This fund is a good choice for investors who prefer consistency. Its appeal hinges heavily on the experience of its lead manager and the team's consistent application of the investment process. The fund manager has over 23 years of experience with the AMC and has been managing this fund since 2012. He is supported by a team of two portfolio managers, two credit analysts, and an economist.

The manager uses top-down macro forecasts to guide their duration positioning and a bottom-up process in their analysis of individual companies' creditworthiness and risks. Relative spreads guide the allocation between G-Secs and corporate bonds. State development loans are used more from a tactical allocation perspective and are actively traded to generate additional alpha for the portfolio.

The fund house places a lot of emphasis on the risk element when it comes to investing and has included a lot of stringent measures to lower portfolio risks. Though this could lead to the fund house adopting a slightly conservative stance in comparison to its more aggressive peers. Issuer selection is based on fundamental analysis of the risk/return profile.

The credit team works closely with the in-house equity team to leverage research on aspects like the company's strategy and its financial data. The internal credit ratings process is based on the credit team's evaluation of an issuer for its creditworthiness and ability to meet their debt obligations. While the fund house typically invests in the most liquid G-Sec papers, allocation to a single long-term paper could vary based on the manager's macro views. The fund's success depends largely on the team's ability to allocate between duration and credits, and by the team's ability to take the right macro calls and position themselves across yield curves.

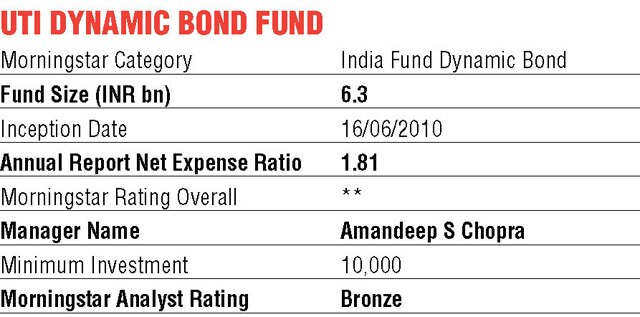

Amandeep Singh Chopra heads the fixed income team at