M&M gets raw material boost, but skids on new launches

The last quarter witnessed a 0.5% drop in raw material costs and the situation is expected to continue in the coming months

XUV 300

Shrinking raw material costs helped Mahindra & Mahindra improve its overall Ebitda margins, but its automotive business slid due to higher costs pertaining to three new launches – Marazzo, XUV 300 and Alturas G4.

The company's overall Edibta margins improved by 50 bais points year on year to 14%. Segmentwise, the farm equipment sector segment delivered an EBIT margin of 19.3% (down only 160 bps YoY) driven by a strong focus on cost control.

However, EBIT margin in the automotive business slid about 290 bps YoY to 6.5% due to higher depreciation pertaining to three launches (Marazzo, XUV300 and Alturas G4).

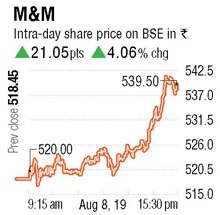

IN SKID LANE |

|

"We expect lower raw material costs and slower spending pertaining to recent launches to support overall margins going ahead," analysts Chirag Shah and Jay Mehta said in an Edelweiss Securities Ltd research note.

"We expect lower raw material costs and slower spending pertaining to recent launches to support overall margins going ahead," analysts Chirag Shah and Jay Mehta said in an Edelweiss Securities Ltd research note.

According to industry observers, the last financial quarter witnessed a 0.5% drop in raw material costs and the situation is expected to continue in the coming months. Taking advantage of lower commodity prices, M&M has taken a price increase in both the auto and tractor segments, they said.

M&M on Wednesday reported a 26% in its net profit for the first quarter at Rs 918 crore. Gross revenues and other income of the company together with Mahindra Vehicle Manufacturers Ltd stood at Rs 12,997 crore as against Rs 13,550 crore during the corresponding period last year. M&M said that it was able to maintain margins only due to falling commodity prices.

Similarly, JM Financial in its report said that M&M's new UV launches have received a lukewarm response, and going forward, they are expected to face stiff competition from MG Hector, Suzuki XL-6 and Kia Seltos.

The analysts said the main reasons for the loss of M&M's market share in UVs in the recent years has been its failure to exploit the strong demand for compact SUVs and crossovers due to subdued performance of new launches (TUV3OO and KUV1OO). "However, we expect the business to get back on track given the company's strong focus on addressing product gaps (a new MPV and Tivoli-based SUV), as well as launching refreshed versions and petrol variants across its portfolio." the JM Financial report said.

Ashwin Patil, a senior research analyst with LKP Securities, said going ahead M&M's volume is expected to clock a tepid CAGR of 1% over FY19-FY21E due to ongoing slowdown, downcycle for the automobile industry and BS-VI-led disruptions.

According to the industry insiders, the slump in sales since around one year is triggering massive job cuts in the sector, which offers employment to around 35 million people directly and indirectly. As per reports, the initial estimates suggest automakers, component manufacturers and dealers have together laid off around 3,50,000 workers since April.

The lobby group Society of Indian Automobile Manufacturers estimates that the slowdown has resulted in 8% loss in GST collection in the first six months of 2019. Just to catch up with the FY19 GST collections, the auto industry will need to grow at least 7% in the remaining eight months of this fiscal.