The mess at Yes Bank

Altico Capital's default could put more pressure on Yes Bank's balance sheet and lead to greater scrutiny

Life is not a template and neither is mine. Like several who have worked as journalists, I am a generalist in my over two decade experience across print, global news wires and dotcom firms. But there has been one underlying theme in each phase; life gave me the chance to observe and tell a story -- from early days tracking a securities scam to terror attacks and some of India's most significant court trials. Besides writing, I have jumped fences to become an entrepreneur, as an investment advisor -- and also taught the finer aspects of business journalism to young minds. At Forbes India, I also keep an eye on some of its proprietary specials like the Rich list, GenNext and Celebrity lists. An alumnus of Xavier Institute of Communications and H.R College of Commerce and Economics in Mumbai, I have worked for organisations such as Agence France-Presse, Business Standard, The Financial Express and The Times of India prior to this.

- Denied trainee job at VIP, Tainwala now heads Samsonite International

- 58 Indian companies in 2017 Forbes 'Global 2000' list

- For Adventz Chairman Saroj Poddar, Gillette Was Just The Beginning

- India Inc's top CEOs track the route to double-digit growth

- CEOs Look For Ways To Get Manufacturing Back On Growth Track

Image: Francis Mascarenhas / Reuters

Image: Francis Mascarenhas / ReutersIn an unrelated development, Yes Bank founder Rana Kapoor is considering selling stakes of his family-owned stakes in Yes Bank to Paytm, in a bid to repay dues.

Yes Bank's stock has fallen by 80 percent to ₹54.15 on the BSE, from a high of ₹280 in April. Concerns over corporate governance and exposure to the commercial real estate which continues to slow down and impact in asset quality are hurting the bank.

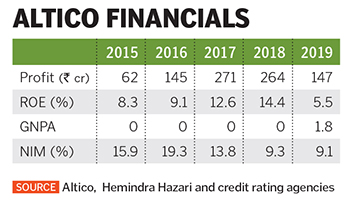

“It is apparent that either Altico’s strategy of concentrated lending to high-risk real estate developers had the board’s full support or they were ignorant of it,” says Hemindra Hazari, an independent banking analyst who publishes his writings on Singapore-based research platform Smartkarma.

Hazari says the lesson from Altico's default is loud and clear: Companies’ financial accounts and the senior management commentary maybe misleading and excessively optimistic.

This could put more pressure on Yes Bank’s balance sheet. It also indicates the incompetence of credit ratings agencies.