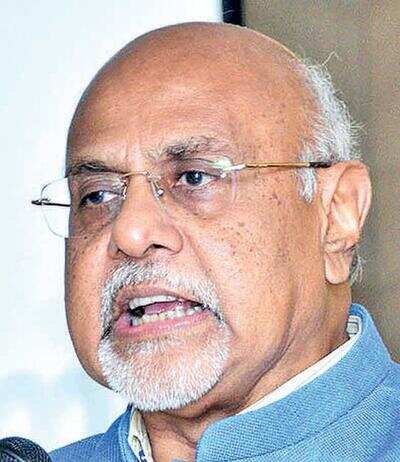

Surat: Eminent tax consultant Mukesh Patel has said that the Finance Minister’s move to provide relief under income tax has confounded the economic analysts.

Speaking at the budget analysis and impact on the economy organised by SGCCI and Gujarat Income Tax Bar Association on Tuesday, Patel said, “The FM has tried to reduce the slab with riders. But ultimately the individual tax payers are not seeing any relief from it. They would rather chose to be with the old tax slabs than going for the new ones.” He further said that the I-T benefits seemed more like illusions. “When people finally worked it out, they found the sops more like a mirage,” he said.

According to Patel, the abolition of DDT has created a lot of confusion. For the high networth individuals (HNIs), DDT is going to increase their tax burden, especially for those earning above Rs 50 lakh. It will also impact individual tax payers, he said. Patel lauded the efforts of the central government for implementing the e-assessment and faceless scrutiny.

“These are the best possible ways to eradicate corrupt practices going on in the department,” he asserted.

Speaking at the budget analysis and impact on the economy organised by SGCCI and Gujarat Income Tax Bar Association on Tuesday, Patel said, “The FM has tried to reduce the slab with riders. But ultimately the individual tax payers are not seeing any relief from it. They would rather chose to be with the old tax slabs than going for the new ones.” He further said that the I-T benefits seemed more like illusions. “When people finally worked it out, they found the sops more like a mirage,” he said.

According to Patel, the abolition of DDT has created a lot of confusion. For the high networth individuals (HNIs), DDT is going to increase their tax burden, especially for those earning above Rs 50 lakh. It will also impact individual tax payers, he said. Patel lauded the efforts of the central government for implementing the e-assessment and faceless scrutiny.

“These are the best possible ways to eradicate corrupt practices going on in the department,” he asserted.

Trending Topics

LATEST VIDEOS

More from TOI

Navbharat Times

Featured Today in Travel

Get the app