PV inventories near healthy levels, but two-wheelers, CVs a worry

July rains bring some uptick in sales, inventory levels of 21 days eyed

Passenger vehicles

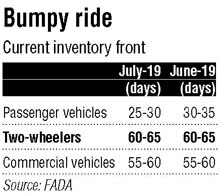

While passenger vehicles (PV) inventory across the showrooms in India has come very close to the ideal levels, however, those of commercial vehicles (CV) and two-wheelers are still a worry, claim the latest data collated by Federation of Automobile Dealers Associations (FADA).

As per the available data, the average inventory level at showrooms across the country for PVs has come down to the range of 25-30 days on a slight uptick in sales in July and production cuts by the vehicle manufacturers, or original equipment manufacturers. On the other hand, the inventory levels of two-wheelers and CVs continue to remain at high levels of 60-65 days and 55-60 days, respectively. An inventory level of around 21 days is considered ideal by the showroom owners.

FADA president Ashish Kale said, “Consumer sentiment and overall demand continued to be quite weak across all segments and most geographies. The July sales continue to be in the negative zone year on year. Although some respite seen with growth in month-on-month numbers, which was mainly due to the revival of the monsoon bringing some positivity and also June having the second-lowest volume base this calendar year after February.”

He said with June being a completely dry and rain deficient month, consumer sentiment was at its lowest and with July rains covering up a lot of the deficit, some confidence in consumer demand led to pending purchase conclusion in July.

He said with June being a completely dry and rain deficient month, consumer sentiment was at its lowest and with July rains covering up a lot of the deficit, some confidence in consumer demand led to pending purchase conclusion in July.

According to a statement issued by FADA, the CV inventory continues to remain at high levels and unlike the slight uptick in sales seen in July for PV and two-wheelers, CV sales continued to be negative in double-digits year on year and month on month, giving little room to the dealers to reduce their inventories.

Still, the inventories are is still lower than the alarming levels of 80-90 days for the past few months. In some of the geographies, the inventory level rose to as high as 100 days, the retailers claim. The inventory level, which has been highest for the two-wheeler category, had turned into a nightmare for the retailers as a muted sales was pushing many towards the deep financial losses.

According to the industry insiders, the two-wheeler OEMs had raised the inventories in February after reducing it in December-January anticipating an increase in sales. However, things did not go as anticipated with inventory piling up at the showrooms. The retailers feel that the pile-up in inventory happened because the OEMs wrongly predicted that the slowdown during the last months of 2018 was a temporary phenomenon and sales was predicted to spike up in the new year.

However, the consistently reducing inventory level of the passenger vehicles (PV) has come a saving grace for OEMs. With the current trend continuing for a couple of more weeks, PV inventories for the first time since the downturn will come down to healthy levels of around four weeks across many geographies and head towards the ideal level of 21 days.

According to the industry insiders, the slump in sales since around one year is triggering massive job cuts in the sector that offers employment to around 35 million people directly and indirectly. As per reports, the initial estimates suggest automakers, component manufacturers and dealers have together laid off around 3,50,000 workers since April.