The domestic equity market is expecting a change in sentiments this week after the government agreed to roll back the surcharge on foreign portfolio investors (FPIs) and announced a slew of measures to boost economic growth.

Analysts are expecting a relief rally in the short term.

The rollback of higher surcharge on FPI as well as domestic investors is seen as a "positive", since it was one of the factors that dented investors' confidence since the Union Budget announcement on July 5.

During July and August till Friday, foreign investors withdrew around Rs 26,261.2 crore from domestic equities whereas the foreign inflow in the debt market was around Rs 18,524 crore during the same period. The net outflow of the foreign investors stood at Rs 7,737.2 crore in July and August so far.

UPSURGE LIKELY |

|

On July 5, finance minister Nirmala Sitharaman had announced an increased surcharge for individuals, Association of Persons for incomes in the range of Rs 2 crore to Rs 5 crore at 25% and at 37% for incomes exceeding Rs 5 crore. Since many FPIs are structured as non-corporate entities such as trusts which are taxed as AOPs, the increased surcharge was also got applicable to FPIs.

On July 5, finance minister Nirmala Sitharaman had announced an increased surcharge for individuals, Association of Persons for incomes in the range of Rs 2 crore to Rs 5 crore at 25% and at 37% for incomes exceeding Rs 5 crore. Since many FPIs are structured as non-corporate entities such as trusts which are taxed as AOPs, the increased surcharge was also got applicable to FPIs.

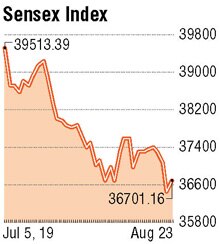

The finance minister had earlier expressed unwillingness to roll back the surcharge, which resulted in a steady sell-off by the foreign investors in domestic equities, with the Sensex losing over 7% since July 5 along with a notional loss of over Rs 13.5 lakh crore to investors.

On Friday, Sitharaman also announced the removal of the enhanced surcharge levied on the long-term and short-term capital gains arising from transfer of equity shares, units of equity oriented mutual funds and units of business trusts. Enhanced surcharge on domestic investors (DIIs) will also be removed.

Amit Gupta, co-founder and CEO TradingBells said "These are just the kind of measures which were required to boost the economy. In the immediate term, we can expect the markets to bounce back on Monday with a gap-up opening, and continue the rally for a few sessions to come. FIIs have withdrawn more than Rs 16,000 crore in July and more than Rs 10,000 crore in August so far, and with the stimulus to FPI taxation, we can expect this trend to reverse in the immediate term."

Rusmik Oza, head of fundamental research, Kotak Securities, said, "Withdrawal of enhanced surcharge on FPI is a big positive for domestic markets as it could reverse the outflows seen since post Budget. It should also help in rupee appreciation. (It is) a good sentiment booster for the economy."

The government also addressed the slowdown seen in the auto sector as it lifted the ban on purchase of vehicles by government departments and allowed additional 15% depreciation on vehicles acquired from now till March 2020. The revision of one-time registration fees has also been deferred till June 2020.

Analysts expect the move would have "a great impact" on sales numbers of the auto sectors. Also, pending GST refunds within 30 days and in the future to be refunded in 60 days is going to bring in more smoothness in GST as a system and further will improve its operational aspects while at the same time reducing leakages, according to Mustafa Nadeem, CEO, Epic Research.

"On Monday, a gap-up will surely be seen since this has turned the sentiments. While we have already seen a recovery in the last trading day on the back of hopes this will further boost the investors/traders community. Nifty is expected to stay above 10700, for now," Nadeem said.