Repo rate cut by 35 bps to 5.40%, GDP growth forecast revised to 6.9%: Highlights of RBI's monetary policy review

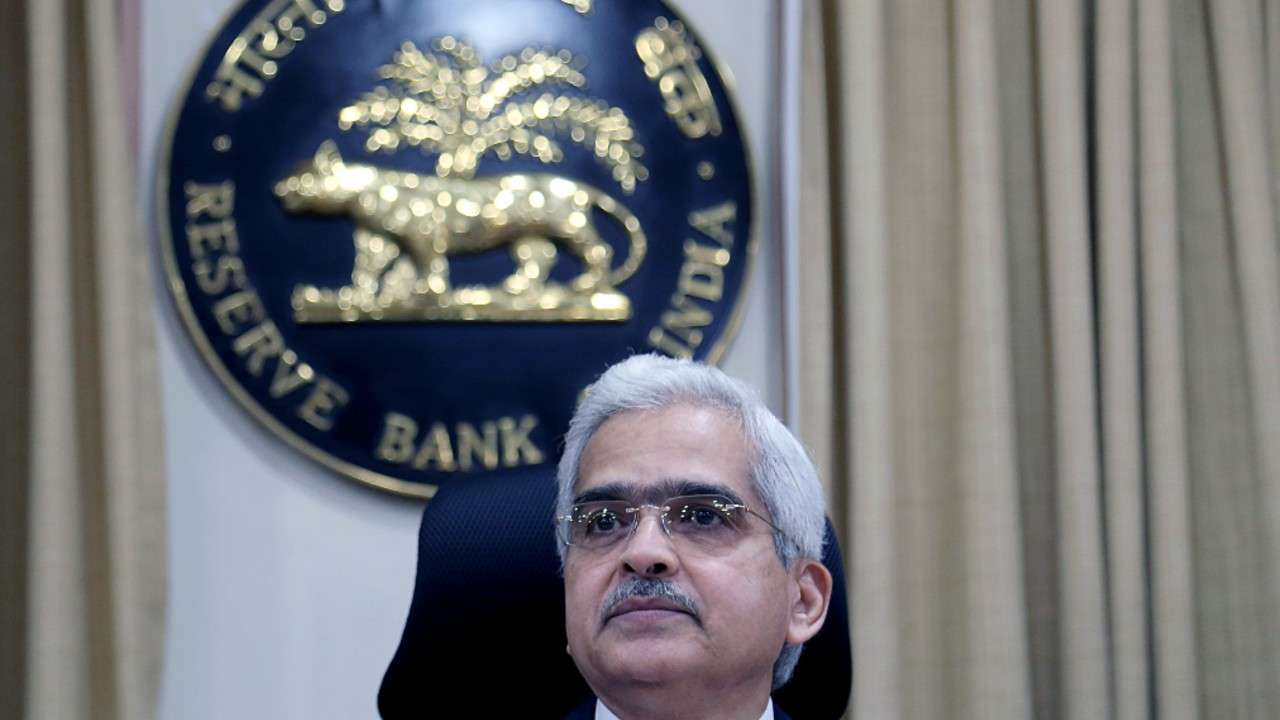

The six-member Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das again cuts the interest rate.

Photo: ANI RBI Governor Shaktikanta Das

The Reserve Bank of India (RBI) has cut repo rate by 35 basis points (bps) in its third bi-monthly policy review for the current financial year. The six-member Monetary Policy Committee (MPC) headed by RBI Governor Shaktikanta Das cut the interest rate for the fourth straight time in this year.

The repo rate stands now at 5.40% while the reverse repo rate is at 5.15%. The apex bank also retained its accommodative policy stance.

This is the first meeting of MPC after RBI Deputy Governor Viral Acharya resigned.

Highlights of the recent MPC decision:

* The RBI reduced 35 basis points on the repo rate, at 5.40% and reverse repo rate at 5.15%. In the June MPC meeting, the repo rate was cut to 5.75% and the reverse repo rate to 5.50%.

* Four out of six MPC members voted in favour of reducing the rate by 35bps.

* The Marginal Stand Facility (MSF) and the Bank rate stands at 5.65%.

* All the members in MPC unanimously decided to retain the 'accommodative' stance of monetary policy instead of 'neutral' stance.

* The RBI also decreased the GDP growth rate for the financial 2019-20 to 6.9% instead of an earlier estimate of 7%.

* The retail inflation is projected at 3.1% for quarter 2 of FY 2019-20 and 3.5-3.7% for the second half of FY 2019-20. The apex bank had earlier projected retail inflation at 3.4-3.7% for the second half of the FY 2019-20.

* The RBI also announced the National Electronic Fund Transfer facility will be available on a 24*7 basis from December 2019.

* India's largest bank State Bank of India has announced a deduction in its MCLR by 15 bps effective August 10.