Ahead of festive season, SBI again cuts lending rates by 10 bps

Highlights

- The new rates are effective September 10, State Bank of India (SBI) said

- One year MCLR, to which all the retail lending rates are linked to, has been reduced to 8.15 per cent from 8.25 per cent earlier

(Representative image)

(Representative image)MUMBAI: Public sector lender State Bank of India (SBI) on Monday announced yet another reduction in lending rates by 10 basis points across tenors.

The new rates are effective September 10, the lender said while announcing the decision.

One year MCLR, to which all the retail lending rates are linked to, has been reduced to 8.15 per cent from 8.25 per cent earlier.

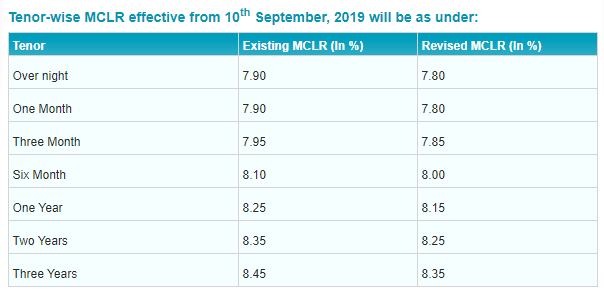

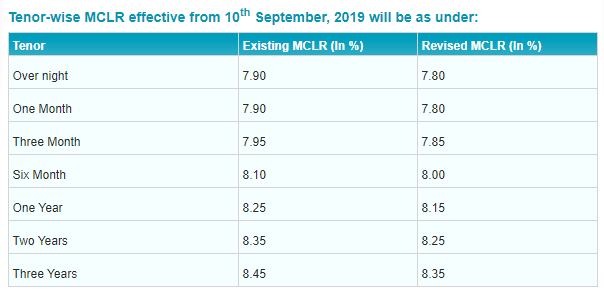

New MCLR rates:

However, SBI also reduced retail term deposit rates by 20-25 bps and bulk term deposit rates by 10-20 bps across tenors.

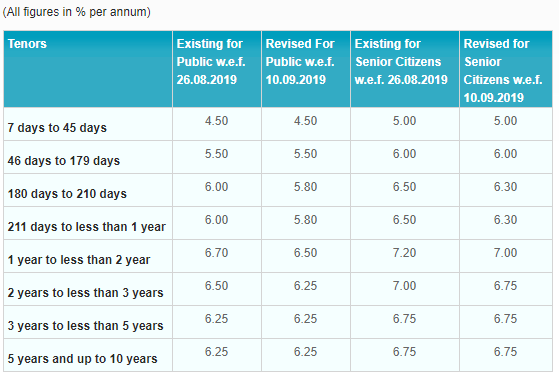

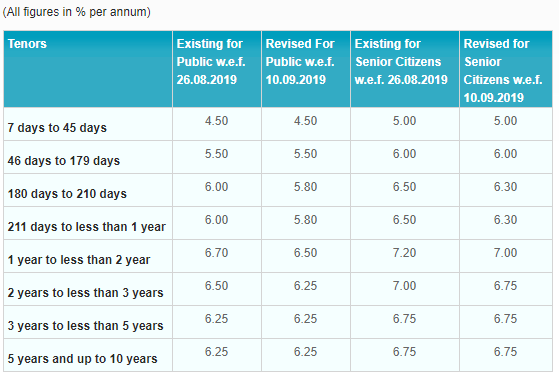

Term deposit rates (below Rs 2 crore):

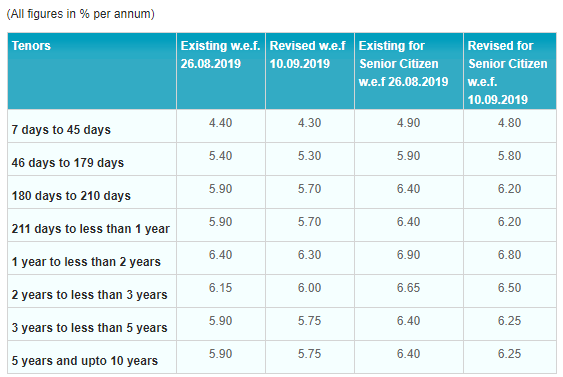

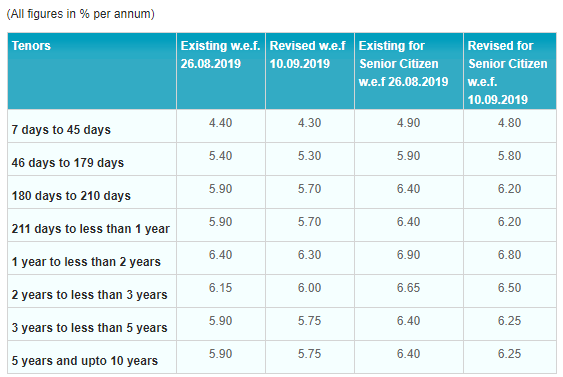

Bulk deposit rates (Rs 2 crore and above):

The lender attributed the falling interest rate scenario and surplus liquidity for realigning its interest rate on term deposits.

The new rates are effective September 10, the lender said while announcing the decision.

One year MCLR, to which all the retail lending rates are linked to, has been reduced to 8.15 per cent from 8.25 per cent earlier.

New MCLR rates:

However, SBI also reduced retail term deposit rates by 20-25 bps and bulk term deposit rates by 10-20 bps across tenors.

Term deposit rates (below Rs 2 crore):

Bulk deposit rates (Rs 2 crore and above):

The lender attributed the falling interest rate scenario and surplus liquidity for realigning its interest rate on term deposits.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE