Tough to recover 98% of I-T arrears: CAG

Highlights

- The federal auditor has said that most of these arrears are difficult to recover as in many cases the entities against whom these demands are pending have no assets remaining to recover

- The audit has also raised concern over amount locked up in appeal cases

(Representative image)

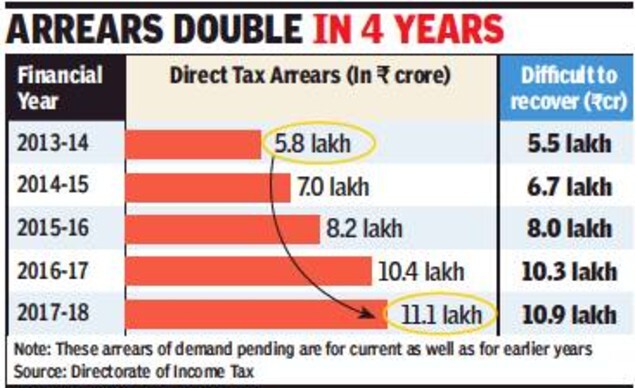

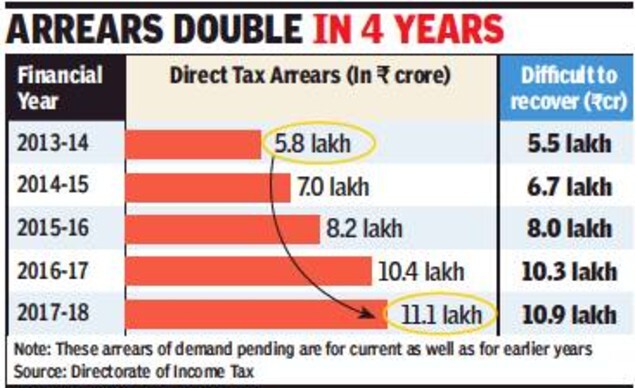

(Representative image) NEW DELHI: A recent audit finding has made critical observations of the total income tax demand arrears of the government which is at a staggering Rs 11 lakh crore till the end of 2017-18 financial year. Significantly, more than Rs 10.94 lakh crore, or 98% of this arrears are difficult to recover, owing to different reasons.

The review of direct tax arrears was carried out by the Comptroller and Auditor General (CAG) of India which, in a recent report tabled in Parliament, has pointed out long pendency of these demands and failure of the tax department to recover them resulting in the arrears almost doubling in the five years from Rs 5.75 lakh crore in 2013-14 to Rs 11.14 lakh crore in 2017-18.

The federal auditor has said that most of these arrears are difficult to recover as in many cases the entities against whom these demands are pending have no assets remaining to recover. In several other cases, the assesses are not traceable, raising serious questions on the administration of the tax department which has left these demands pending for long.

The CAG listed reasons for difficulty in tax recoveries, including no assets, inadequate assets for recovery, cases under liquidation, assessees not traceable, demand stayed by courts or tribunals, mismatch in TDS, etc. “These demands have been increasing year after year and accounted for 98.2% of the total arrears of demands in FY 2017-18 as against 98.6% in FY 2016-17,” the auditor said.

The audit has also raised concern over amount locked up in appeal cases. “The appeal cases with commissioner of Income Tax (Appeals) is more than the revised revenue deficit of the government of India in FY 2017-18,” CAG pointed out. The appeals and writs pending with the Income Tax appellate tribunals, high courts and Supreme Court as on March 31, 2018 are over 82,600 with amount locked up in litigation to the tune of Rs 4.42 lakh crore.

The review of direct tax arrears was carried out by the Comptroller and Auditor General (CAG) of India which, in a recent report tabled in Parliament, has pointed out long pendency of these demands and failure of the tax department to recover them resulting in the arrears almost doubling in the five years from Rs 5.75 lakh crore in 2013-14 to Rs 11.14 lakh crore in 2017-18.

The federal auditor has said that most of these arrears are difficult to recover as in many cases the entities against whom these demands are pending have no assets remaining to recover. In several other cases, the assesses are not traceable, raising serious questions on the administration of the tax department which has left these demands pending for long.

The CAG listed reasons for difficulty in tax recoveries, including no assets, inadequate assets for recovery, cases under liquidation, assessees not traceable, demand stayed by courts or tribunals, mismatch in TDS, etc. “These demands have been increasing year after year and accounted for 98.2% of the total arrears of demands in FY 2017-18 as against 98.6% in FY 2016-17,” the auditor said.

The audit has also raised concern over amount locked up in appeal cases. “The appeal cases with commissioner of Income Tax (Appeals) is more than the revised revenue deficit of the government of India in FY 2017-18,” CAG pointed out. The appeals and writs pending with the Income Tax appellate tribunals, high courts and Supreme Court as on March 31, 2018 are over 82,600 with amount locked up in litigation to the tune of Rs 4.42 lakh crore.

All Comments ()+^ Back to Top

Refrain from posting comments that are obscene, defamatory or inflammatory, and do not indulge in personal attacks, name calling or inciting hatred against any community. Help us delete comments that do not follow these guidelines by marking them offensive. Let's work together to keep the conversation civil.

HIDE