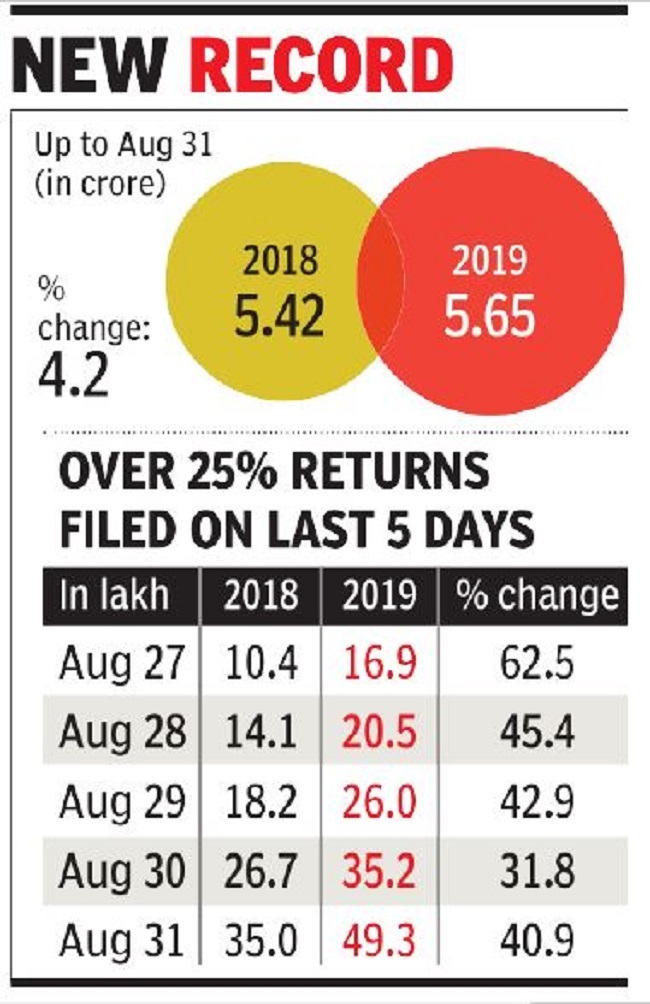

49 lakh filings on August 31 push I-T returns for year to record 5.65 crore

Highlights

- Data released by the income tax department showed that till the end of August, there was a 4% increase in filings for financial year 2018-19, compared with the 5.4 crore returns that were filed up to August 31, 2018

- Last year, there was a 71% surge, which was attributed to the impact of demonetisation as cash deposits resulted in income disclosure

(Representative image)

NEW DELHI: A record 5.65 crore income tax returns were filed up to Saturday, the extended deadline for the annual filing, suggesting that more individuals are now part of the tax net. However, the surge in filing of returns seen in the aftermath of demonetisation seems to be petering out.

Data released by the income tax department on Sunday showed that till the end of August, there was a 4% increase in filings for financial year 2018-19, compared with the 5.4 crore returns that were filed up to August 31, 2018. Last year, there was a 71% surge, which was attributed to the impact of demonetisation as cash deposits resulted in income disclosure. Besides, the government's decision to levy a fee on delayed returns last year onwards prompted many individuals to file within the deadline.

Tax officials, however, are cheering the increase achieved so far during the current year, arguing that it came on a high base, and are hopeful that it will expand further in the coming years as the full impact of GST kicks in.

Besides, they are taking credit for a glitch-free filing process this August with over 49 lakh returns filed on Saturday, and almost 25% of the returns being filed during the last five days, with the technology system showing no signs of slowing down. On Saturday, the peak filing rate per second was at 196 ITRs and peak filing rate per minute was at 7,447. "The information security team of I-T department thwarted over 2,205 malicious attacks on the website aimed at disrupting services in the peak period," an official statement said.

This was also the first year when pre-filled forms were tried out for a large number of taxpayers and the department believes the experiment has been successful, prompting it to look at ways to expand the coverage next year.

Over the last few years, tax authorities have also focused on faster refunds and with more individuals opting for electronic verification, the process is expected to be speeded up. So, far 3.6 crore returns have already been verified, which is nearly two-thirds. Of this, nearly 80% or 2.86 crore have opted for e-verification, mostly using Aadhaar-based one-time-password. "The I-T department intends to carry out campaigns to increase awareness about e-verification of ITRs where verification is still pending," the statement said.

Data released by the income tax department on Sunday showed that till the end of August, there was a 4% increase in filings for financial year 2018-19, compared with the 5.4 crore returns that were filed up to August 31, 2018. Last year, there was a 71% surge, which was attributed to the impact of demonetisation as cash deposits resulted in income disclosure. Besides, the government's decision to levy a fee on delayed returns last year onwards prompted many individuals to file within the deadline.

Tax officials, however, are cheering the increase achieved so far during the current year, arguing that it came on a high base, and are hopeful that it will expand further in the coming years as the full impact of GST kicks in.

Besides, they are taking credit for a glitch-free filing process this August with over 49 lakh returns filed on Saturday, and almost 25% of the returns being filed during the last five days, with the technology system showing no signs of slowing down. On Saturday, the peak filing rate per second was at 196 ITRs and peak filing rate per minute was at 7,447. "The information security team of I-T department thwarted over 2,205 malicious attacks on the website aimed at disrupting services in the peak period," an official statement said.

This was also the first year when pre-filled forms were tried out for a large number of taxpayers and the department believes the experiment has been successful, prompting it to look at ways to expand the coverage next year.

Over the last few years, tax authorities have also focused on faster refunds and with more individuals opting for electronic verification, the process is expected to be speeded up. So, far 3.6 crore returns have already been verified, which is nearly two-thirds. Of this, nearly 80% or 2.86 crore have opted for e-verification, mostly using Aadhaar-based one-time-password. "The I-T department intends to carry out campaigns to increase awareness about e-verification of ITRs where verification is still pending," the statement said.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE