflation based on consumer price index (CPI) at 4 per cent (+,- 2 per cent).

Retail inflation crossed the 7 per cent mark during December 2019, mainly driven by food prices.

The government has estimated GDP growth at 5 per cent in the current financial year owing to both domestic as well as global factors amid weakening consumption demand in the country.

RBI’s monetary policy committee cut rates by 135 basis points over five straight meetings last year, before surprising markets in December by holding the policy repo steady at 5.15% due to growing concerns over inflation.

While presenting the Union Budget on February 1, finance minister Nirmala Sitharaman projected the fiscal deficit to widen to 3.8 per cent of the GDP against the earlier estimate of 3.3 per cent.

A higher fiscal deficit means the government will go in for more market borrowing leading to hardening of interest rate which in turn will put pressure on inflation.

In Video:Repo rate remains unchanged at 5.15%: RBI

Repo rate is the rate at which the RBI lends to banks, while reverse repo rate is at which it borrows from banks.

The central bank retained GDP (gross domestic product) growth at 5 per cent for 2019-20 and pegged GDP growth for 2020-21 at 6 per cent. It also anticipated inflation to remain elevated in short-run.

"Economic activity remains subdued and the few indicators that have moved up recently are yet to gain traction in a more broad-based manner. Given the evolving growth-inflation dynamics, the MPC felt it appropriate to maintain status quo,” the Monetary Policy Committee (MPC) said.

The RBI also revised upwards its retail inflation projection for the last quarter of the current fiscal to 6.5 per cent owing to likely increase in input costs for milk and pulses amid volatile crude oil prices and termed the overall outlook on price rise as "highly uncertain".

Going forward, the inflation outlook is likely to be influenced by several factors like food inflation, crude prices and input costs for services, RBI said.

The MPC has been tasked by the government to tame retail inflation based on consumer price index (CPI) at 4 per cent (+,- 2 per cent).

Retail inflation crossed the 7 per cent mark during December 2019, mainly driven by food prices.

The government has estimated GDP growth at 5 per cent in the current financial year owing to both domestic as well as global factors amid weakening consumption demand in the country.

RBI’s monetary policy committee cut rates by 135 basis points over five straight meetings last year, before surprising markets in December by holding the policy repo steady at 5.15% due to growing concerns over inflation.

While presenting the Union Budget on February 1, finance minister Nirmala Sitharaman projected the fiscal deficit to widen to 3.8 per cent of the GDP against the earlier estimate of 3.3 per cent.

A higher fiscal deficit means the government will go in for more market borrowing leading to hardening of interest rate which in turn will put pressure on inflation.

In Video:Repo rate remains unchanged at 5.15%: RBI

Download The Times of India News App for Latest Business News.

more from times of india business

Business News

LATEST VIDEOS

More from TOI

Navbharat Times

Featured Today in Travel

Quick Links

ELSS Mutual Funds BenefitsIncome Tax Refund statusWhat is AssochamITR Filing Last DateHome Loan EMI TipsHome Loan Repayment TipsPradhan Mantri Awas YojanaTop UP Loan FeaturesIncrease Home Loan EligibilityHome Loan on PFTax Saving Fixed DepositLink Aadhaar with ITRAtal Pension YojanaNita AmbaniIndian EconomyRBIAadhaar CardSBIReliance CommunicationsMukesh AmbaniIndian Bank Ifsc codeIDBI Ifsc codeIndusind ifsc codeYes Bank Ifsc CodeVijay Bank Ifsc codeSyndicate bank Ifsc CodePNB Ifsc codeOBC Ifsc codeKarur vysya bank ifscIOB Ifsc codeICICI Ifsc codeHDFC Bank ifsc codeCanara Bank Ifsc codeBank of baroda ifscBank of America IFSC CodeBOM IFSC CodeAndhra Bank IFSC CodeAxis Bank Ifsc CodeSBI IFSC CodeGST

Get the app