For now, it has been left to individuals to decide whether they want to opt for the existing system of tax calculation or go for the new one. (File photo)

For now, it has been left to individuals to decide whether they want to opt for the existing system of tax calculation or go for the new one. (File photo)

Moving to reform personal income tax, the government Saturday announced a new tax regime for individuals, offering much lower tax rates to taxpayers willing to forego all deductions and exemptions including those currently available on EPF contribution, tuition fee payment, principal and interest outgo on home loans, standard deduction of Rs 50,000 and medical insurance premium among others.

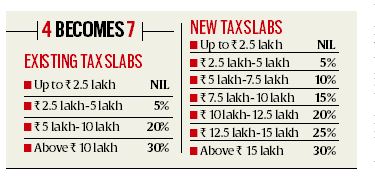

This scheme will co-exist with the existing tax structure and will be optional. While the existing tax system has four tax slabs, the new one has seven tax slabs and offers lower tax rates.

Speaking at a press conference after presenting the Union Budget, Finance Minister Nirmala Sitharaman said the government intends to gradually remove all I-T exemptions.

In an interview to CNBC-TV18 news channel, Sitharaman said eventually, if not today, she would want to see the government removing all exemptions. Saying she has taken the first step towards complete removal of exemptions and deductions, she indicated that the existing tax plan will go, indicating a timeline of five years.

Once an individual opts for the new tax plan, there’s no returning to the existing plan that offers deductions and exemptions. “The option shall be exercised for every previous year where the individual or the HUF has no business income, and in other cases the option once exercised for a previous year shall be valid for that previous year and all subsequent years,” the Budget document stated.

For now, it has been left to individuals to decide whether they want to opt for the existing system of tax calculation or go for the new one. Rough calculations show that taxpayers across a wide spectrum could face a higher tax incidence under the new taxation system.

For example, under the existing system, an individual with a gross taxable salary of Rs 7.5 lakh will end up paying a tax of only Rs 18,200 after claiming standard deduction, deductions available under Section 80C (EPF and PF contribution, insurance premium, child tuition fee etc), deduction under Section 80D (medical insurance). But under the new tax system, the individual will end up with a tax outgo of Rs 39,000. So, the tax outgo under the new system would be more than double under the existing system.

Similarly, in case of an individual with a taxable salary of Rs 15 lakh, the existing outgo will be limited to Rs 140,400 (with additional deduction on interest income and exemption on home loan interest). But under the new taxation system, one will have to pay Rs 210,600 in taxes. So, the tax outgo works out to be 50 per cent higher under the new system.

In her Budget speech, Sitharaman said in “the new tax regime, substantial tax benefit will accrue to a taxpayer depending upon exemptions and deductions claimed by him. For example, a person earning Rs 15 lakh in a year and not availing any deductions etc will pay only Rs 195,000 as compared to Rs 273,000 in the old regime. Thus, his tax burden shall be reduced by 78,000 in the new regime. He would still be the gainer in the new regime even if he was taking deduction of Rs 1.5 lakh under various sections of Chapter VI-A of the Income Tax Act under the old regime”.

However, personal finance experts say it will not benefit many. “Only individuals or assessees who are not in a position to save and claim deduction and exemptions will benefit under the new scheme,” said Surya Bhatia, founder of Asset Managers, a financial advisory firm.

There are some who feel that the new taxation system may encourage individuals in the informal economy and those with unaccounted money to take advantage of the lower tax rates introduced under the new system, and become part of the formal system. “Small traders, merchants, self-employed individuals may like to take advantage of the new tax charter which is easier to understand and has lower tax incidence,” said a Chandigarh-based chartered accountant.

The Indian Express is now on Telegram. Click here to join our channel (@indianexpress) and stay updated with the latest headlines