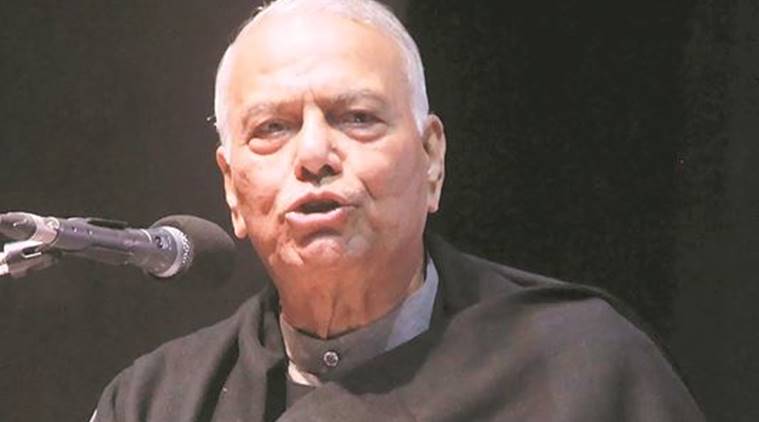

Former Union Finance Minister Yashwant Sinha has questioned the impact of slashing corporate taxes, saying this would only benefit 0.7 per cent of corporate companies in the country.

Including the last week’s announcement made by Union Finance Minister Nirmala Sitharaman, the government has so far announced a slew of measures in the wake of the ongoing economic slowdown.

As “very few” corporate companies are set to benefit, an estimated shortfall of Rs 1.50 lakh crore has now been created.

“Before the ‘tax bonanza’ was announced last week, nearly 99.3 per cent companies whose annual turnover was up to Rs 400 crore were already paying 25 per cent (of their annual profit) as corporate tax. This means that the revised tax slab will only cater to the rest 0.7 per cent big corporate companies,” said Sinha, who was addressing a talk on ‘Economic Slowdown: Structural or Cyclic’, organised at Gokhale Institute of Politics and Economics in Pune on Monday.

Sinha also asked whether the same 0.7 per cent companies in the country would readily invest the newly created deficit of Rs 1.50 lakh crore.

“Though the decision will prove to be good in the long run, will improved balance sheets of the big corporates now put money back into the pockets of the farmer and common man?” he asked, adding that the ongoing slowdown is much deeper than it appears and the entire truth is yet to be spelt out.

The origin of the economic slump, according to Sinha, lies in the agrarian distress, besides severe impact caused to Medium and Small Scale Industries (MSME) and unorganised sectors, like civil construction. The growth rate in rural wages has fallen from 28 per cent to 3.7 per cent between 2013-2014 and 2018-2019. “Framers are not getting due prices for their produce. The rural demand is at an all-time low and rural wages have taken the hit,” he added.

Emphasising on the important role played by civil construction in the economy, Sinha said, “Civil construction contributes nearly 45 per cent to the country’s GDP and offers jobs to 94 per cent labour from this unorganised sector. When jobs are lost, there is a significant number of labourers who return to villages,” said Sinha. As a result, more labourers turned to the Mahatma Gandhi National Rural Employment Guarantee Act (MNREGA) scheme and continue to work without pay.

Sinha blamed decisions like demonetisation and GST for bringing down the country’s growth rate, which now stands at 5 per cent in the first quarter of 2019-2020.

“The decision to introduce GST could have been made with a good intention but the government could not have forgotten the informal economy,” said Sinha.

Highlighting that the demand for goods has been hit, Sinha said a similar contraction in demand of goods had hit the then NDA-led government in 1998, in which Sinha was the finance minister. He said, “We focused on investing in infrastructure projects that spanned from housing, roads, telecommunication and others. This greatly helped in reviving the economy.”

He said, “The government must invest in creating demand for investment goods, which will in turn generate employment and bring liquid money into circulation.”

‘Forgotten to protest’

Expressing anguish on Indians remaining mute spectators, Sinha said, “Indians have forgotten to protest. Possibly because it is very easy to be branded as an ‘anti-national’.”