Value Research Stock Advisor has just released a new stock recommendation. You can click here to learn more about this premium service, and get immediate access to the live recommendations, plus new ones as soon as they are issued.

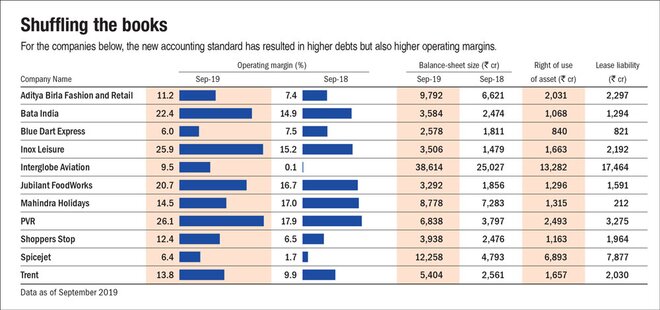

In the 2019 issue of Wealth Insight, we provided a detailed analysis of the new accounting standard Ind AS 116. It mandates lessees to recognise assets and liabilities for all leases with tenures of over 12 months. We gave example of a few companies whose balance sheets would get stretched due to this change. The table at the end of this story summarises the impact on those companies.

Let's understand the impact in greater detail with the example of Interglobe Aviation. When Interglobe bought an aircraft, it didn't do so by paying directly for it or by raising debt. It would pay a token amount of 5-15 per cent of the cost of the aircraft and ask a financier to pay the rest. It would then pay the financier a rental for a long term. This allowed the company to avoid bringing its lease liabilities on its balance sheet. Now with Ind AS 116, it has to recognise them in its balance sheet.

Impact on financial statements

Interglobe has created a new item, 'lease liability', amounting to `17,464 crore on the liability side of the balance sheet as of September 2019. It created another item, 'right of use of assets', amounting to `13,282 crore on the asset side. The debt-to-equity ratio and the size of the balance sheet both increased as a result of these entries. The airline was earlier debt-free. Now the debt stands at `1,106 crore after lease liabilities.

Earlier Interglobe charged lease payments to the profit-and-loss (P&L) account as an operating expense. Now with such expenses charged as depreciation/finance costs, operating expenses are likely to be lower, resulting in a higher operating profit. This has inflated its operating margin.

There is no net effect on the company's cash flows, though the classification of items has changed. The lease rentals that were earlier deducted from operating cash flows are now charged to cash flows from financing activities. As a result, cash flows from operations and free cash flows are higher.