Repo-linked home loan rates can be volatile

Highlights

- In the case of repo-linked home loans while the cost of the loan may come down over the years, the EMIs may not drop proportionately

- If in future RBI decides to choose the repo rate to suck out liquidity from markets to defend the rupee, home-loan customers could experience high volatility in their repayments

(Representative image)

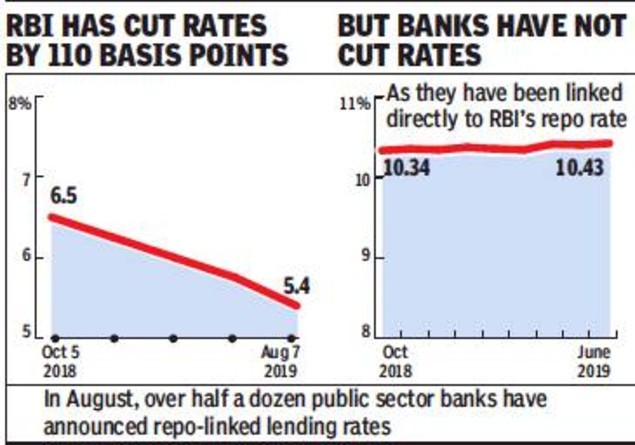

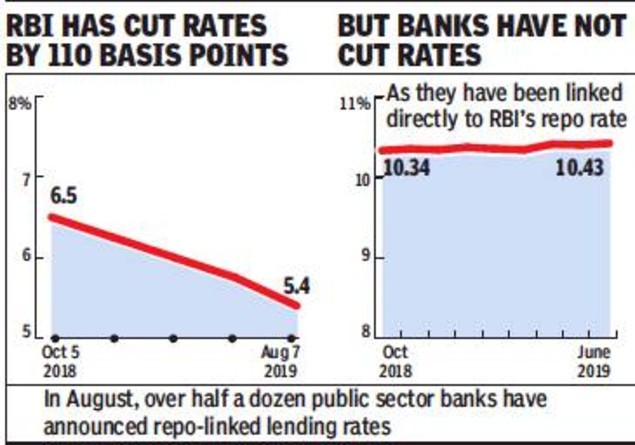

(Representative image)MUMBAI: Repo-linked home loans have drastically reduced borrowing costs for customer. For instance, SBI's home loan rate dropped to 8.05% after it linked its advances to the repo rate which is nearly half a percentage point lower than the 8.55% it charged customers in June under the marginal cost of lending rate (MCLR).

What makes the product more attractive is that RBI is very likely to reduce rates further given the slowdown in the economy. Any such reduction will get transmitted to the borrower in three months as the rate is reset every quarter. Also, if the revision is applicable on a particular date, banks will calculate interest on a pro-rata basis.

But like every product an external benchmark like the repo does have its downsides.

This includes the risk of higher volatility compared to MCLR. Also banks have structured the loans to protect their interests which could mean revision in installments.

In the case of repo-linked home loans while the cost of the loan may come down over the years, the EMIs may not drop proportionately. SBI has said that the loan repayment is such that at least 3% of the principal is repaid every year. This is unlike most long-term home loans where the lenders end up collecting largely interest in the initial years. This means that EMIs could be higher or fluctuate during the year.

The other risk is that of volatility. Although the repo is now a signalling tool for the RBI, in the past the central bank has used the repo to manipulate liquidity in the system particularly at times when the rupee has come under pressure.

If in future RBI decides to choose the repo rate to suck out liquidity from markets to defend the rupee, home-loan customers could experience high volatility in their repayments. The historic low for the repo rate is 4.75% which is 65 bps lower than the current rate of 5.4%. The historic high is however 9% which is 360 bps higher than current rates.

What makes the product more attractive is that RBI is very likely to reduce rates further given the slowdown in the economy. Any such reduction will get transmitted to the borrower in three months as the rate is reset every quarter. Also, if the revision is applicable on a particular date, banks will calculate interest on a pro-rata basis.

But like every product an external benchmark like the repo does have its downsides.

This includes the risk of higher volatility compared to MCLR. Also banks have structured the loans to protect their interests which could mean revision in installments.

In the case of repo-linked home loans while the cost of the loan may come down over the years, the EMIs may not drop proportionately. SBI has said that the loan repayment is such that at least 3% of the principal is repaid every year. This is unlike most long-term home loans where the lenders end up collecting largely interest in the initial years. This means that EMIs could be higher or fluctuate during the year.

The other risk is that of volatility. Although the repo is now a signalling tool for the RBI, in the past the central bank has used the repo to manipulate liquidity in the system particularly at times when the rupee has come under pressure.

If in future RBI decides to choose the repo rate to suck out liquidity from markets to defend the rupee, home-loan customers could experience high volatility in their repayments. The historic low for the repo rate is 4.75% which is 65 bps lower than the current rate of 5.4%. The historic high is however 9% which is 360 bps higher than current rates.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE